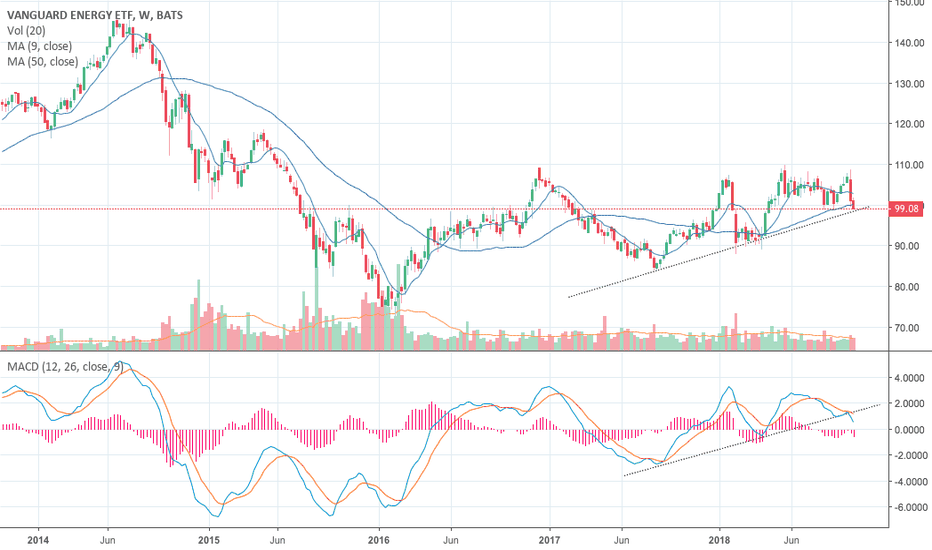

VDE trade ideas

$VDE Energy Sector Profit Taking/Profit Protection TimeAs the energy sector is heating up, it could be time to start locking in profits or raising stops to protect profits earned from the recent run up

Energy more then likely will continue the overall uptrend in the long term as it works it way back towards its 2008 highs however from the recent short term high as the sector has run into a major resistance area over the past few years and increasing by nearly 40%+ since the start of the year to run into this area, it could just as easily pull back a big part of this move before it could be ready for the next leg higher

request for VDE from a buddy on trading view. I would look to get out around 47.30$ maybe even a bit lower , not sure what your target was

this analysis is personal opinion , in no way it's a professional guidance for a particular position. I do wish you luck, sounds like this one will be a great winner for you :))

what's your vision on it, where do you think you will actually get out?

sometimes its best to walk away with 75k then to dream of a 100 and then end up with 50 lol , which isn't bad also

for - @Stockmaniac55