CMI trade ideas

Reversal indicated in CMIThis is a stretch, but I'm posting anyway because it's saying it's accurate. And if I get the clown emojis, I shall be stronger for it LOL

This was chosen from a list of earnings names this week via my dowsing work. As in, with a pendulum. I had posted the earnings idea elsewhere, and the gist was up 4%, then down. That's playing out, so I thought I better follow up and see wth is so important with this thing.

The message is super bearish. I get both "new all time low" and "new 52 week low". This does NOT mean literally all time low or even 52 week low (as I've learned). But it does indicate a substantial reversal lower.

I'm having a bit of trouble nailing down the target. It could be as low as around $203 if it's a 45 point move. OR, it could be a 45% drop and go way lower. At a minimum I'd say test $200. I ask how long to be in this and get the date of around 5/29. Looks like options go to June though.

On a technical note, and for perspective, I looked at a monthly and see a bit of a diamond pattern. I haven't seen many of these, but did once that I remember and it had a powerful move. I'm not a big pattern seeker though, so maybe someone else knows if this could be meaningful. Also interested if anyone knows a fundamental scenario for a big drop?

My only other concern with these repeating numbers I get in the '40s is that it's currently trading in the 40s, so it might be better to see it completely break the 240s altogether, and that is confirmation it's 45 pts, or percent, and not a shallow drop from the current price. The number 42 came up twice and price range of 125-150, so that's why I have that level as the final potential target.

That's all.

CUMMINS - SHORT TERM BUY OPPORTUNITYAt the end of last month, CMI broke the long resistance level in the downtrend channel located at $211 and the local resistance of $215. The next price resistance Is located between $234-$244 or a possible return of 7.5% to %12.5. in the next couple of weeks

Risk Disclosure: Trading Foreign Exchange (Forex) and Contracts of Difference (CFD's) carries a high level of risk. By registering and signing up, any client affirms their understanding of their own personal accountability for all transactions performed within their account and recognizes the risks associated with trading on such markets and on such sites. Furthermore, one understands that the company carries zero influence over transactions, markets, and trading signals, therefore, cannot be held liable nor guarantee any profits or losses.

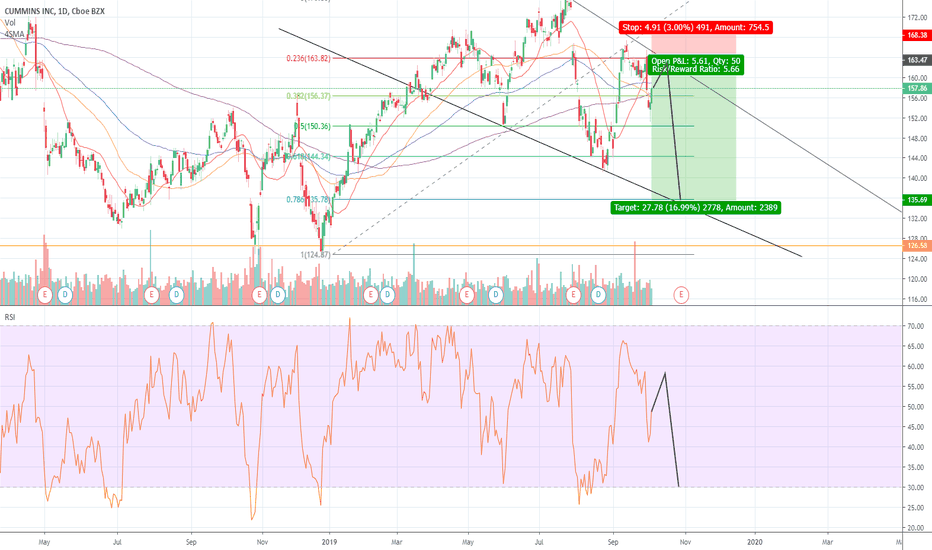

CMI, We are going to reach to the sell zoneHello guys

According to the chart you can see the price is moving downward trend and it has need more correction to have good R/r then we have permission to take short position until the target.

You should take signal at first then dont forget use stop loss and observe to your capital management.

Take a look on volume guys dont forget to check it, And dont forget to risk free and manage your position.

Everything is shown on chart, If you have question send us messages

Good Luck

Abtin

Long-term/dividend/value holding idea in high inflation economy My take:

Up after ER, PT $261. That will be a good exiting point if need to adjust a portfolio %.

Then if nothing or bad events happen, it will fall back to $245 around 4 weeks after topping PT. May fall further to if ER is not optimal or other economic events (very likely, such as interest rate hike). Then that will be a good chance to make up % in a portfolio if oversold at the previous exiting point.

Short-term resistance at $240 may come into play before ER due to increasing vol and MACD trend deviation. But generally, we are still halfway to the next top.

The long-term overview/PT remains the same after the rate hike in my opinion due to demand/supply and the early player in H2 energy play.

Overall, it's a bullish play for long-term/dividend holding.

Earnings 8-3 BMO Simple Moving AveragesJust a run down on moving averages on a possibly cyclical stock that I happen to like )O: Cyclical is cyclical though. And there is a truth to a cyclic stock. They cycle in and out )o: The stock can be the greatest thing since sliced bread. CMI is a wonderful company and I own it long term in my IRA, so I do not mean to single it out. I own this long term and bought it at almost half the price it was on Friday. Could form a triple bottom and could beat earnings Tuesday morning (odds are they will but market response is key) and change this whole scenario. Fact is the moving averages look really bad and is why I chose this one for this post as I was looking for a chart with ugly moving averages.

Cummins Inc. designs, manufactures, distributes, and services diesel and natural gas engines, electric and hybrid powertrains, and related components worldwide. It operates through five segments: Engine, Distribution, Components, Power Systems, and New Power. The company offers diesel and natural gas powered engines under the Cummins and other customer brands for the heavy and medium-duty truck, bus, recreational vehicle, light-duty automotive, construction, mining, marine, rail, oil and gas, defense, and agricultural markets; and offers new parts and services, as well as remanufactured parts and engines.

From this short description, it is involved in a several industries or sectors and is why I bought it a while back. Yearly low is 192.72. Yearly high is 277.09. Price closed today at 232.10. I just am not sure CMI feels comfy at the higher prices it was at. Maybe it does not live there. Price usually returns home eventually.

But to examine moving averages, and these are simple moving averages, not exponential, smoothed etc. I do not go there. I use the simple ones (o:

The 50 (orange) is sloping down and has already crossed down through the 100 (yellow) which is also sloping downward. The 200 is still sloping upward (red) which is a long term signal that this security may have some rough times in the near future but in the long run, for now, it is okay. In other words, I would be safe here but am not selling a long term hold. The long term moving average, the 200, is still sloping up.. Shorter term says to me "possible further pullback coming" But with earnings so close, and the market being so funky, who knows?

The 20 (blue) looks really bad and is the shortest term moving average on this chart so it should be on top of the 50, 100 and the 200. The 20 (blue) should not be below it's heavier counterparts like the 50, 100 and 200. But damnation, it is!

This particular security can move a lot in a day, but all in all, this one looks bad moving average wise )o:

In a perfect world the longer term moving averages are on bottom, with the shorter moving averages on top of it, preferably in chronological order with the shorter term moving averages on top and longer term moving averages on bottom and in order. I do not use a 5 day moving average. It is usually right on top of price. The 50 and the 200 are important to me. A day trader would most likely choose different moving averages. Dunno.

Then again, this scenario can change, and then the moving averages straighten out or slope upward before you realize it! If you buy pull backs or bottoms, this is an example of what you may be challenged with. The moving averages can look awful, until they change and start looking good. This is the reason many look at more than one indicator. Moving averages are often considered an indicator with bullish and bearish crossovers, the slopes of the moving averages, the order etc. Volume, support and resistance levels, any divergence with an oscillator, overbought or oversold conditions, and the whole market sentiment plus the chart patterns come in to play and so on. This is not an easy game we play.

Price is close to support. If broken, well that is another story )o:

It does not mean do not do it, just means be very, very careful (o: Negative volume is very high. Short interest is low at 2.2%. RSI is showing possibly a lot of supply at this level. It is "lingering".

Just an example of ugly moving averages except the 200 and is by no means, a recommendation

ST Swing, LT HoldI'm fairly new to CMI, but have been looking at it since our Q1 2021 rotation into value has taken place.

Technicals:

On this chart, I have drawn 3 lines which represent significantly different timeframes to be aware of (from left-to-right on the chart):

1) COVID Trendline--this has been some pretty steady support since our COVID lows and represents to me a great buying opportunity for swing trades

2) Long-Term Trendline--this has been in place since 2007 as resistance. In COVID, we have clearly broken this bullish in Aug 2020 and back-tested it in Oct 2020. While we have definitively broken this line, it may be an important support level to consider if CMI and/or the broader market turn bearish and have another correction.

3) Short-Term Support--on 21 January we had a high of 252.71. Since then broke out to 277.09 and have retraced to 253.54, which I'm calling close enough to be a bounce and to indicate a potential support level. This ~250-255 range also encompasses some Fib retracement levels of the last big move. This range could be another good ST buy point for a swing trade.

On a separate note, I have drawn some purple rectangles to represent the previous swing-trade buying opportunities. Importantly in these areas, there are 3 technical indicators that line up: RSI reaches reasonable levels (~50), MACD is decreasing while the stock is horizontal, and the , these show cooling off MACD and RSIs, and the Stoch dips around 20. When all 3 of these align, the stock then breaks to the upside.

Now, our (1) COVID Trendline and (3) Short-Term Support are converging, and we may be at the start of a new 'purpose rectangle' range of consolidation. I may look to buy CMI in the 250s for a quick swing into the 270s, or could hold Long-Term. I'm just nervous that we will see the (1) COVID trendline break at some point and that we'll retrace to the (2) Long-Term Trendline. If I see more consolidation and if we get back to these levels (15-20% pull-back), then I'll be much more bullish for the long-term.

On the Fundamentals side of things:

- CMI is similar and has exposure to industrials that I'm interested in right now: DE, CAT (farming equipment) as well as CSX, UNI, NSC (railroads), and GM, F (autos). CMI makes engines which go in tractors, trains, and cars (more so trucks). It'll be a great infrastructure play without technically being infrastructure itself. Their 2% yield isn't something to complain about either.

- On the growth side, CMI is investing a lot in hydrogen, so they could be good comps to the likes of LIN, DOW, or a renewable utility such as BEP or NEE.

This is not an investment advice, do your own due diligence.

BEAUTIFUL Support on CMII'm really proud of my trade and position on NYSE:CMI not just for the profit but the beauty of clear price structure which I wanted to share. This is clearly a BULLISH stock on a run but within it are some positive teachable moments. Multiple times it has held CLEAR price high/log inflections along with 50% retracement levels.

Trades like this are why I love trading... when things just come together in an almost artistic way!