Trend Transfer - 45min Interval - EURCHFHello Everyone,

The currency pair (EURCHF) appears to be shifting trend direction as numerous buyers (bulls) are entering the market. (Be cautious of a false reversal, wait for confirmation).

Resistance Level 2 - (1.12550 - 1.12580) 30 pip interval

Resistance Level 1 - (1.12185 - 1.1215) 30 pip interval

Blue Horizontal Line (KPZ) - (1.12105 - 12.130) 25 pip interval

Support Level 1 - (1.11610 - 1.11640) 30 pip interval

Not Investment Advice. For Educational and Analytical Purposes Only. (Be Aware and Stick To Your Trading Plan)***

-LionGate

Success

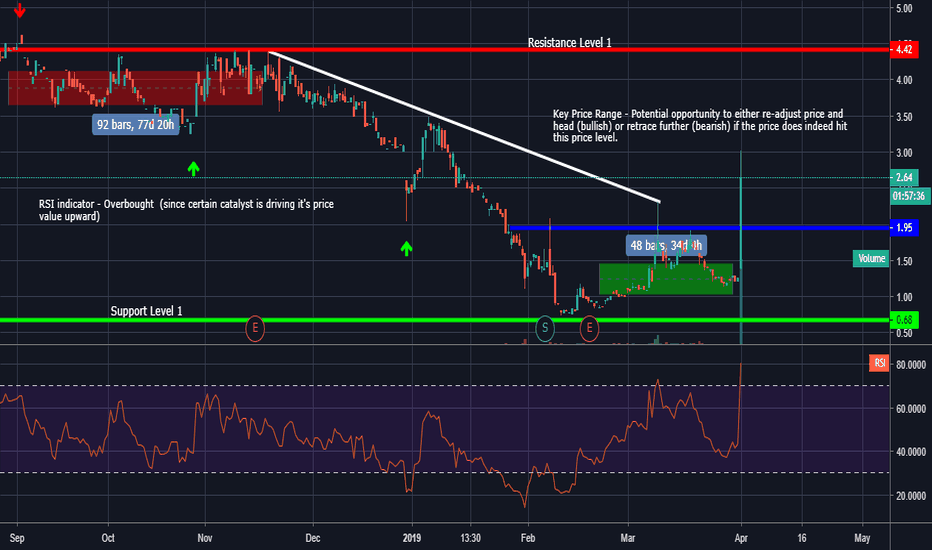

Potential Trend Continuation - 45min Interval - GTXIHello Fellow Traders,

The stock (GTXI) presents a subtle and "non-movement" position within the (4hr + intervals). In the 45min, however, the stock appears to be pulling northward (bullish) for a further continuation from previous average highs.

Resistance Level 2 - (2.45 - 2.65) 20 cent interval

Resistance Level 1 - (1.60 - 1.85) 25 cent interval

Blue Horizontal Line (KPZ) - (1.35 - 1.60) 25 cent interval

Support Level 1 - (0.95 - 1.20) 25 cent interval

Support Level 2 - (0.70 - 1.00) 30 cent interval

Not Investment Advice. For Educational and Analytical Purposes Only. (Be Aware and Stick To Your Trading Itinerary)***

-LionGate

Volatile Past - 4hr Interval - ADMAHello Everyone,

The stock (ADMA) PA (Price Action) has been nothing but (IMO) an eye opener. As numerous traders were seeking to short the stock at price intervals (4.10 -4.15), there was another (bullish) penetration in the stock's trading average. This certainly is lesson for anyone interested or keen on investing in the stock market. (Avoid sporadic price fluctuations, be diligent and considerate of market catalysts)

Resistance Level 2 - (6.80 - 7.10) 30 cent interval

Resistance Level 1 - (5.80 - 6.10) 30 cent interval

Blue Horizontal Line (KPZ) - (4.30 - 4.55) 25 cent interval

Support Level 1 - (1.90 - 2.20) 30 cent interval

Furthermore, risk management is pivotal when attempting to trade such a stock. (Do not let impulsive actions wipe-out your account).

Not Investment Advice. For Educational and Analytical Purposes Only. (Be Conscientious and Stick To Your Plan)***

-LionGate

Consolidation Taking Place - 30min - LINUFHello Everyone,

The stock (LINUF) has begun to consolidate at PA (Price Action) levels (0.037020 - 0.012578), which can be quite a discrepancy in value. There does not appear to be any (solidified) S/R levels that can implicate a viable position at this moment in time (IMO). Further analysis and patience is ideal within any trading strategy.

Resistance Level 3 - (0.131140 - 0.121170) .000030 cent interval

Resistance Level 2 - (0.099750 - 0.099790) 0.000040 cent interval

Resistance Level 1 - (0.039650 - 0.039680) 0.000030 cent intveral

Blue Horizon Line (KPZ) - (0.023985 - 0.023105) 0.000020 cent interval

Support Level 1 - (0.009920 -0.009950) 0.000030 cent interval

Not Investment Advice. For Educational and Analytical Purposes Only. (Be Aware and Stick To Your Trading Itinerary)***

-LionGate

Position Formation - 4hr Interval - USDCADHello Everyone,

The currency pair (USDCAD) throughout the past week consolidated and then gained traction towards a downward (bearish) identity. A reversal or further consolidation may be imminent. Be cautious and let market action take place (Support Level 1 or Resistance 1).

Resistance Level 1 - (1.34680 - 1.34730) 50 pip interval

Blue Horizontal Line - (1.33200 -1.33250) 50 pip interval

Support Level 1 - (1.32430 - 1.32480) 50 pip interval

Support Level 2 - (1.31100 - 1.31150) 50 pip interval

Not Investment Advice. For Educational and Analytical Purposes Only. (Be Aware and Stick To Your Plan)***

-LionGate

Current Consolidation - Daily Interval - ONTXHello Everyone,

The stock (ONTX) began price consolidation after a tremendous push north (Bullish). As of currently PA is immensely volatile and I advise caution when longing or shorting this stock.

Resistance Level 3 - (11.15 - 11.35) 20 cent interval

Resistance Level 2 - (5.90 - 6.15) 25 cent interval

Resistance Level 1 - (4.70 - 495) 25 cent interval

Blue Horizontal Line (KPZ) - (3.35 - 3.65) 30 cent interval

Support Level 1 - (1.55 - 1.80) 25 cent interval

Not Investment Advice. For Educational and Analytical Purposes Only. (Be Aware and Stick To Your Trading Plan)***

-LionGate

Potential Short Position - 4h Interval - PULMHello Everyone,

The stock (PULM) experienced rapid growth (bull) within today's market. Considering the current sporadic momentum upwards, there is none-the-less an opportunity to short the stock till price consolidation.

Resistance Level 1 - (4.30 - 4.50) 20 pip interval

Blue Horizontal Line - (1.80 - 2.10) 30 pip interval

Support Level 1 - (0.50 - 0.80) 30 pip interval

Furthermore, (PULM)'s Net Income: -18.056M which can be quite alarming, as their return on assets is negative as well (-1.1653). If they can revitalize the negative totals (into positive), there still may be hope for them in the coming months and year.

Not Investment Advice. For Educational and Analytical Purposes Only. (Be Aware and Stick To Your Trading Itinerary)***

-LionGate

Potential Correction - 4hr Interval - ADXSHello Everyone,

The stock (ADXS) has none-the-less presented an immense amount of volatility within the last few days (2). The overall trend of the stock, however, is pulling downwards (Bearish) towards territory that hasn’t been contest since (2009).

Resistance Level 2 - (14.70 - 15.00) 30 cent interval

Resistance Level 1 - (10.75 - 11.00) 25 cent interval

Blue Horizontal Line - (8.00 - 8.30 ) 30 cent interval

Support Level 1 - (2.55 - 2.80) 25 cent interval

Furthermore, this is highly sporadic stock and should be handled with immense caution. (Wait for PA confirmation prior to entering a position)

Not Investment Advice. For Educational and Analytical Purposes Only. (Be Aware and Stick To Your Trading Principles)***

-LionGate

Position Developing - 45min Interval - CELHello Everyone,

The stock (CEL) has appearing to garner a modest amount of upward momentum. In the very least, PA is either attempting to consolidate at current price levels or formulate a breakout position. (Let Market Action Take Place and Then Form Your Decision).

Resistance Level 1 - (7.45 - 7.75) 30 cent interval

Blue Horizontal Line - (4.25 - 4. 55) 30 cent interval

Support Level 1 - (5.30 - 5.55) 25 cent interval

Support Level 2 - (3.40 - 3.70) 25 cent interval

Not Investment Advice. For Educational and Analytical Purposes Only. (Be Aware and Stick To Your Trading Itinerary)***

-LionGate

Reversal Impending - 4hr Interval -VUZIHello Everyone,

The stock (VUZI) appears to have endured a significant amount of sellers over consuming buyers (bearish market). In this regard, an immediate (or within the next formation) reversal may be in order to either consolidate at current PA (Price Action) level or breakout to lower lows (or higher highs). Further is always necessary prior to trading transfers

Resistance Level 3 - (7.15 - 7.45) 30 cent interval

Resistance Level 2 - (5.25 - 5.65) 40 cent interval

Resistance Level 1 - (3.70 - 4.10) 30 cent interval

Blue Horizontal Line - (3.15 - 3.35) 20 cent interval

Support Level 1 - (2.45 - 2.75) 30 cent interval

Not Investment Advice. For Educational and Analytical Purposes Only. (Be Aware and Stick To Your Trading Plan)***

-LionGate

Position Formation - 4hr Interval - EURJPYHello Everyone,

Currency Pair (EURJPY) appears to be forming various potential setups within the upcoming weeks.

Blue Horizontal Line - (125.475 - 125.525) 50 pip interval

Resistance Level 1 - (126.185-126.235) 50 pip interval

Resistance Level 2 - (126.750 - 126.800) 50 pip interval

Resistance Level 3 - (127.475 - 127.525) 50 pip interval

PA (Price Action) - (124.700 - 124.850) 150 pip interval

Furthermore, the resistance levels represent possible formations if the (blue horizontal line) is coupled (broken). Which can provide further bullish momentum to hit Levels (1-3). As for the current price action, let the market run its intended course and then wait for confirmation at (blue horizontal line).

Not Investment Advice. For Educational and Analytical Purposes Only. (Be Aware and Stick To Your Trading Plan)***

-LionGate

Reversal Imminent - 45min Interval - EURUSDHello Everyone,

The currency pair (EURUSD) has been on a (bearish) trend since (March 20th -21st). Considering the present PA at Support Level 1, there is a plausible opportunity to believe that the pair will be in an uptrend (or consolidation) within the next few days. Wait for further price confirmation. The PA has broken numerous consolidation levels to further progress downwards (March 25th -26th, March 28th - April 1st).

Resistance Level 1 - (1.13915 - 1.13945) 30 pip interval

Support Level 1 - (1.11890 - 1.11920) 30 pip interval

Not Investment Advice. For Educational and Analytical Purposes Only. (Be Diligent and Stick To Your Trading Plan)***

-LionGate

GBPNZD ShortAs we see we've got double tops on the 1.91500 level which gave us confirmation to take shorts to the downside.

On the 4 hour TF we have also double tops which strongly indicates the major bearish trend.

I'm trying to hold a bit longer than usual 30 PIP's to test a swing trade what I haven't really done yet.

TP Zone I marked out on 1.90200 area where price has already been respecting that zone many times.

This thoughts came only from my analysis, where I'm trying to figure out how the market behaves and in order to become successful trader, it is essential to keep your trades and analysis. Tradingview is the perfect place!

All the best!

Profitable Trading - Tom HallCASINO MINDSET

Casinos consistently generate billions in revenue per year in what many individuals believe is luck.

Casinos don’t exists because of luck, they understand that over a series of events, the odds are in their favour.

As a financial trader you must become the Casino and understand that you will hit drawdown and period of losses, however if your continue to execute your trade plan your profitable edge will play out over time.

Remember, you have no control over when the markets will provide trade opportunities, you do however have control over your capital.

STAND BEHIND YOUR ANALYSIS

Do you experience a feeling of excitement or dread once you execute a live position?

If yes, there are a number of reason why these emotions would be present.

The first is you either have not backtested your strict entry rules, or have no idea what the historical results have produced.

By not knowing your numbers will inevitably cause emotional and impulsive behaviour as you continuously ask yourself whether or not you have a profitable strategy.

The second is your risk is far greater than what you are comfortable losing in relation to your account balance or net worth.

By minimising your risk allows you to have a clearer outlook when approaching your technical / fundamental analysis.

Third, you begin to second guess your technical / fundamental analysis, this could be present because you have viewed a more experienced traders analysis and their thesis was the opposite to yours, alternatively your simply not confident in your ability to read markets.

My advise, analyse the market with a clear and objective approach.

Once you execute your position, sit back and let your profitable edge play out over time.

THE HOLY GRAIL INDICATOR

There are hundreds of trading strategies that provide a profitable edge in the market, so why do traders struggle to become consistently profitable?

Novice traders enter the financial market with the illusion there is a golden indicator that will solve their financial problems.

I’m here to tell you the holy grail indicator doesn’t exist, in-fact implementing an indicator you have not backtested could expose your entire account balance to failure.

Building a profitable edge trading strategy requires significant hours of backtesting and preparation, implementing indicators that provide additional confluence to your thesis.

The more confluence you can build in a small trading zone the higher the probability of success.

Once you have generated a confluence based trading strategy that you are confident to implement, it’s key you fight the consistency and greed demons.

The ability to stay consistent when your strategy enters drawdown comes from the confidence you have in your backtesting data, if you have no historical data of your strategy, how can you build trust and confidence when things are not going to plan.

The greed demons kick in when your strategy is providing some healthy returns, the thought process of a novice trader is to increase risk in the anticipation of retiring quicker than expected, the experienced trader knows that this is simply a period where a strategies profitable edge is playing out, knowing a small drawdown is just around the corner.

Fighting the consistency and greed demons can be the difference between success and failure.

WINNING / LOSING

There is no such thing as winning or losing in a game that has no end, there is only ahead or behind.

Finance is a never ending marathon that requires stamina, just because you’re ahead today does not mean you can’t be behind tomorrow.

- Tom Hall

NZDCHF short trade ideas.NZDCHF is heading down after bouncing off of the descending trendline and there are multiple ways to get involved A) which is more likely to happen and it would be also better to see the trend continuation or B) in case the price fail to push lower and comes back to test the higher resistance.

NZDCAD heading down!!!NZDCAD moved to the descending trendline where i personally got short entry at 0.9241 right at the lower timeframe double top and it moved down nicely. Of course there will be another trading opportunities on the lower timeframes. Targets are set and now wait for pullbacks to resistance levels.

AUDNZD multiple trading opportunities with great reward.AUDNZD broke ascending trendline support and bounced off of what it looks like descending channel (pink lines) which means that there is very good chance that the price will try to reach the top of the descending channel. If this is the case then we have multiple opportunities to get involved in the bull run. The more conservative approach would be idea A) if the price comes back to test the low of the channel or B) if the price breaks the ascending trendline (purple line) and bounce off of it. In the short term we could trade short pullback to the descending channel following the A idea.

EURGBP short trade opportunity.EURGBP reached previous high and did not break it creating a nice pin bar on weekly timeframe which indicates that the price could drop even further. Great entry was at the previous high level but in case you missed it then there is another opportunities to get short. A) if the price reached the daily resistance or B) if the price move back to the highs. Both ideas gives us minimum 3:1 reward or more.