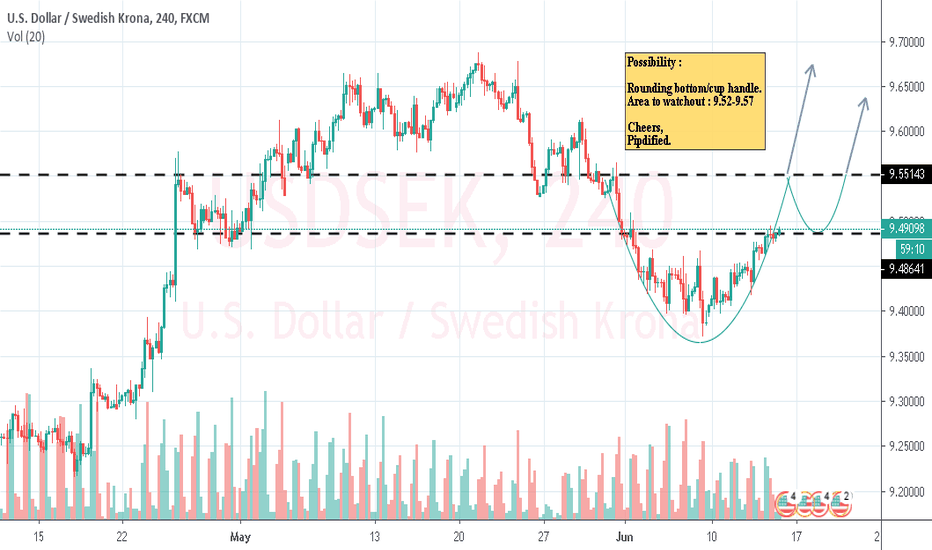

USDSEK trade ideas

USDSEK - 240 - Wait for a 4-hour candle closeTrade idea

USDSEK is trying to recover some more of its losses made during the end of May. Of course, the pair has some obstacle to overcome first, before it could make its way higher. We need to see clear close of a 4-hour candle above the 9.472 barrier and ideally a close above the 200 EMA. Only then we will consider further upside.

Please see the chart for levels, targets and the alternative scenario.

Don't forget your stop-loss.

Failed socialist country going to ZERONot going to enter into details about Sweden.

Sweden central bank "Uh we have no idea why our currency is falling and why our economy is falling behind" duuuuh!

Am already shorting it via EURSEK & added a bit with USDSEK, have a limit order at that green level.

If I am in the green on EURSEK & add on USDSEK as it goes does can I call this adding to my winner?

Stop loss is tight. If this EURSEK is THE double bottom before the rally (and USDSEK bottoms at the same time) this can fly up to the moon.

here is my analysis of USD/SEK.If i did or made something wrong plz lemme know, i am not a pro trader nor a newbie. I am going long on this trade because of the uptrend on the higher time-frame,level of resistance became support and was tested multiples times by the market making it a major zone. Of course i will not buy imitatively when the market open but wait for a chart pattern like engulfing or a break above close above candle to do so. Im well open for opinion even critiques.

"Top and Bottom Analysis" USD/SEK by ThinkingAntsOk4H CHART EXPLANATION:

In 4H chart we can observe that price has broke the Ascending Trendline and the previous support zone, making a pullback on it. It has potential to continue the downside movement towards the Support Zone at 9.4700 and if it is broken, then to the bottom of the Ascending Channel

Updates coming soon!

MULTI TIMEFRAME VISION:

Daily:

Weekly:

*Please note that the above perspective is our view on the market, we do not provide signals and take no responsibility for your trades.

USDSEK - 240 - Within a small rising channelUSDSEK experienced a strong sell-off during the release of Sweden's GDP figures, which came out better than expected. The Swedish krone strengthened initially, but quickly retraced back up. That said, there is a chance we may see another slide again towards the lower side of the small channel, as those traders who missed the initial drop could start coming in and pushing USDSEK lower. But until one of the sides of the rising channel is violated, the pair might continue trading within those frames.

Please see the chart for levels and targets.

Always have your stop-loss in place.

USDSEK 9.6-->9.22USDSEK & EURSEK charts are forming a top formation, which is the end of the very extended downside trend for the SEK (483 days).

Some kind of a mean reversion is expected towards the 9.22 area by Aug-Mid Sep.

For more fundamental points I wish to recommend Torbjörn Isaksson analysis

USDSEK Still Rises Towards 10.0000Last post: May 3rd 2018. See chart .

Review: Price broke above the previous all-time high.

Update: Price has remained above this level and heads towards the 10.0000 round number.

Conclusion: As price approaches the major round number we will need to wait and see how price will react once it gets there. If it breaks through then we should see more strength to the upside.

Any comments or questions, do not hesitate to leave them below. Give us the thumbs up if you share our sentiments!

Sublime Trading

USD/SEK 5th wave bullish in the short-term,sentiment swifts 20201. 10 flat rate might be psychological resistance

2. 2 Possible bullish targets at the 1.272 and 1.62 * Wave 1.

2. Things are heating up in the States, we will see how long it will last.

3. Global growth rate slowdown (particularly the EU(Italy, Spain, France) Turkey, China, Canada, Australia) will catch up onto the States in the near term. There's a good chance that the new tariffs will stay in place.

=>2007-09 Pattern should reoccur, as USD usually corrects very hard during recessions, as Swedish GDP is quite stable, ironically because of the good safety net and unemployment spending. The US can't even borrow soo much money anymore and the deficit is rising.

US dollar still bullish against the Swedish kronaThe US dollar initially rallied during the trading session on Friday as we got the jobs number, but has pulled back a bit against the Swedish krona, which is a simple function of the fact that perhaps we are a little bit overbought, but ultimately there is significant support just below. Quite frankly, this could end up being a nice buying opportunity for those who are willing to take the chance.

The 9.45 level was shown as supported previously and that should extend to the 9.5 level. Because of this, we have a nice range from which to start buying after a negative candle stick for the Friday session. If that ends up being the case, it’s likely that this pullback will be yet another buying opportunity. The market has recently formed a little bit of a bullish flag, and it measures for a move towards the 9.8 level, perhaps even the 10.0 level over the longer-term.

The pair does tend to focus on risk appetite, with the Swedish krona being a proxy for risk. As the US dollar has strengthened against most currencies around the world lately, it makes sense that it translates to a higher market here. It is not until we break down below the 9.45 SEK level that I would be concerned about the uptrend. You can see that the 20, 50, and finally the 200 day EMA are all moving in the same direction, showing that we are in fact a very bullish market.

I would anticipate a lot of trouble at the 10.0 SEK level, mainly because it is such a psychologically important figure. Beyond that, there is nothing special about the handle but a lot of people use these big figures to get out of a market.