TSN trade ideas

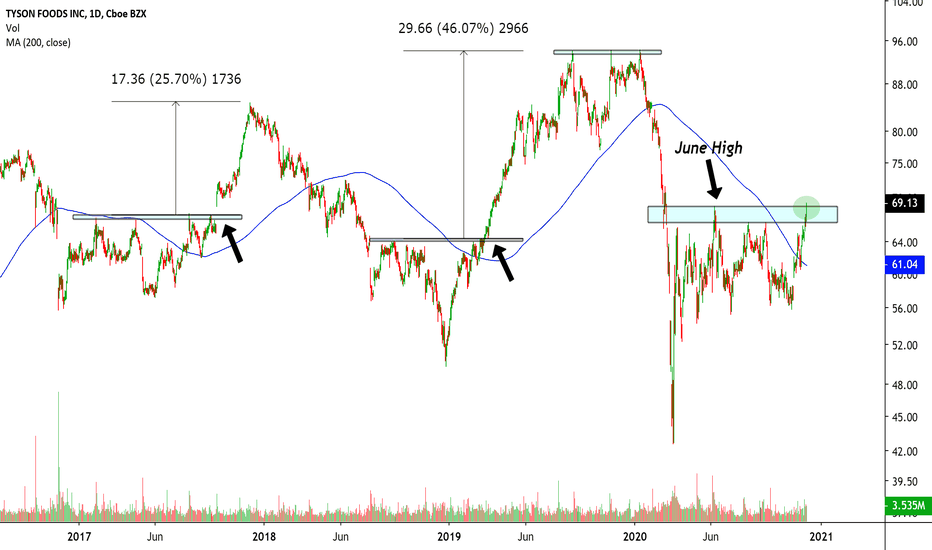

Tyson Foods $TSN breaksout, but I'm not convincedNYSE:TSN looks great, is clearly in an uptrend breaking out of a second base after beating EPS estimates last week. The thing is that I don't see volume action, or a good follow-through. Still, I keep my eye on this one. Industrials have been leading the market for the last weeks and NYSE:TSN is one of the leaders of the Food Production Industry, is rank 3th by IBD, and has a Relative Strenght Rating of 69. Ussually I'd like it better if it had a higher number regarding its relative strength.

I'd like to add that I'm watching NYSE:DAR and have a small position in NYSE:INGR . All leaders in the Food Industry.

TSN is ready!Wait for pullback entry, but this is a beautiful setup if you like easy money.

On the weekly, TSN has been trading under the weekly ichimoku cloud since the beginning of March 2020 and we have finally crossed over and bounce above the clouds with decent volume.

We have potential to get to the 0.786 at $83.26 by the end of month.

Long term price targets 74.53 - 83.26 - 94.37 - 106.62

TSN Chicken, Get SomeTyson is looking good to retest the gap around 68$.

Technical Info:

Gap confirmed to buy back to

Earnings per share better than expected 1.94 vs 1.58

RSI is above 50 and thats good for upward momentum

TSN has underperformed the market and this stock typically does better when the leading sectors like technology start to lose their attractiveness. This is a good short trade or a good entry for longterm.

TSN - Breakout watch - Target 73TSN is in break out watch.

Breakout target 73.

———————————————————

How to read my charts?

- Matching color trend lines shows the pattern. Sometimes a chart can have multiple patterns. Each pattern will have matching color trend lines.

- The yellow horizontal lines shows support and resistance areas.

- Fib lines also shows support and resistance areas.

- The dotted white lines shows price projection for breakout or breakdown target.

Tyson Foods, following the pathSupport level at $ 60.

Resistances at $70 (61.8% of the Fibo) and $80 (78.6% of the Fibo).

Expected return between 7 and 23 percent at current price during this quarter.

Close to breaking a triangle (bullish)

Initiating a bullish channel.

Exposure in more than 170 ETFs.

80.39% institutional property.

Vanguard, BlackRock, State Street, and Invesco as its main investors.

EMA awaiting trend.

NYSE:TSN

TSN primed for an increase?Hi, this is my first idea published. Still learning about chart patterns.

Ascending triangle set up. 5- and 10- day moving averages are increasing and are approaching 22 day moving average. Stochastic and RSI don't indicate overbought or oversold conditions and suggest momentum to help push a breakout. Setting a price target of 68, though I could see it pushing closer to 70.

BUY to TYSON FOODS DailyHello traders, TYSON FOODS is on a bullish temptation with low buy volume and sellers trace. The TIMEFRAME M1 shows a marubozu with a high volume of purchase there is a high chance of breaking out the price. Then then the comfort zone for arrival in another and mounted on the next top which and the beginning of the last panic. And if the buyers are back try to return to the front Vue in MULTI TIMEFRAME. With two tests two resisitances on THE TIMEFRAME H1 Little buying force to touch the intermediate median of ANDREWS PICHTFORK.

Please LIKE & FOLLOW, thank you!

$TSN with a neutral outlook after earnings$TSN posted its earnings with a positive over reaction following its release with the PEAD projecting a neutral outlook placing the stock in Drift B

If you would like to see the Drift for another stock please message us. Also click on the Like Button if this was useful and follow us or join us.