$TSLA LONG | CURRENTLY ON SUPPORT LEVELHello hello hello...

It's time for a brand new analysis, today we're breaking out $TSLA.

This chart is on 1 hour timeframe. As we can see $TSLA has hit the 250 mark for 2 times already and it has bounced back to 300-340 mark. This pattern has hit already twice in a row, now we will see if it happens for the third time.

RSI9 is pretty nice indicator in downtrends and if you look at the RSI bottoms it is lining up with other dips. After these dips it everytime does a correction. Even tho Wall Street is now skeptical about Tesla's future, I still believe in chart analysis. It will get up! :)

#LONGTESLA

Tslaanalysis

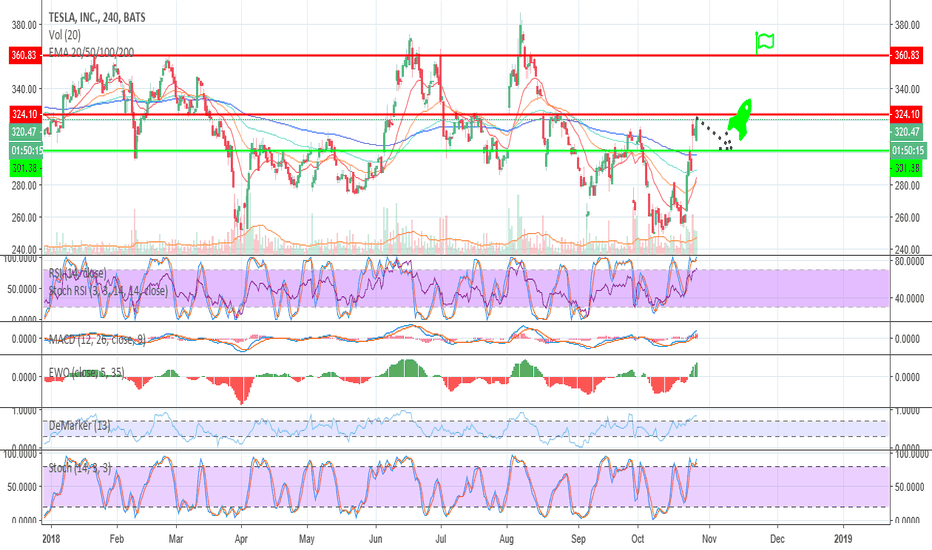

#TSLA With huge potentialThe Stochastic indicator shows us about Oversold as we are below 20 points. This is the first reason for our recommendation for buying. The second reason is the price stuck within a price range between 250 and 380 from July 2018 with support and resistance as clear as seen in the graph and at this moment we are very close to support (With recent declines in indices you should be careful that this can lead to a breakout of support and then further declines)

Sell TSLA:

Entry Price: 257

Take Profit: 380

#TSLA With huge potentialThe Stochastic indicator shows us about Oversold as we are below 20 points. This is the first reason for our recommendation for buying. The second reason is the price stuck within a price range between 250 and 380 from July 2018 with support and resistance as clear as seen in the graph and at this moment we are very close to support (With recent declines in indices you should be careful that this can lead to a breakout of support and then further declines)

Sell TSLA:

Entry Price: 257

Take Profit: 380

$TSLA Giga-move

In the ranging market from December 2013 to December 2016, there were what I see as 3 main moves between $177-$290.

In the current range from March 2017 to now March 2019, you can also see 3 main moves, just a little messier.

The UTA (Ultimate Trend Analyser) and Spectro-O confirm that there is plenty of room for a big move up over the coming months. Spectro-O looks like an almost perfect fractal from February 2016 to February 2017 where I have highlighted. The UTA confirms volume has changed and we're near the optimal entry.

The 50 month MA has been tracking as a well used dynamic support with TSLA and we have come down and kissed it just over the last week, found support and started moving on.

Optimal entry will be under $280 and will need to implement a well thought out stop loss strategy if you're wanting to capture the full move.

Fundamental fuel:

New Giga-factory- www.zacks.com

Model Y reveal in 4 days- cleantechnica.com

Tesla MonthlyTesla rejected the 1.618 many times and has formed a strong resistance there, I see current support 260-245.

If price comes down more I would be watching 250-220 range around the green trend.

If Tesla makes a new high and breaks above 1.618 I would target the fib levels above, so the 2.0 first.

Fundamentally I love Tesla and Elon, but I don't trade fundamentals. Trade safe!!

TESLA STOCK OPPORTUNITY!Tesla, stock has been retracing lately and it is one of the companies which I have a believe in the future so its time to check the charts. Tesla looks like it getting back on track and wants to test 350+ USD prices however I think a short-mid term retrace is coming and we are going to test 300 USD as our support area after which we should take off and go to 350 USD+ area where if we break 400 USD resistance then we might really be taking off!

Good Luck, Traders! #moon #mooncommunity #turtlestyletrading ;)

Be a turtle my friend © Farhad Jafarov

TSLA Short; Weekly Close under Heffae Clouds - MTF Analysis TSLA is closing underneath the Weekly Cloud bottom for the first time since inception.

I believe this means more than consolidation, as the path-fitting has given extremely valid signals on bottoms running up the Monthly so far.

This is an extremely strong signal given the prior path validity and being a longer time frame in agreement with repeated signals from shorter timeframes on Heffae Clouds.

The Monthly provides a target for closing short at 217:

Hybrid Timeframe is showing resistance at 285.

Ideal Entry: 295-300

Target: 218

Tesla Inc long term longs at monthly demand levelTesla Inc. #TSLA Very strong monthly demand in control. monthly is now ranging with price bouncing back and forther betweeen opposing monthly imblances at 340 and 257. Previous monthly and weekly demand levels have been playing out nicely.

No longs allowed right now unless price reaches fresh monthly demand imbalance around 199.

Recent Tesla Data Showing ProblemsRegarding the Model 3:

The company fabricates its production numbers. It goes by “factory gate” or partially completed cars rather than those actually produced and sold to consumers.

Management grew weary of the valid criticism of its persistent – though entirely expected – overpromising and

Full post here: aff.whotrades.com