We wanna BUY Recsi At 15-16.60Using 4h chart. We have had a big wawe upp. From 9.45 To 20-21.

The Stock Are shortet Right now. And i Belive They will push the Price down. So They can acumulate more Stocks Before News. After this big wawe uppwards i Also want to Se a ABC correction. And Hopefully we can Get Recsi Below 16.60 But be in mind, that many buyers looking for This price.

Rsi 4 h Get declined and is getting pushed downwards.

We Are now inside in this Triangel. And resistens you find in the green Line.Break out from this will be reversal from Bear To Bull.

Good luck Happy Hunting.

Strongpoint $STRO huge rally after strong newsflowDelivery platform unicorn Glovo chooses StrongPoint as preferred supplier for grocery picking solutions

StrongPoint today announces that Glovo, the on-demand meal and grocery delivery platform available in 22 countries and one of Europe’s leading technology unicorns (a valuation of over USD 1 billion), has chosen StrongPoint as a preferred supplier for grocery picking technology.

Glovo plans to use StrongPoint’s picking solution to empower its grocery partners with a faster, more efficient and accurate way of processing online orders – saving time and cutting costs. The project will begin in Q1 in Southern Europe and the intent is to later deploy StrongPoint’s technology to also other countries in which Glovo is operating. Glovo provides on-demand groceries via its retail grocery partners which include Walmart, Carrefour and Spar.

“Our customers expect us to be effective and efficient, delivering orders with speed and accuracy. StrongPoint has a proven track record of supplying retailers and grocery stores with highly efficient picking solutions that make fulfilling online orders faster. Every day we are onboarding more grocery store partners and we want to provide them with the easiest way to pick and pack the groceries orders so we can deliver it to the customer as quickly as possible,” said Daniel Alonso, Vice President of Q-Commerce at Glovo.

“We are extremely proud that our world-class grocery picking solution has been recognised by the tech unicorn and delivery platform Glovo and look forward to empowering their grocery retail partners with our technology. For grocery retailers the key to e-commerce profitability is making the logistics of processing online orders as fast and efficient as possible – which is exactly what our technology enables,” said Jacob Tveraabak, CEO of StrongPoint.

-----------------------

StrongPoint is a Norwegian company that improves the way retailers do business, the company is organized in two business areas; Retail Technology and Labels.

StrongPoint provides retailers with integrated technology solutions that increase productivity and improve the shopping experience in stores and

online. The Labels business area offers adhesive labels for any product and application.

Recently, the companys stock has skyrocketed after very strong newsflow.

Aker Solution potential breakout of down trend. OSL:AKSO

On 1-hour time frame, we can see a breakout of the downtrend pattern. Also, we can see not so nice of invers head and shoulder pattern. To continue of the uptrend we need to wait to break resistance at 15,5 NOK, With the coming quarterly report (15 February) and potential dividends pay we might see AKSO going above 20 NOK in the short term time.

Nas.ol from next E!I think in short term will drop around 55/45 dolars wich will be a good entry point for long term! After E or from E I expect to drop and to have a good ocasion to buy! A good stock with a huge potential for next 2/4 month!

Buy zone 55/45!

Strong suport at 50! Average price 61!

Next 2/3 month price target 90+!

This its not a finacial advice, its just my idea!

Good luck to everyone!

BUY signal confirmed!! Fundamentaly the stock is solid. Strong short term and long term. If you look at pattern last month, we are probably looking to hit the roof in short term, most likely monday.

Market look bright for Rec silicon next years and many triggers follow. The moses lake factory are closed due to trade war with China, but US are working hard to make its own value chain in solar and batteries. Rec silicon har world leading in its field and largest outside of china. If you belive that EU and US will try to make their independenta from China regarding solar production, then i would place all my bets on Rec silicon asa. Once message about reopening the moses lake plant comes, stock will double. Recomend to read recent news. Huuuuuge potential. The factory that are still open , Butte, having an yearly ebitda on 30 musd minimum, but prices is rising, so is the demand. Whole company at mcap less then 1 b usd. Raplacemeny cost of the 2 factories is 1.7 b usd... nothing is priced inn at the moment... huge potential.

EQUINOR (EQNR) | Technically a Good Investment OpportunityHi,

Equinor ASA (Norway) , an energy company (lately renewable electricity also), explores for, produces, transports, refines and markets petroleum and petroleum-derived products, and other forms of energy in Norway and internationally.

Break above the downwards trendline, break above the strong horizontal price zone.

Break confirmed and we can enter around 140-153 NOK.

Good luck,

Vaido

Photocure $PHO Partners with Asieris on Hexvix in ChinaPhotocure Partners with Asieris MediTech to Commercialize Hexvix in Mainland China and Taiwan

Agreement Expands Photocure’s Hexvix®/Cysview® Franchise Footprint to over 30 Countries

Oslo, Norway January 26, 2021, Photocure ASA (PHO:OSE): The Bladder Cancer Company focused on delivering transformative solutions to improve the lives of bladder cancer patients, announces that it has entered into a partnership agreement with Asieris MediTech Co., Ltd. (Asieris), a division of Jiangsu Yahong Meditech Co., Ltd., whereby Asieris has obtained exclusive rights to register and commercialize Hexvix® in Mainland China and Taiwan.

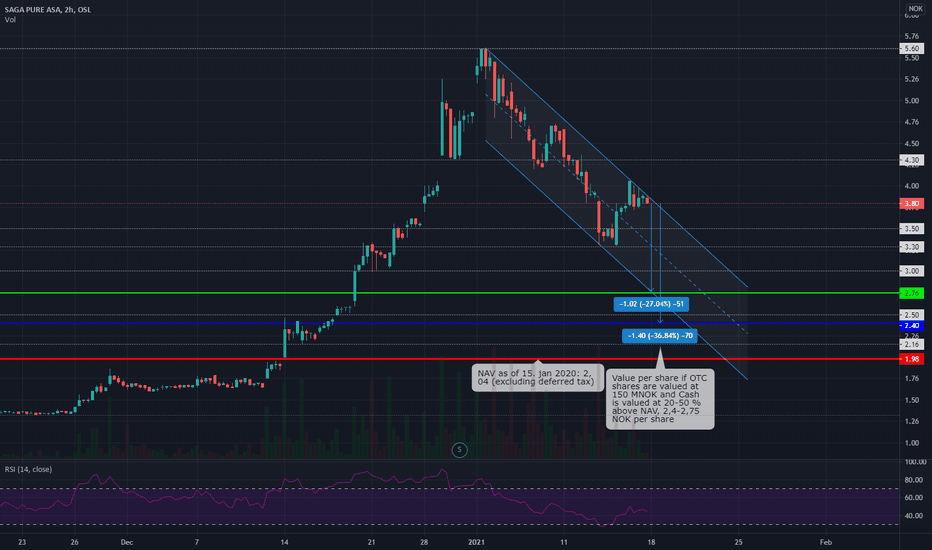

Saga Pure trading at 175-194 % of NAV (price target 2.2-2.9 NOK)Saga Pure ( OSL:SAGA ) is an investment company focusing on renewable and clean energy. Their investments are in both publicly traded companies and in private companies. The largest shareholder is Øystein Stray Spetalen.

The company was previously named Saga Tankers and owned stocks in S.D. Standard Drilling, an indoor sport arena and other smaller investments. Prior becoming an investment company the company owned various tanker vessels that was sold in 2011 and 2012. The company launched a new strategy in the fall of 2020 where investments would focus on renewable and clean energy. With a new strategy they divested what they considered outside the Company's main investment focus (except Vistin Pharma and Element), hired a new CEO (Bjørn Simonsen) and have issued shares a number of times to fund future investments.

According to my calculations, Saga Pure is currently trading at 175-194 % of net asset value. My price target is 2.2-2.9 NOK per share.

The company published a prospectus 11th of January 2021 as they are doing three subsequent offerings after the a number of private placements. According to my understanding of the prospectus:

Net asset value as of 15th of January 2021 before execution of subsequent offerings:

Sum listed investments (fair value, market price): 325.94 MNOK

Sum investment in private companies (investment value): 65 MNOK

Net cash-liabilities: 517.1 MNOK

Cash received from partial divestment of Everfuel ASA: 13.3-101.5 MNOK

NAV: 921.34-1,009.54 MNOK

In addition to the assets listed above they have an nine-month option for a 30 MNOK investment in Bergen Carbon Solutions.

NAV per share:

Post private placements (469,149,831 shares), NAV 1,96-2,15 per share

Post private placements + CEO options (484,149,831 shares), NAV 1,96-2,15 per share

Post private placements + CEO options + Subsequent offering I (488,149,831 shares), NAV 1,97-2,15 per share

Post private placements + CEO options + Subsequent offering II (493,049,831 shares), NAV 1,98-2,15 per share

Post private placements + CEO options + Subsequent offering III (497,849,831 shares), NAV 2.00-2.17 per share

If we assign the cash holdings with a value 20-50% above NAV the price target for Saga Pure is 2.2-2.8 NOK per share. If we value investment in private companies (executed in 11th and 28th of december 2020) at double the investment price target is 2.3-2.9 per share.

Investments:

Everfuel ( OSL:EFUEL ), 1.8 million shares, listed on Euronext Growth, market price as of 15th of January 2021 153 NOK, fair value 275.4 MNOK

Vistin Pharma ( OSL:VISTN ), 2,284,280 shares, listed on Oslo Stock Exchange, market price as of 15th of January 2021 20 NOK, fair value 45.69 MNOK

Element ( OSL:ELE ), 970 thousand shares, listed on Oslo Stock Exchange, market price as of 15th of January 2021 5 NOK, fair value 4.85 MNOK

Horisont Energi ASA, 35 MNOK, not listed, fair value at investment date 35 MNOK

Bergen Carbon Solutions AS, 30 MNOK (+option agreement with the right to invest additional 30 MNOK in a nine-month period), not listed, fair value at investment date 35 MNOK

Sum listed investments (fair value, market price): 325.94 MNOK

Sum investment in private companies (investment value): 65 MNOK

Capitalization and indebtedness adjusted for post-balance sheet events, private placements and investments:

Cash: +537.2 MNOK (including private placements, excluding potential proceeds from subsequent offerings)

Trading securities: +18.1 MNOK

Long term debt: -0 NOK

Other current financial debt: -38.2 MNOK (including 35 MNOK investment in Horisont Energy)

Net cash-liabilities: 517.1 MNOK

Other noteworthy changes in balance sheet:

Saga Pure has divested 700,000 shares in Everfuel between 29th of October 2020 and 6th of January 2021. Bringing their investment from 2.5 million shares to 1.8 million shares. The price for the 700,000 shares sold is unknown. The market price per share has a low of 19 NOK and a high of 145 NOK in the same period. This will have a positive effect on their cash holding by 13.3 - 101.5 MNOK.

Private placements since 20th of October 2020:

Number of shares prior 20th of October 2020: 286,149,831

54,000,000 (2020-10-20), gross proceeds 70.2 MNOK, cost 1.5 MNOK, net proceeds 68.7 MNOK

34,000,000 (2020-11-30), gross proceeds 54.4 MNOK, cost 1.2 MNOK, net proceeds 53.2 MNOK

35,000,000 (2020-12-14), gross proceeds 73.5 MNOK, cost 1.3 MNOK, net proceeds 72.2 MNOK

30,000,000 (2020-12-21), gross proceeds 87 MNOK, cost 2.0 MNOK, net proceeds 85 MNOK

30,000,000 (2020-12-29), gross proceeds 123 MNOK, cost 2.0 MNOK, net proceeds 121 MNOK

Number of shares post private placements: 469,149,831

Number of shares available in subsequent offerings:

4,000,000, price 2.1 NOK per share, potential gross proceeds 8,4 MNOK (bringing the total number of shares to 473,149,831)

4,900,000, price 2.9 NOK per share, potential gross proceeds 14,21 MNOK (bringing the total number of shares to 478,049,831)

4,800,000, price 4.1 NOK per share, , potential gross proceeds 19,68 MNOK (bringing the total number of shares to 482,849,831)

Subscription period ends on 27th of January for all three subsequent offerings.

Number of shares the board has allocated to share options (25 million shares authorized to allocate for options for employees and key persons):

5,000,000, strike 1.5 NOK

5,000,000, strike 2.0 NOK

5,000,000, strike 2.5 NOK

10,000,000, authorized but not allocated

Other information from the prospectus:

Saga pays a fee on a total of NOK 200,000 ex. VAT each month to Ferncliff Holding AS for consultancy services carried out by Martin Nes and Øystein Stray Spetalen. Ferncliff Holding AS is a company owned and controlled by director and main shareholder in Saga, Øystein Stray Spetalen.

The Company pays on a hourly basis for back-office services such as accounting, and a monthly fee for rent of office premises and common costs.

KahootFundamentally Kahoot can be a possible rocket of 2021.

- more and more companies are discovering their potentiel on the international scene

- Vastly increasing turnover for every each year