VYM trade ideas

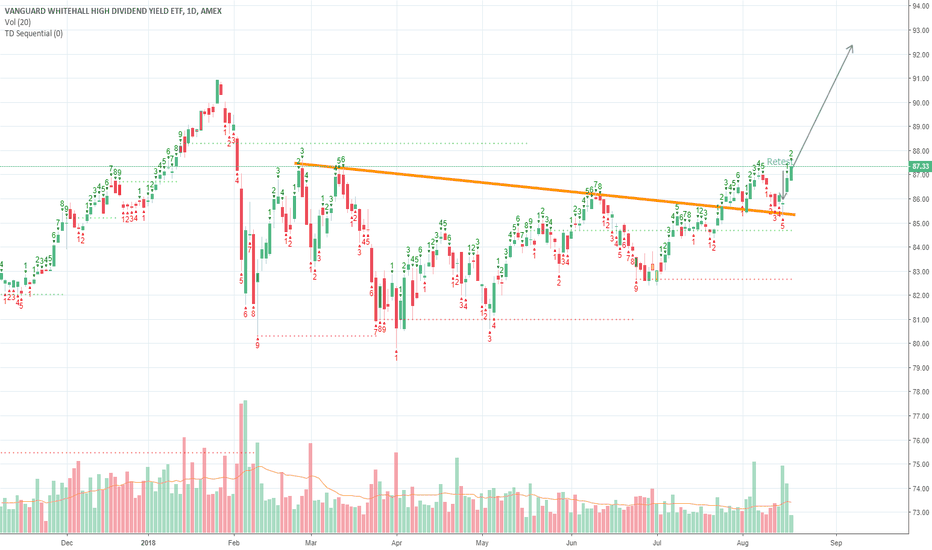

Continuation Diamond (Bullish) | 19% move possibleVanguard High Dividend Yield ETF forms bullish "Continuation Diamond" chart pattern

"Continuation Diamond (Bullish)" chart pattern formed on Vanguard High Dividend Yield ETF (VYM:NYSE). This bullish signal indicates that the stock price may rise from the close of $110.96 to the range of $130.00 - $134.00. The pattern formed over 452 days which is roughly the period of time in which the target price range may be achieved, according to standard principles of technical analysis.

Tells Me: The price has broken upward out of a consolidation period, suggesting a continuation of the prior uptrend.

The pattern begins during a downtrend as prices create higher highs and lower lows in a broadening pattern. Then the trading range gradually narrows after the highs peak and the lows start trending upward. When the price breaks upward out of the diamonds boundary lines, it marks the resumption of the prior uptrend.

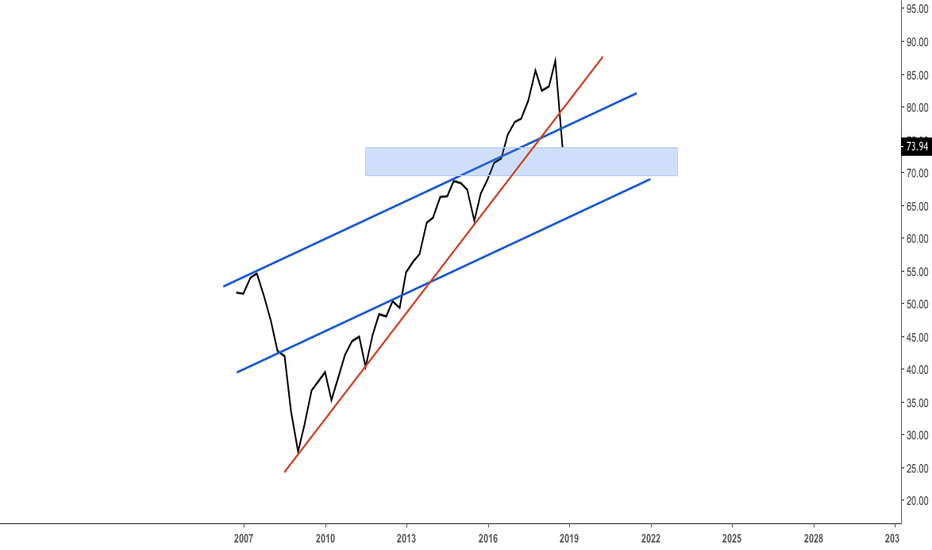

VYM high yield dividend to see a -20% correctionThe Vanguard High Yield dividend fund could see a further repricing of about -20%, considering that supply chain shocks, Inflationary commodities prices, and higher marginal costs have compressed revenue growth margins for corporations. This will make corporations have to reduce dividends and earnings per share going forward, thereby making High Dividend Yield funds an overpriced fund. A further repricing of 20% down to a value area of 85>80 could be a possibility, also from a technical standpoint, a retracement drifting lower on the channel line support could then become an attractive value investment, if and when macroeconomic conditions and corporate earnings will start to improve.

Long for VYMHigh Dividend ETFs are Beating the Market now, because it contains a lot of save recession proceed assets. This is what all need in current market environment.

We have a nice price action pattern. And reversal pattern with 2 day in row close above last pivot at the D perviod.

I am going to buy after correct to 10.36.

Long opportunity Hey guys,

Most stocks breakout after market opening so it makes sense to open a position the previous day before the market close. What we can see on Vanguard is a obvious bullish flag for more upside potential.

Set your SL in profit once it spiked up.

Wanna join my telegram channel ?

Leave me a private message.

Stock buying opportunity Hey traders,

Although we actually focus on forex trading we keep a look on stocks. In this case we see a wonderful possibility to go long in Vanguard. It’s forming an inverse HS and it’s overall bullish.

BUT

Be careful about 80.00 . It’s a technical and psychological resistance.

Once we broke it, we can go much further.

Popular Vanguard Has High Exposure to Bad Market Conditions.Vanguard funds have substantial exposure to bad market conditions. Investors will usually find their investment weighted towards the most popular stocks - and these can be the most volatile ones. Although the portfolios can own many different stocks, a large share of these is usually condensed in a small percentage of them. Meaning there is more risk on certain assets and correlated asset than some Vanguard investors may think.

This fund has performed very well recently, but herein lies the potential problem. It has gained a lot of ground by having a lot of exposure to volatility. So far so good on the direction of volatility for investors, but if this switches and price starts to fall, prices can fall over three times as far as they have risen.

The popularity this fund has gained adds to the risks for investors. Many people invested in the same assets may lead to liquidity problems if a lot of them panic and want to make similar moves at similar times. This herd sort of reaction in common in markets. This could increase the downside volatility, making this a more unstable asset.

From a technical viewpoint, when using a 1.61 projection from the last big fall in this, there is an obvious reaction when price meets this level. After making this reaction it has went higher, but this could turn into a false breakout. Using reduced risk to sell at current prices gives good RR. If this comes down and back under the 1.61 projection level, this becomes a strong sell.

An interesting footnote on Vanguard, in one of their own documents it is disclosed that Vanguard employees have around $6.5 billion invested in Vanguard products. Vanguard's portfolio managers have $560,000 (or less), and this is held between two people. The rest have nothing invested. When the people making the tea have more at stake than those at the wheel, might not be good.

Swing Trade : Sell VYM 94.78. Stop Loss 97.90. Target 34.

If this move starts to happen, I will post additional short term trades to follow the momentum through days/weeks

Bearish on VYM -which could be buying opportunityAlthough the recent break above resistance is definitely a bullish signal, I do think we will see a reversal. The breath of the break and the two candles following seem to show that the market is uncertain and ready to drop back down at any moment. Add to this the recent political issues -which are issues- and the trade tariffs which do weight on larger/international companies of which VYM is composed and there is a bit potential for a downturn.

Note that I do think this is a good opportunity to buy; unless a real crash is coming, a correction of 10% would offer entry points in a good/stable economy and index.