BVA trade ideas

Bailout coming - BBVA and their podcast experts (LMAO)So I've decided to somehow repost this big scheisse after the bank doesn't stop sending me emails saying they have experts analyzing the markets and wanting to give an explanation of why the stocks are going up. Really? Who are they trying to convince with this graph?

It will be bad, very bad. And in the end we will always pay for it, always the same. Enough! Because all spanish big banks are all almost in the same situation. If you want to check other countries issues: METRO, DB... can continue forever. Buff, I'm so annoyed today.

Be careful outside!

End the FED, end this fractional reserve system. Burn them all down soon.

US stonx I'm interested inAMAT - Applied Materials

The domestic TSM, almost sounds like Tiamat. Eastern Asian spies? In my processor? It's more likely than you think.

www.nasdaq.com

CMI - Cummins

Lol, produces stuff for different industries, natgas. Should monitor PPI for April.

www.nasdaq.com

www.bls.gov

www.bloomberg.com

BBVA - Banco Bilbao Vizcaya Argentaria

This one doesn't look too hot but they're 'investing in zero knowledge proofs' and all that matters is that they mention 'blockchain' for the exit pump.

www.nasdaq.com

www.bloomberg.com

www.bbva.com

cointelegraph.com

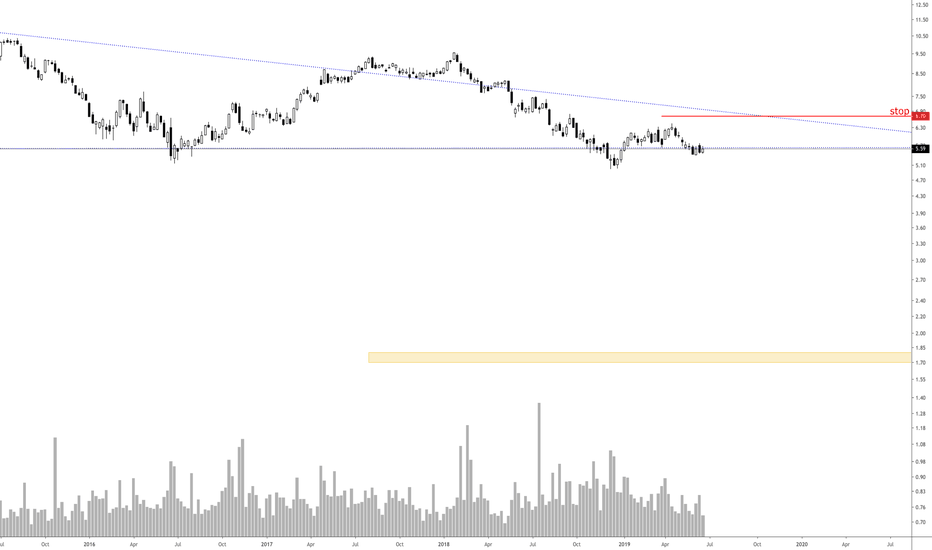

#BBVA - In big steps #BancoBilbaoAfter almost 2 years, Banco Bilbao share is still on target.

A bailout/bailin is imminent and should lead to riots or even revolution in another 2 years.

In 2018 this was still unimaginable and today hardly anyone would doubt it or rule out the possibility, would they?

BBVA loss with to tight stopWrite sometning about your psyhology thinking before trade? I am good at one week pause

Describe the trade. What you see? play within the channel on a way up

What have I done well for this trade? Enter point was at the right time maybe a little to late

What can I take away to help with later trades? that the stop loos in this kind of trades should be much wider, but in that cas I could not play such a trades

BBVA Approaching Resistance, Potential Reversal BBVA is approaching its resistance at 5.309 (61.8% Fibonacci extension, 61.8% & 23.6% Fibonacci retracement, horizontal swing high resistance) where it could reverse to its support at 5.025.

Stochastic is also approaching resistance where a reversal could occur.