idfk

Based on the current price action, I am under the impression 69K was an Elliott Wave cycle top and we created a larger degree wave 1 and we are currently in the corrective wave 2, which could be a very painfull ride down. Confluence posted in the chart, in addition to the LOG chart, 9300$ is also the 90% retracement area in linear, a well known Fibonacci area...

Many people talking about the bear flag, so I am expecting a reversal/short squeeze soon. In this idea we have made a 3 wave move down from the ATH, since I am not under the impression 32.9K was the bottom after all I labelled this ABC down into a larger W wave. Another 3 wave move creates the X wave, before the final Y wave (another 3 wave move) will be put in....

It looks like another impulsive move down is forming on the charts and correcte wave 4 is over. 2 areas of interest for me: - liquidity grab at $39.500 - yearly volume POC at $34.400

We can see a Cypher harmonic is forming. I would like to see BTC break out of the choppy range we are in right now for a clear direction. Big volume POC at 61K level, will be hard resistance.

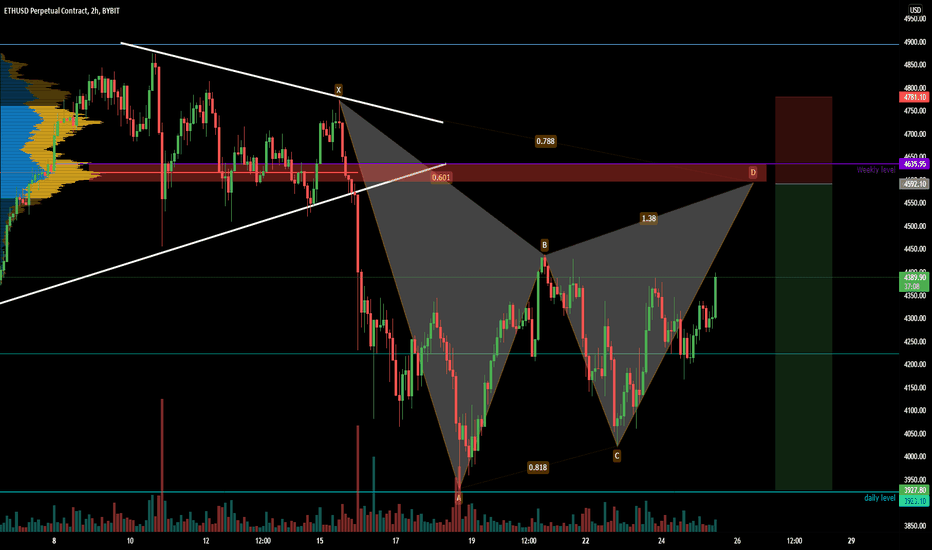

Possible Gartley forming; weekly + POC resistance in confluence with the 786. This could also go external and become a Crab harmonic, so keep an close eye on the price action at D.

I am expecting the ABC correction of wave 4 is almost over and we will see the 5th impuls wave beeing formed after the break of the descending triangle

54900 incoming? Please see my updated EW idea for further info.

I am under the perspective we are in EW correction count 4. I have found a nice fractal which could support the idea. I will also post a HTF picture under this post, the 1-1 FIB extension gives a very nice target of 88.000$

The idea speaks for itself. Also keep in mind that wave 4 could end in an ABC flat correction. Trade safe!

ETH reached a major target, the 1-1 FIB extension of the last impuls (wave 3-4). Overal we are in the 2 - 2.618 region of wave 1, which is common region for Elliot Wave impuls 5 topping out. On the low time frame/5 minute chart we could see signs of a market structure change, which could indicate the rally up is completed and a pullback is imminent. Keep an...

GODS/USDT is currently in EW 4 retrace. We can see a perfect ABCDE correction in a parralel channel forming. The swing low to E would provide a perfect long opportunity. We have the Value Area High in confluence with the bottom of the channel, the .618 fibonacci and the weekly VWAP all ligning up there. It would also make a perfect S/R flip of the 29 and 30th...

Fractal of a lower high in 2019. With the stock markets overbought and China FUD I could actually see it coming down to the .618 from the COVID dump to the ATH.

Possible butterfly forming. If price comes down below the white line CCV for 2x 30 min candles it is likely price retraces to the previous day value area low, which is also around the daily level. Nice long entry at C, be aware of the range POC at around 35.8K.

Bottomed out on the short term? Be aware of a possible rejection of the POC approx 47.8K

Tradingview won't let me publish the fractal on a low TF, it looks quite nice than Check out here easy invalidation if we drop below daily again

Looking for a long entry at D, targets tp1 = X, tp2 = B, tp3 = .618 of the A-D retracement (around C area possibly) Invalidation below the green box. DYOR!

Sorry, it's a bit crowded in my chart. Possible short entry at 48.9K area. Reasons are the .618 FIB of the last swing high to low, .382 FIB from the ATH to the low at 43K, R3 FIB pivot on 15 min time frame (also "P" pivot on the 1HR time frame) and a daily level acting as resistance. TP1 is .382 area in confluence with the range POC, TP2 is .618 in confluence...

Hello fellow traders, This is my short term price prediction for BTC against USDT. a W pattern seems out of play so I think we will drop down to the bottom of the falling wedge. From there we can see a bounce up to 32300 USD and set a lower high, entering the greater retracement towards the 23000/0.5 FIB line. This is a 45% percent correction from the ATH wich is...