MAI.ROS1! trade ideas

CORN FUTURES (ZC1!) DailyDates in the future with the greatest probability for a price high or price low.

The Djinn Predictive Indicators are simple mathematical equations. Once an equation is given to Siri the algorithm provides the future price swing date. Djinn Indicators work on all charts, for any asset category and in all time frames. Occasionally a Djinn Predictive Indicator will miss its prediction date by one candlestick. If multiple Djinn prediction dates are missed and are plowed through by same color Henikin Ashi candles the asset is being "reset". The "reset" is complete when Henikin Ashi candles are back in sync with Djinn price high or low prediction dates.

One way the Djinn Indicator is used to enter and exit trades:

For best results trade in the direction of the trend.

The Linear Regression channel is used to determine trend direction. The Linear Regression is set at 2 -2 30.

When a green Henikin Ashi candle intersects with the linear regression upper deviation line (green line) and both indicators intersect with a Djinn prediction date a sell is triggered.

When a red Henikin Ashi candle intersects with the linear regression lower deviation line (red line) and both indicators intersect with a Djinn prediction date a buy is triggered.

This trading strategy works on daily, weekly and Monthly Djinn Predictive charts.

This is not trading advice. Trade at your own risk.

CORN FUTURES (ZC1!) WeeklyDates in the future with the greatest probability for a price high or price low.

The Djinn Predictive Indicators are simple mathematical equations. Once an equation is given to Siri the algorithm provides the future price swing date. Djinn Indicators work on all charts, for any asset category and in all time frames. Occasionally a Djinn Predictive Indicator will miss its prediction date by one candlestick. If multiple Djinn prediction dates are missed and are plowed through by same color Henikin Ashi candles the asset is being "reset". The "reset" is complete when Henikin Ashi candles are back in sync with Djinn price high or low prediction dates.

One way the Djinn Indicator is used to enter and exit trades:

For best results trade in the direction of the trend.

The Linear Regression channel is used to determine trend direction. The Linear Regression is set at 2 -2 30.

When a green Henikin Ashi candle intersects with the linear regression upper deviation line (green line) and both indicators intersect with a Djinn prediction date a sell is triggered.

When a red Henikin Ashi candle intersects with the linear regression lower deviation line (red line) and both indicators intersect with a Djinn prediction date a buy is triggered.

This trading strategy works on daily, weekly and Monthly Djinn Predictive charts.

This is not trading advice. Trade at your own risk.

CORN FUTURES (ZC1!) MonthlyDates in the future with the greatest probability for a price high or price low.

The Djinn Predictive Indicators are simple mathematical equations. Once an equation is given to Siri the algorithm provides the future price swing date. Djinn Indicators work on all charts, for any asset category and in all time frames. Occasionally a Djinn Predictive Indicator will miss its prediction date by one candlestick. If multiple Djinn prediction dates are missed and are plowed through by same color Henikin Ashi candles the asset is being "reset". The "reset" is complete when Henikin Ashi candles are back in sync with Djinn price high or low prediction dates.

One way the Djinn Indicator is used to enter and exit trades:

For best results trade in the direction of the trend.

The Linear Regression channel is used to determine trend direction. The Linear Regression is set at 2 -2 30.

When a green Henikin Ashi candle intersects with the linear regression upper deviation line (green line) and both indicators intersect with a Djinn prediction date a sell is triggered.

When a red Henikin Ashi candle intersects with the linear regression lower deviation line (red line) and both indicators intersect with a Djinn prediction date a buy is triggered.

This trading strategy works on daily, weekly and Monthly Djinn Predictive charts.

This is not trading advice. Trade at your own risk.

CBOT CornGood Morning

From a mild Johannesburg and ahead of tonights WASDE (out at 7 pm local time) I would like to share what I feel to be a very RR (risk/reward) trade.

Of all the softs heading into tonight's numbers, I feel that Corn has the highest probability of rallying.

I believe that we can see a rally toward the $4.24 level in the coming days and post tonights numbers.

The targets also fit perfectly in with the 61.8% retracement.

At current levels, this trade presents us with a 31/10 bet based on a stop under $3.71.

This could just be the way to end off the 1st week of 2020….. with some decent $$$$ in your pocket!

Happy hunting and always remember the following: “hard work and discipline will always trump talent when talent does not work hard” ~ anonymous

Giancarlo

CORN Long - Range playNothing really exciting happening here, but a possible small range play looks possible. Price has been bouncing around a ascending channel, currently around the bottom of it. If it price holds and a confirmation of bounce, look to hold a position towards the upper end of channel 380ish area.

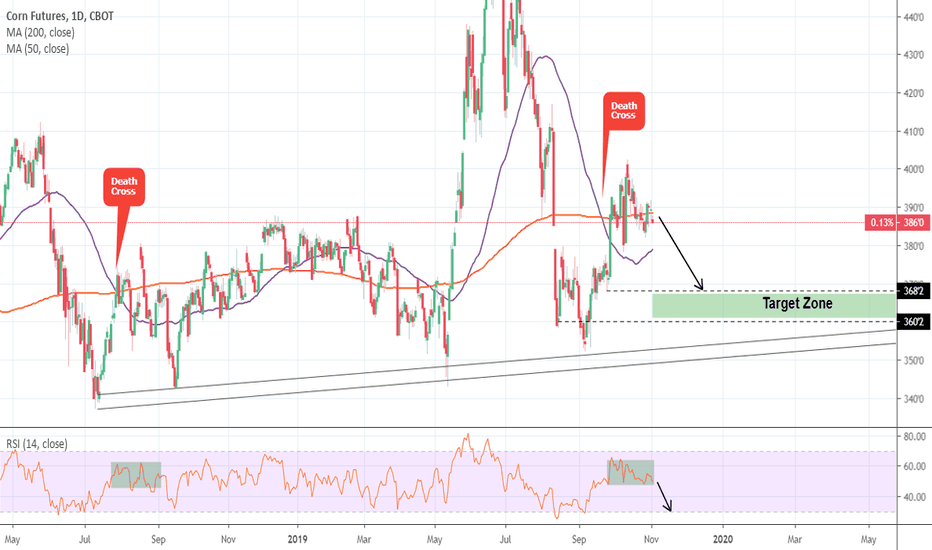

Corn: Short opportunity on 1D Death Cross and RSI.Corn has been consolidating recently following the 402 peak on 1D (RSI = 54.610, STOCH = 53.472, MACD = 0.760, ADX = 18.642) after the September Death Cross. A similar candle sequence took place in August 2018, when after a 1D Death Cross (MA50 under MA200) and a market Top, the price made a new Low (Higher Low on 1W).

Since the RSI is on the same zone as then, we are expecting a decline towards 368'2 - 360'2.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.