INRUSD trade ideas

USDINR-Weekly Outlook-Venkat's BlogPast week saw a consolidation after a sharp fall in the previous week. The support at 81.70 is seen as crucial and a daily close below would trigger next round of selling and could drift towards the next support at 81.20. Most likely scenario would be a consolidation between 81.20 and 82.74. There could be choppy moves within this range. A close outside this range requires re-assessment of risk/direction and target. If the momentum continues we may see the pair drifting towards 79.90.

A few more observations:

The currency corrected after making multiple attempts to break 83

Dollar Index-DXY is likely to continue the familiar range of 101-105.

The raising upward channel indicate the broader range of 77.10-83.30

As noted in the previous blog, continue to keep the following input for quick reference.

The 82.75-83.25(with error adjustments) zone is the Fib projection of July 2011 to July 2013. Hence, the importance. If breached, we may see another spike towards 85.70.

At least for now the zone is protected

The increased volatility and wild swings likely to continue

Disclaimer: The views expressed here are personal and not connected to SYFX Treasury Foundation. The views are for learning and reference purpose only.

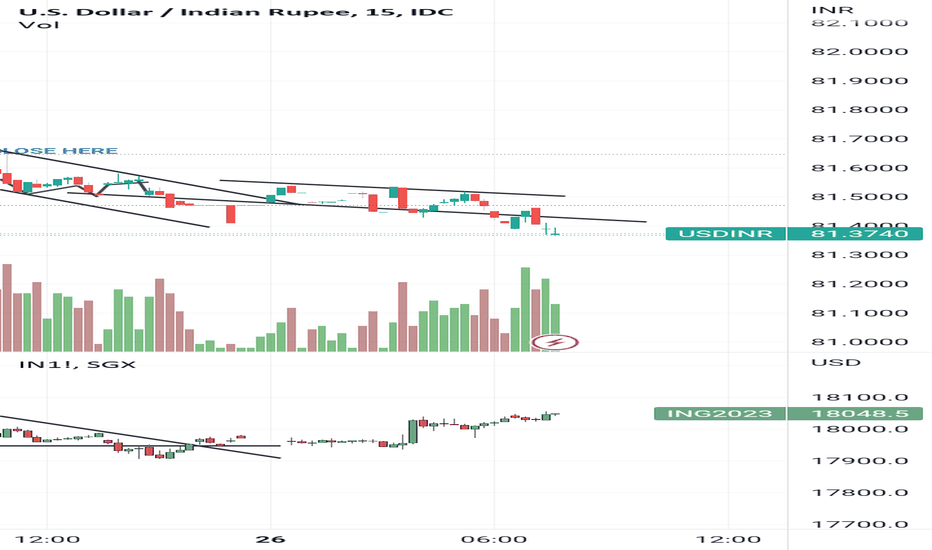

Nifty 50 ..Hi this is Vijay Shrivastava And

This is thinking 🤔💭

I am try to predict Nifty50 with compare usdinr and sgx nifty..

(1) usdinr :- try to go UP its take support at 82.000.

last night usdinr had a up rally and its come to 82.000 and stay here.. this moment effected SGX NIFTY IN last night and it's go down Upto 100 point...

All the thing make possibilities to Nifty50 will go down and open with 50 point gap down ......

USDINR-Weekly Outlook-Venkat's BlogAs noted in the previous blogs the supply improved closer to 83 mark and the pair saw an unexpected deeper correction after 4-5 weeks of continuous buying interest. Also that the target of 81.80 achieved and even the pair has seen even lower levels. Now the question is on what next and where from here. Since the [pair has closed below the critical 81.80 levels, the next crucial level to look for would be 81.25. We may see a pullback if we do not see a daily close below 81.20. Most likely scenario would be a consolidation between 80.90 and 82.20. There could be choppy moves within this range. A close outside this range requires re-assessment of risk/direction and target. If the momentum continues we may see the pair drifting towards 79.90.

A few more observations:

The currency corrected after making multiple attempts to break 83

Dollar Index-DXY is likely to continue the familiar range of 101-105. However, there may not be major impact seen on the pre-existing range

The raising upward channel indicate the broader range of 77.10-83.30

As noted in the previous blog, continue to keep the following input for quick reference.

The 82.75-83.25(with error adjustments) zone is the Fib projection of July 2011 to July 2013. Hence, the importance. If breached, we may see another out of spike towards 85.70. At least for now the zone is protected

The increased volatility and wild swings likely to continue

Disclaimer: The views expressed here are personal and not connected to SYFX Treasury Foundation. The views are for learning and reference purpose only.

US DOLLAR/INRMaking ascending triangle pattern breakout level was 83.

But getting third time rejection from resistance level (83).

Now near toh small support zone if reverse from here then indian market will fall or if support level broken down then more upmove can come in Indian market.

A Big fall in Indian will only come if dollar closes above 83 level.

A New high will be on cards in Indian markets when dollar closes below 80.47 level.

USDINR-Weekly Outlook-Venkat's BlogFor the fifth consecutive week the pair saw constant buying interest and posted a green candle. However, the size of the move is narrowing viz. between 82.56 & 83.02. From Oct 2022 we have seen this as the third attempt to cross 83 mark. The question is whether it will breach this time. While we may expect the supply to improve closer to 83 mark, we cannot rule out the chances of one spike to 83.50-83.70 and then cool-off. Alternatively, if the 83 holds for a couple of weeks more we may see the reversal towards 81.80. Till we see a daily close below 81.80, we can assume that the pair would continue the consolidation phase between 81.80 and 83.30. Most likely scenario would be a consolidation between 81.60 and 83.20. There could be choppy moves within this range. A close outside this range requires re-assessment of risk/direction and target.

A few more observations:

The currency is attempting the top of long term trend line

Dollar Index-DXY is likely to break the familiar range of 101-105. However, there may not be major impact seen on the pre-existing range

The raising upward channel indicate the broader range of 77.10-83.30

As noted in the previous blog, continue to keep the following input for quick reference.

The 82.75-83.25(with error adjustments) zone is the Fib projection of July 2011 to July 2013. Hence, the importance. It is a million-dollar question whether this zone will be breached. If breached, we may see another out of spike towards 85.70

Candle formation does not indicate immediate risk. Yet the impact on businesses would be immense if it does happen

The increased volatility and wild swings likely to continue

Disclaimer: The views expressed here are personal and not connected to SYFX Treasury Foundation. The views are for learning and reference purpose only.

Ascending triangle breakout in USDINRA chart says more than a thousand words!

As the technical analysis suggests, The #usdinr is once again all set to give a bullish breakout of an ascending triangle pattern.

Here are three fundamental reasons that can also support this breakout.

- Federal Reserve's preferred inflation indicator, The US core PCE price index has increased by 4.7% annually, beyond market estimates of 4.3% and rising from December's rate of 4.6%.

- FOMC minutes signal that policymakers will increase interest rates and keep them higher for longer to tame unsustainable price growth.

- A fall in the Indian foreign exchange reserve from 575.27 billion to 561.27 billion this month and rising US bond yields will also strengthen the dollar against the Indian rupee.

Note: This post is only for educational purposes. Trade at your own risk.

#forex #usdinr #trading #technicalanalysis

#federalreserve #newsupdate #interestrates #inflation

Predict for indian currency market Hi this is Vijay Shrivastava

And This is thinking 🤔💭

USDINR... IN INDIAN market usdinr close at price 82.8400 aprox and global currency market its move between 82.7300 to 82.6690. That's means indian currency market will open down with 1260point ... then after its back to up with strong move its try to tuch 82.8000 again from 82.6900

Good luck for trade....

USDINR-Weekly Outlook-Venkat's BlogFor the fourth consecutive week the pair saw constant buying interest and posted higher highs and higher lows. However, the size of the move is narrowing viz. between 82.49 & 82.99. From Oct 2022 we have seen this as the third attempt to cross 83 mark. The question is whether it will breach this time. While we may expect the supply to improve closer to 83 mark, we cannot rule out the chances of one spike to 83.50-83.70 and then cool-off. Alternatively, if the 83 holds for a couple of sessions more we may see the reversal towards 81.80. Till we see a daily close below 81.80, we can assume that the pair would continue the consolidation phase between 81.80 and 83.00. Most likely scenario would be a consolidation between 81.80 and 82.80. There could be choppy moves within this range. A close outside this range requires re-assessment of risk/direction and target.

A few more observations:

The currency is attempting the top of long term trend line

Presently the correlation between DXY and USDINR is not active and the Dollar Index-DXY is likely to hover in the familiar range of 101-105

The raising upward channel indicate the broader range of 80.10-83.10

The 82.75-83.25(with error adjustments) zone is the Fib projection of July 2011 to July 2013. Hence, the importance. It is a million-dollar question whether this zone will be breached. If breached, we may see another out of spike towards 85.70

Candle formation does not indicate immediate risk. Yet the impact on businesses would be immense if it does happen

The increased volatility and wild swings likely to continue

Disclaimer: The views expressed here are personal and not connected to SYFX Treasury Foundation. The views are for learning and reference purpose only.

USDINR-Weekly Outlook-Venkat's BlogFor the third consecutive week the pair saw constant buying interest and posted higher highs and higher lows. Till we see a daily close below 81.80, we can assume that the pair would continue the consolidation phase between 81.80 and 82.80. While things look favoring further up move, we may find sellers emerging around 82.80 which is closer to the steep trend line resistance. Most likely scenario would be a consolidation between 81.80 and 82.80. There could be choppy moves within this range. A close outside this range requires re-assessment of risk/direction and target.

A few more observations:

The currency pair reacting and reversing after successful attempt of the top of the break-down trend line

Presently the correlation between DXY and USDINR is not active and the Dollar Index-DXY is likely to hover in the familiar range of 101-105,

The raising upward channel indicate the broader range of 80.10-83.10

The increased volatility and wild swings likely to continue

$usdinr- blow off top incoming?posting this out of curiosity

1970ish is when Nixon said that the $ does not need any gold to back it since then its been up only

with a lot of countries dumping their us bonds and trading with other currencies it aint looking good for Uncle Sam specially with the $33 trillion debt? ( think i got the right figure)

dollar dumping to a ATL would mean everything priced in usd would rocket up since you need more dollars to buy the same thing

been waiting for this scenaro since 2017 so dont hold your breath for it to happen overnight but that's my general outlook

imo time to liquidate all usd denominated assets and pop it i emerging economies.

for now looks like we head on up still recon its USD's last tango

only time will tell

43.5 by 2034

USDINR-Weekly Outlook-Venkat's BlogThe pair took support at 81.45 and saw constant buying interest. As observed in the previous blog daily close above 81.75 made the pair attempt the steep trend line with a high as well as close of 82.43. While things look favoring further up move, we may find sellers emerging around 82.55 and then at 82.80 which is closer to the steep trend line resistance. Most likely scenario would be a consolidation between 81.35 and 82.80. There could be choppy moves within this range. A close outside this range requires re-assessment of risk/direction and target.

A few more observations:

The currency pair trying to attempt the break-down levels in the reactive move

though the Dollar Index-DXY is likely to hover in the familiar range of 101-105, the correlation between DXY and USDINR is not currently active

The raising upward channel indicate the broader range of 80.10-83.10

The increased volatility and wild swings likely to continue

Disclaimer: The views expressed here are personal and not connected to SYFX Treasury Foundation. The views are for learning and reference purpose only.

USDINR - Weekly Outlook-Venkat's BlogThe pair took support at 80.90 and made an attempt to scale higher of 81.76 levels, it got sold-off again. The support at 80.90 is a tuff nut to crack and may consolidate in the range of 80.90 & 82.05 with choppy moves on either side. A close above 81.75 can be treated as a reversal for re-attempt of 82.55. Only a break below 80.90 can see the pair drift towards 80.50 and then to 80.20. Most likely scenario would be a consolidation between 80.90 and 82.05. A close outside this range requires re-assessment of risk/direction and target.

A few more observations:

The currency pair trying to attempt the break-down levels in the reactive move

The correlation between DXY and USDINR is not currently active

though the Dollar Index-DXY is likely to hover in the familiar range of 101-105

The raising upward channel indicate the broader range of 80.10-83.10

The increased volatility and wild swings likely to continue

Disclaimer: The views expressed here are personal and not connected to SYFX Treasury Foundation. The views are for learning and reference purpose only.

Compare to indaxHi this Vijay Shrivastava and

This is thinking 💭 🤔

I try to compare SGX NIFTY WITH USDINR for catch Nifty 50 next moment..

(1) I think Nifty will go up upro 100 point because sgx have a strong support zone from here and currency make resistance..

In my opinion I currency move to 81.3500 so sgx nifty also cross 18100 level and in Indian market Nifty will come to 18150 again....

And one more thing if currency go 81.3500 so I am also bullish in bank Nifty..

(2) if currency move up to 81.4500 to 81.5500 may be in that case we see Nifty in sideways zone..

(3) this is very important Nifty try to make support from here it's also like aresistance level if currency move up from here so definitely in next trading day Nifty will more down from here aprox 85 to 130 point...

So be raddy next day what ever market decide to go we raddy catch our luck 🤞 from here

..

Tomorrow market mood There to difficult to understand behavior Then whether it is of human or of market?

The mood of market for tomorrow by the comparison USDINR TO NIFTY 50..

USDINR is show down from its make a side way move ..

Is NIFTY follow this pattern then we see Nifty also is side way in tomorrow trading hours between 18100 to 18150...