USDBRL trade ideas

Brazilians: Co-relation USD-BRL and Ibovespa (loss mitigation)Peguem investimentos em ações e vejam uma relação ainda maior (ex com fundos: bitly/fiaBRUS )... O Brasil é muito suscetível à economia global, o que não é de todo ruim. Saber conciliar investimentos externos (até mesmo câmbio de dólar) e internos balanceia as perdas e potencializa ganhos.

Brazilian Real continues to recover its spaceAfter the pension's reform approval in the Brazilian Congress, the price of the pair FX_IDC:USDBRL reacted in favor of the tropical country and is showing some signals that it's aiming to test the previous lows, around 3.64

Let's see how it'll progress...

Short USDBRL, some economic improvement with political change?Trade logic on Right wing move towards government after year of lefties in power.

Some economic reforms are expected, and Capital is eyeing transfer to Brazil as a consequence.

Technically, a head and shoulders pattern just finished forming, (can be seen clearly on daily chart), with any move downward likely to be quick,

TP just above 3.2 is suggested based on previous support and fiobonacci retracement from previous multi year lows and highs.

A second TP in the range of 2.4 to 2.5 is possible but likely to take some long time (at least 6 months and very possible more than a year from now); reasoning is to look at weekly chart, given the head and shoulders we hoped for finishes, a double top chart will form and price may head to next fib. retracement and previous resistance (between 2008 and 2014) that will act as support.

For now focus on first target

Long Brazil Real Short US DollarPlease check the following two indicator for Brazil Real : MACD and RSI

Even though the real has achieved a new low, MACD histogram got a lower maximum compared to September 2018.

A similar pattern could be seen in the RSI, which achieved a lower maximum while the real got a new low.

$USDBRL $EWZ $BVSP - Brazilian Real Under PressureAs market volatility has come back with a vengeance and the US Dollar continues to remain strong, one EM currency that has been hit particularly hard this year has been the Brazilian Real ($USDBRL).

Sluggish growth forecasts, coupled with waning support for the Brazilian President has sent the Brazilian Real to its lowest level of the year thus far. The sharp declines have also been fueled by uncertainty over the US-China trade talks on the macro level. The combination of the two forces, the external macro headwinds and feeble domestic economy, have been a perfect storm for the under-performance of the $USDBRL in 2019.

Further more, on a technical basis, the $USDBRL continues to show deterioration within the Brazilian Real, with the 10-day EMA being a strong support for the currency pair.

We believe if this continues, $USDBRL 4.25 is the next stop.

USDBRL is going to go downHello,Traders. In the USDBRL chart, we were expecting a regular flag formation for the price to keep pushing for downward. Now, it has broken the trendline, so the view has changed whereby we might see price testing the top and then reverse to the downside. Look out for any ipmulsive move tothe downside as itis not necessary for price to break the top and then reverse. Trade with care.

Happy trading, guys.

If u like the analysis and want future chart updates, please do help share the charts and like my page. There is more to come ;) , lets make money. Thank you.

IF you are interested in letting us manage your account for consistent profits, just PM to me or for copytrade head to fbsmy.com

We do manage investors accounts.

Thank you.

USDBRL - Dólar x RealDadas as informações que temos até o momento, acredito que o preço do dólar (USDBRL) está indo para a zona dos 3.5 Reais (BRL) e de lá continuará sua trajetoria de queda para a regiao dos 3.10 que é o target da figura de ombro, cabeca, ombro que se formou no grafico. No caminho, a zona dos 3.30 pode se mostrar um bom suporte, e eventualmente, segurar o preco por um tempo.

- EN - I do believe that the price is going to the region of the 3.5 reais, and then will take a decision, whether re-test the 3.8 or continue the path to 3.10 which is the target of the Headers and shoulders.

The region of 3.30 can be a good support on this path and hold the price for a while since it was a resistance region in the past.

For me, this is the most likely scenario.

BRL struggling right now. Next weeks are critical.All necessary information is on the chart.

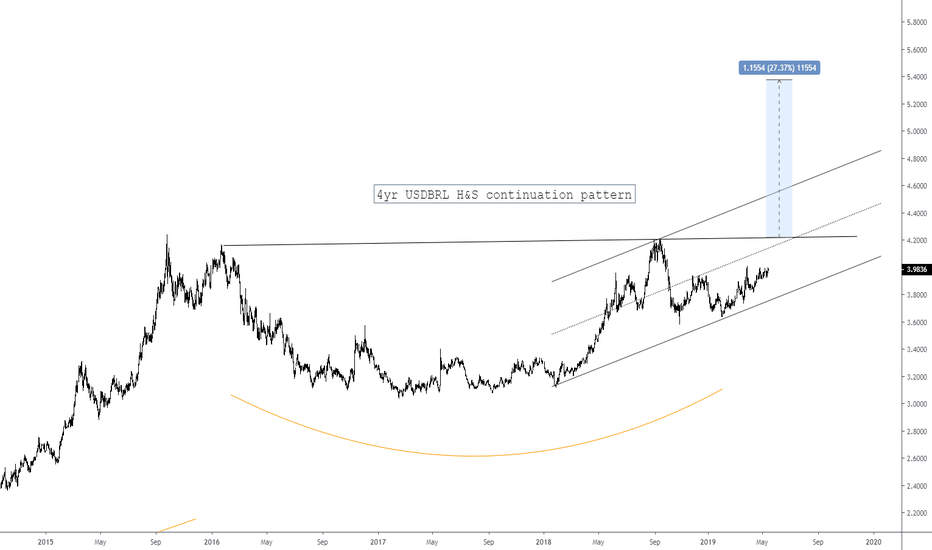

Following last years elections results BRL recovered against the US dollar, but despite a series of positive indicators, reports and overall better economical mood BRL failed to follow towards the target of the previous head and shoulders pattern, instead, encouraged by yet another corruption scandal, the price has been hiking strong, and has the potential to trigger a massive cup and handle pattern. Such a massive loss of value is not unheard of in South America, and has as a matter o fact befallen a neighboring country - Argentina - a few years ago.

#BRICS currencies movement for the Week - 22Feb19Fairly stable week for most BRICS #currencies, thanks to some USD weakness. #SouthAfrica recovering some of last weeks losses. #BRICS currency/USD movements for this week:

Brazil -1.3%

Russia +1.4%

India +0.4%

China +0.9%

South Africa +0.5%

Euro/USD +0.4%

I must admit that the one currency that is looking mighty interesting technically this week, is the Brazilian Real. At 0.2664/USD it is not only finding itself close to the 50-day moving average at 0.2652/USD, but also at a nice little trend resistance line. A bounce off these levels could see us test the short-term highs made in both January this year and October 2018 – target 0.2744/USD . Should the current resistance break, traders should watch the 200-day moving average at 0.2608/USD as first target/stop.

USDBRL - Downtrend line resistanceIn the graph we can see the primary line (yellow 55 days) and secondary line (green 21 days) are still point down. The downs and ups of peaks and troughs are getting lower peaks and lower troughs. We can draw a downtrend line connecting the peaks, is a resistance line.

For tomorrow we can expect the downtrend line act as a resistance around 3.73 and if the price goes down we can see the next support 3.68, 3.64, 3.60.

Queda no Preço do USD ao BRLO preço do Dolar Americano no câmbio USD BRL continuará a cair amanhã conforme minha previsão, baseada em análises técnica e fundamentalista. Vista, aquela, no gráfico de 15 minutos.

E deve continiar a cair no mês de fevereiro de 2019, até a faixa entre os preços de R$3,3480 e R$3,1149, mas pode descer até R$3,0415, conforme o gráfico semanal.