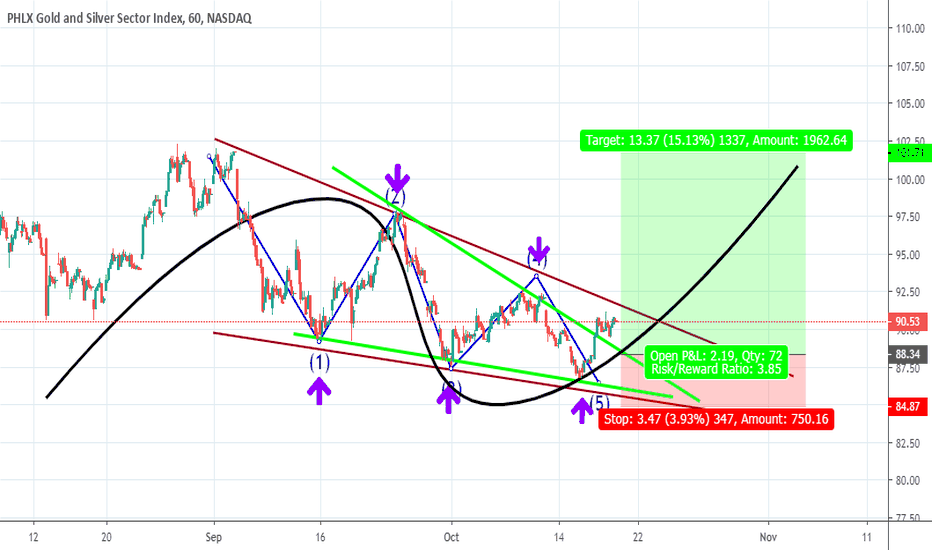

XAU trade ideas

Negative Divergence in #PHLX indicates a potential reversal- Either #gold or the #spy or both are subject to a bearish attack soon, as there is a weakening #PHLX

- there is a clear divergence in MACD

- current levels shall be watched very close ; once the prices return back from here, a sharp decline is possible to expect.

XAU - more perspective!In 2008-2009 the financial crisis interrupted a lengthy ongoing rally in gold and mining stocks which resumed and ultimately made a higher high before rolling over. Today the miners are still coming out of the prolonged bear market from that time and the events of the last three weeks have cleansed this sector and most all assets for the excesses of the last 11 years. I believe we will see a bottom for miners very close to these levels (maybe another 5-7%) but some where around here and that the next time this index gets to the yellow line resistance it will confirm the bull market in miners. Again, patience is a must. Sell the high flyers and buy the miners. That will be my mantra going forward.

XAU - Sell-off Perspective!They literally crushed miners today. I'm not sure I've ever see a day in the mining space like I did today. This chart puts things in perspective. Gold off almost $200 from its highs. XAU has given back 60% of its move from the 2016 bottom. They were throwing them away today as the market had another screaming bear market rally. The next bull market is about to start. Don't miss it.

Gold-Gold Miners-DXY-Fed Funds-Monetary Base All CorrelatingThis is the Gold Miners Index to DXY ratio. This feels likes 2001 or 2009. Gold is correlating with Fed Funds, the monetary base, and the DXY like its 2009 and 2001. Gold stocks are priced like its 2009.

Since 2019 we have seen the Fed Funds Rate free fall, since September 2019 we have seen the monetary base expand past the low set in December 2016, same with the Fed's balance sheet. We have seen the Fed Rate continue to fall now down to 1.00-1.25. And since September we've seen gold continue to make new highs, the US dollar / DXY break through critical support. We've also seen gold and gold stocks breakout against US indices.

Could this be the beginning of the next bull run? Could this be the run we started in 2009 and prematurely ended in 2011?

If so, hold on to your seat because we're just getting started here. Look for Gold Miners (XAU) to DXY ratio to start surging as the mining sector plays catch up to gold and as the Fed Funds rate continues to plummet and the balance sheet / monetary base continue to grow.

What's interesting is the gold tends to fall when the monetary base falls. But gold has tended to rise when the monetary base moves sideways. It seems like without Fed intervention the monetary base is shrinking and the only way to keep asset prices propped up is to keep expanding the base. This means gold could be on the cusp of an incredible move without much downside even with the prospects of a broad market crash remaining fairly high.

Gold Miners Set to Outperform US Stock MarketTechnical breakout and retest.

My expectation for 2020 is a volatile market for both the US indices and for the gold miners. I think gold miners will actually outperform US stocks to the downside here and then will explode higher once we reach full ZIRP and QE5++. The SPX and other US indices could take a major blow in terms of gold which will drag down gold miners a bit but they won't get killed like in 2008. I think miners are waiting for gold to clear $2000/oz, then they will soar like you cannot believe. I think we can get $2000/oz A LOT faster than seems possible.

Gold miners are at historical lows relative to the rest of the US economy. Be snagging shares during this period of correction.

I ultimately think XAU could surpass all-time highs or at least surpass 0.2 on this ratio but even if we don't get that and all we get is 0.1, we will still make a killing in gold miners. if we go to .2 or higher we will make a fortune.

Gold Miners - SPX500 Ratio: Opportunity of a LifetimeAs you should know, ratios are measured from 0-1. The Gold mining sector hit its all-time high in 1984, registering a 0.9 on the ratio.

An individual company can go to zero, but an entire sector like metals cannot unless humanity gets wiped out. The mining sector is the closest to zero it has ever been. The last time it was this low was when gold bottomed in the year 2000 and the ratio bottomed at 0.03. Currently, the ratio sits at 0.025. I couldn't figure out how to make tradingview show additional decimals. In 2011 the ratio hit 0.2. That move from 0.03 to 0.2 from 2000-2011 was a roaring bull market in metals.

In the next chart, I'm going to publish, you will see that not only is the gold mining sector the cheapest it has ever been versus the US stock market, it is also the cheapest it has ever been versus the price of gold itself. For those paying attention, the opportunity in precious metals is right now.

A lot of investors right now are suggesting to sit on cash in preparation to buy a crash. In my opinion, the cash you should be sitting on is metals, not dollars. The mining sector is a long-term hold in my eyes. I also see intermediate profit opportunities in swing trading the metals in the 6-12 month TF.

Gold Mining Sector is a No-Brainer. Cheapest it has ever beenGold miners versus the price of gold itself is the cheapest it has ever been.

The gold mining sector cannot go to zero and it is the closest to zero it has ever been.

How often does one get the opportunity to enter a sector at generational

Value investors should love this sector.

- fundamentally undervalued. basing at all-time lows

- Gold achieved 6-year highs in the dollar this year and all-time highs in all other currencies.

- Tremendous amounts of malinvestment and toxic debt.

- Central banks openly expressing they will provide all the liquidity the market needs. Increasing acceptance of negative interest rates, including in the US Federal Reserve. No signs in sight of money printing slowing, precisely the opposite.

GOLD BUY ANALYSISUpon Analysing the Waves and the structure that the market is making within all time frames, I can see that Gold still has great potential of staying in the uptrend. Fib, wave analysis and structure are all saying the same thing. Its a decent buy for now. May go into a little Retracement but, the move is still an upside.