USDCNY trade ideas

Chinese yuan rebounds on Shanghai reopening hopesThe Chinese yuan rose to one-week highs on Monday, fueled by expectations that Shanghai, the country’s financial hub, will soon emerge from a two-month lockdown that has crippled economic activities in the city and weighed on the country’s overall economic recovery.

The CNY traded at 0.1504 against the greenback on Monday, recovering further from an over one-week low of 0.1481 on Wednesday when the yuan weakened against a basket of 24 currencies tracked by the China Foreign Exchange Trade System (CFETS).

Still, the yuan has fallen below the 0.1570-mark against the USD since April as concerns over China’s economic recovery grew following Shanghai’s prolonged lockdown that has affected consumption, industrial production, lending, foreign trade, and other aspects of the economy. The RSI indicator is at least suggesting that this recovery in the yuan may not last.

Slowing economy

China’s zero COVID-19 policy has definitely taken a toll on the domestic economy. In April, China’s retail sales fell at the sharpest pace in over two years as the lockdowns in Shanghai hammered consumption and the supply of retail goods. There have been reports of food shortage in Shanghai, with state-run Xinhua News reporting that multiple botanists called on residents to stop digging and consuming wild vegetables.

Industrial output, meanwhile, unexpectedly fell in April versus a year earlier, reversing the modest gain in March. The drop in China’s factory output last month was the steepest since the height of the COVID-19 pandemic in February 2020. It came as lockdowns forced the closure of vital factories including those operated by local and domestic carmakers. Shanghai is one of China’s major auto production hubs and the lockdowns weighed on carmakers’ revenues in April.

All-out effort to stimulate economy

As investment banks and economists downgraded their outlook on the Chinese economy this year due to the lockdown’s impact, Beijing has vowed to all-out efforts to stabilize industrial and supply chains and boost infrastructure construction. On Friday, Chinese Premier Li Keqiang acknowledged that the country’s latest economic challenges are worse than those seen in 2020.

Li said the government is "at a critical juncture in determining the economic trend of the whole year.” He urged local governments to make every effort in bringing the economy back to its normal track.

Shanghai reopening

The Shanghai government is working to ease the city’s lockdown, issuing on Sunday an action plan that consists of 50 policies and measures to help stimulate the economy. The measures include relaxing the rules on resuming production starting June 1 and expanding the scope of subsidies for companies’ pandemic prevention and disinfection, state-run Xinhua News reported Sunday.

LongAs analyzed a long time ago, the crazy devaluation of the RMB has just begun. Do not invest in any Chinese assets, which may be cleared. This is not a warning, it is a definite risk. Chinese stocks listed in the United States could be taken off the shelves. Giants are leaving China, so retail investors should not die.

USDCNY - Strength set to continue following 5 Up WeeksSince 1981, the Chinese Renminbi has recorded 5 consecutive up weeks 17 times. Last week marked the 18th occasion. Weekly winning streaks of this length usually led to further gains over the next 7 weeks, providing an average gain of 1.51%, win rate 14 from 17, maximum 5.28%, median 1.52%, minimum -0.06%, standard deviation 1.44%.

Disclaimer: This data is not financial advice. Past performance is not a guide to future performance and may not be repeated. Past performance does not diminish the risk expectancy of any strategy. By its very nature ‘risk’ means you could and most likely will experience losses. No representation or warranty is given as to the accuracy or completeness of any information provided. Data is for educational and informational purposes only.

2022 the end of the Chinese era beginsThe devaluation cycle of RMB will resume. The first goal is 6.6, the second goal is 7.49, and the third goal is 10. With the aging population, the birth rate of China's economy has decreased and began to decline in an all-round way. The collapse of real estate, the withdrawal of foreign capital, debt default, the explosion of China concept shares, and Hong Kong's loss of its status as a financial center. Relations with neighboring countries and western developed economies have deteriorated in an all-round way. In the future, no assets in China are worth investing in, and the Chinese era is over.The world began to go Chinese.

Today's analysis on USDCNYDue to USA involved in the war between the Russia and Ukraine and declining economy according to various economic data, more people in the world show their preferrence to buy safe haven assets including CNY, because of China's stable development. With CNY rising, US dollar has kept falling.

bing chiling is melting downbing chilling!

i miss china so much, but who on earth would want to be there right now while the ccp is having a meltdown in international relations and covid mitigation.

keep it simple, keep it free.

just let the people be.

a little bit of my heart will forever belong to shenyang and dandong.

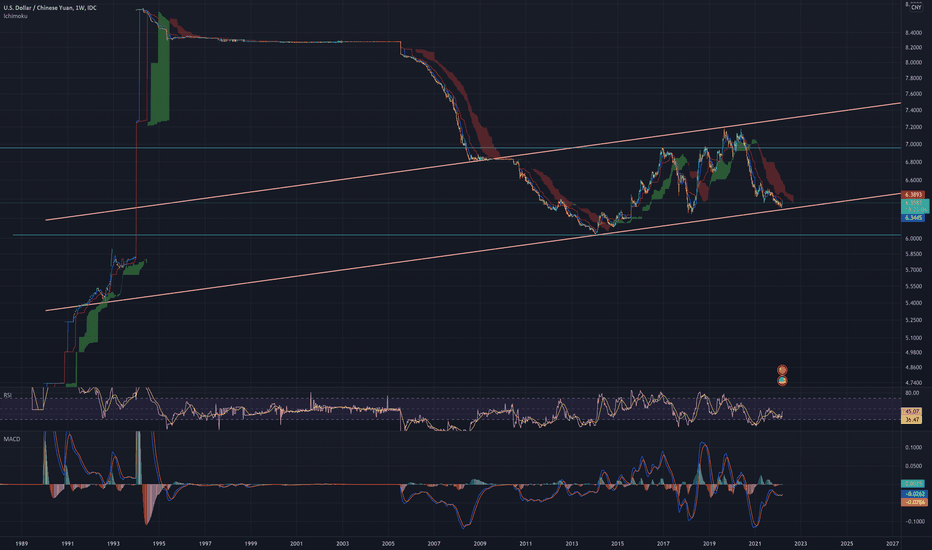

USDCNY Establishing a New Accumulation Range The price action of USDCNY is currently establishing a major Accumulation range, as postulated by the Wyckoff Method, between the support level at 6.3450 and the 23.6 per cent Fibonacci retracement level.

The completion of the preceding downtrend, underscored by the descending channel, is confirmed by the completion of a 1-5 Elliott impulse wave pattern.

A potential breakout above the upper limit of the channel could signify a subsequent test of the 23.6 per cent Fibonacci once more.

CNY will be weakened and China Stock will have a short rebounceChina lever: controlling the yield spread between yuan and US dollar.

In the last 10 years, everytime China central banks (1) holds down the yield spread rate, (2) holds the yield spread underwater 1.25%, then that would be a strong indication of the near future the CNY will be weakened.

Currency:

In this chart we predict the CNY will goes devaluate in the next year.

Stock:

When that happens, stock price will be appreciated and exports could be partially benefited from that.

Stock recommendation: Leveraged China stocks: eg: YINN (a US listed ETF).

USDCNY About to Test a Historic SupportUSDCNY's downtrend accelerated earlier today following the release of the surprising crunch in China's trade surplus, underpinning falling global demand.

The downtrend is taking the form of a 1-5 impulse wave pattern, as postulated by the Elliott Wave Theory. Seeing as how the price action is currently in the process of developing the final impulse leg (4-5), a bullish pullback may be due soon.

On the other hand, the ADX indicator continues to thread above the 25-point mark, highlighting the strength of the downtrend.

USDCNY Developing a 1-5 Elliott Impulse Wave PatternThe price action of the USDCNY continues to be developing a major 1-5 impulse wave pattern, as postulated by the Elliott Wave Theory. Given the declining bearish momentum in the short term, as underpinned by the MACD indicator, a pullback to the 61.8 per cent Fibonacci retracement level at 6.4156 is likely to ensue next.

This would serve as the second retracement leg (3-4) of the Elliott pattern. A potential reversal there would then underpin the likely beginning of the third impulse leg (4-5).

Bears can look for an opportunity to sell there on the expectations for a subsequent dropdown to the previous swing low at 6.3570.

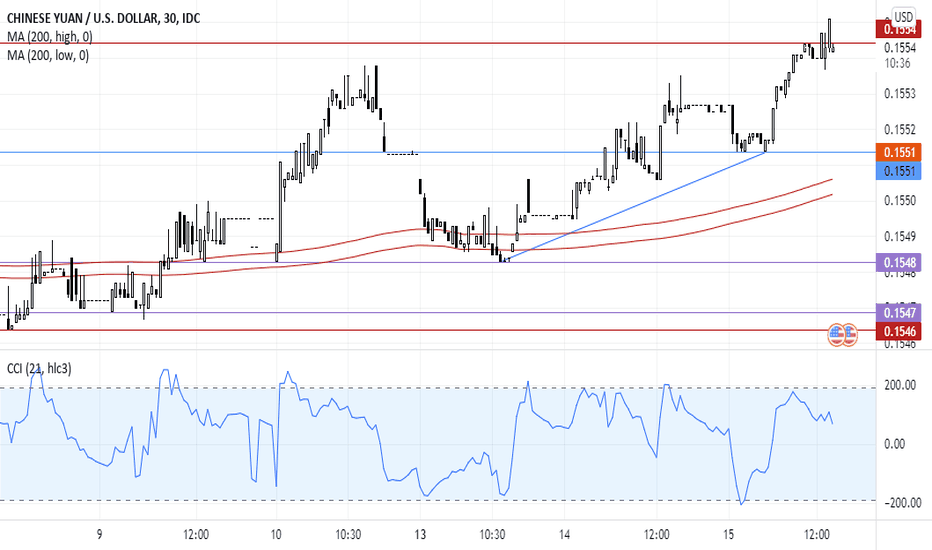

The Reversal Trend of The Chinese Yuan Against The US Dollar.The currency pair of the Chinese Yuan against the US Dollar has started to rise by 3 points between the support line 0.1551 and the resistance line 0.1554, and this is an identical reaction to the continuation pattern of the ascending triangle. On the other hand, the Chinese Yuan may reverse its trend and start decline against the rise of the US Dollar; due to the negative report issued by China's National Bureau of Statistics about annual retail sales, which came less than the expected percentage by 4.4% therefore, the currency pair can break the first support line 0.1551 to meet the second support line 0.1548, then the third support line 0.1547, and it is unlikely that the currency pair will breach the resistance line 0.1554

USDCNY Likely to Rebound From the 23.6% Fibonacci The price action of the USDCNY pair has been range-trading since the 16th of July, as underpinned by the ADX indicator. Bearish pressure has been slowly accumulating over the same period, which is illustrated by the current reading of the Stochastic RSI indicator.

The price action is likely to reach a new dip at the 23.6 per cent Fibonacci retracement level, which is the closest psychologically significant support level. A bullish rebound can be expected to occur there, given the current development of a Descending Wedge pattern. The latter represents a classic trend reversal pattern.

The first major target for the renewed uptrend would be the descending trend line (in red) just above the 38.2 per cent Fibonacci.

Don't Visit China for a bit.Won't be a pretty place for us Americans in the coming decade. They're getting serious about Taiwan after taking HK - also, looks to break below this line. For something so manipulated, there's finally some pattern & reason.

I've visited China twice; I absolutely love the country and her people to bits and pieces. Obviously don't agree with what the CCP is doing, and the people's dissent shows many think alike. We'll see how it goes.