$ZC_F March/December Corn SpreadThe best cure for a high corn price is a high corn price because producers will plant more corn next season to take advantage of the current high price and inadvertently drive up the supply which will in turn drive down the future price. Assuming supply through March is scarce and by December it will be relatively plentiful, it makes sense to go long the March contract and short December because the March contract should outperform the December. Both can go up and down together, March just needs to outperform. Yesterday was a red day for both contracts and today is a green day for both, gains in the March/December spread were realized on both days. The December leg can be closed for greater reward if March corn resumes the strong upward rally but the risk will be greater because there will no longer be a balanced quantity of contracts mostly cancelling each other out. I currently have one contract of each and am playing it by ear because spread trading is new to me. I may up the quantity to two or three each depending on how the trade goes and if my broker will let me.

ZC1! trade ideas

Corn: A Potential Fade Approaching Corn seems to be in the final stage of a bullish run here. In terms of % gain, it is almost at the psychological 100% increase area from Mar'20 low. Short risk exposure is becoming more risky at these levels. With another push higher, some decent supply inflows are expected.

Is it time to short the Corn Market???CBOT:ZC1!

In recent times most commodities have been heavily inflated. So when is it time to short these things on a macro scale? Well, if seasonality tells us anything, typically corn prices start to fall once we enter the month of June.

There are 2 areas of supply on this chart, 1 of which we are already sitting in while the other is sitting at 627-680.

ZCH21-Technical'sMarch 2021 U.S Corn: Weekly Chart

*considering such tight U.S corn c/o, bullish fundamental narrative has not changed.

*focus is on SAM weather issues / logistical problems in SAM

Price Target: 640'0 | BULLISH OUTLOOK

-not surprised to see recent liquidation w/ m.m crts net longs close to 350K and at record-high. M.M making substantial gains recently w/ most of pos. initiating before bullish USDA report during Jan 11.-(which showed a surprise in most grain's and exceeded most trade guess highs )

Studies: RSI, ATR, Volume

Traditional|ZC1!|Long and shortLong and short ZC1!

Activation of the transaction only when the blue zone is fixed/broken.

Working out the support and resistance levels of the consolidation zone.

* Possible closing of a trade before reaching the take/stop zone.

The "forecast" tool is used for more noticeable display of % (for the place of the usual % scale) of the price change, I do not put the date and time of the transaction, only %.

The breakdown of the upper blue zone - long.

Breakdown of the lower blue zone - short.

Working out the stop when the price returns to the level after activation + fixing in the red zone.

Blue zones - activation zones.

Green zone - take zone.

Red zone - stop zone (S-SL short stop, L-SL long stop).

Orange arrows indicate the direction of the take.

Red arrows indicate the direction of the stop.

P.S Please use RM (risk management) and MM (money management) if you decide to use my ideas, there will always be unprofitable ideas, this will definitely happen, the goal of the system is that there will be more profitable ideas at a distance.

ZC Coiling up for next moveAfter this week's WASDE report, ZC limited up on 1/12. After the expected retracement, ZC has been trading in a range from 527-537.

POC is located at 534, I am expecting a retest of the high of 541'4 in the coming weeks. However, any break below 522'0 would indicate short term weakness.

Long term target of 560'0 by early Spring.

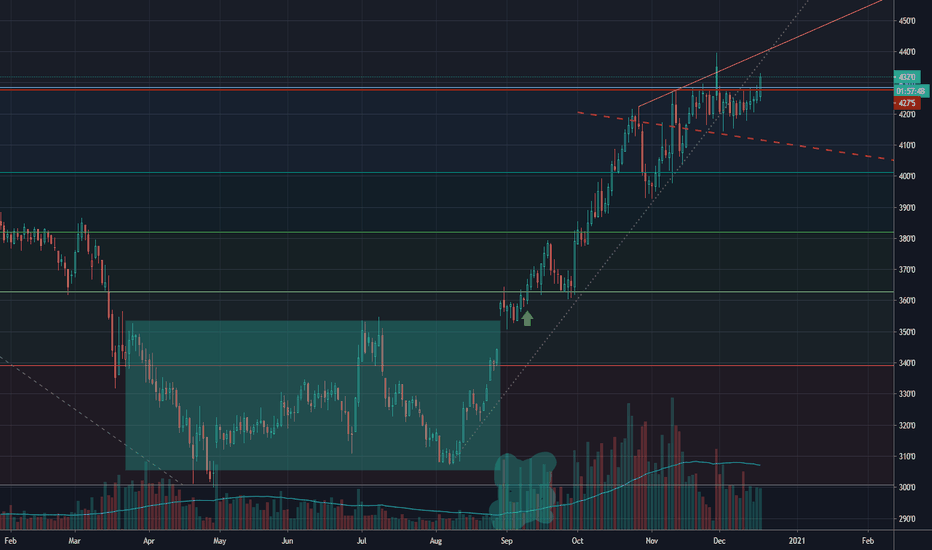

Current Corn StructureTop: Monthly Corn (2012-Present) Green box illustrates the current Harvest rally. Currently Corn is up 63% from its August Low, matching the 03/04 rally.

The next target above at the 38% retracement of 5.07. **06/07 and 07/08 rallies illustrated above**

Middle: US Dollar- US Dollar is trending lower, but the path forward is up for much debate. Higher or Lower???

Bottom : COT / Funds & Commercials – The Funds are Long and the Commercials are Short. We rarley see the Commercials this short In a strong carry market with an abundant supply, especially this time of year. The 03/04 market had the commercials eventually lifting their shorts and followed up with the next couple of years trading in the range that precluded the 03/04 rally. The 07/08 rally kicked off a multi year bull market. Funds long and Commercials remained Short…

Upside is unmeasurable, but Bulls proceed with caution. The first run out of a multi year bear, usually isn’t as strong as the later years in a multi year bull.

Continuous Corn Then to NowTop: Monthly Corn - Green boxes illustrate Harvest rallies from Aug into the next year. The dark green boxes below represent the end of each rally. Strength of rally’s depend on strengh or weakness of dollar and money flows from the funds and (more importantly) hedge activity from the commercials.

Middle: US Dollar- Strong $ discourages a healthy US export market. Slows demand. Weak dollar strengthens the grain markets

Bottom : COT / Funds & Commercials – Weak dollar spurs export demand. Demand creates volatility & higher prices. All of which work together to engage the producers selling. The commercials buy the physical (offsetting with short hedges), and the speculators riding the waves. At times the commercials get caught with sudden strong demand or short crop. Commercials can remain short for extended periods until the next supply build. Funds stay Long

After pullback, long ZCStrong technical upward trend last few weeks on ZC which broke price levels not seen since 2014. Expect some volatility going into next week's WASDE report on 1/12/21. From a fundamental side, current La Nina weather pattern in the Pacific could impact South American crop production.

After a pullback, I am anticipating this trend to continue. Targeting mid to upper 500's by February/March.