There is a possibility for the beginning of an uptrend in SNTBTCTechnical analysis:

. StatusNetworkToken/Bitcoin is in a range bound and the beginning of uptrend is expected.

. The price is below the 21-Day WEMA which acts as a dynamic resistance.

. The RSI is at 44.

Trading suggestion:

. There is a possibility of temporary retracement to suggested support zone (0.00000500 to 0.00000460). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (0.00000500)

Ending of entry zone (0.00000460)

Entry signal:

Signal to enter the market occurs when the price comes to " Buy zone " then forms one of the reversal patterns, whether " Bullish Engulfing ", " Hammer " or " Valley " in other words,

NO entry signal when the price comes to the zone BUT after any of the reversal patterns is formed in the zone.

To learn more about " Entry signal " and the special version of our " Price Action " strategy FOLLOW our lessons:

Take Profits:

TP1= @ 0.00000582

TP2= @ 0.00000646

TP3= @ 0.00000710

TP4= @ 0.00000880

TP5= @ 0.00001008

TP6= @ 0.00001375

TP7= @ 0.00001980

TP8= @ 0.00002928

TP9= Free

SNTBTC

$SNT Volume increasing... Potential Ascending triangle$SNT Volume increasing... Potential Ascending triangle as continuation of the breakout..

UCTS Buy signal active on the 1D

Crossing over EMA200 (rejected many times), EMA50/100 as support

MACD about to bullcross, RSI Rising + bullish divs

1st & 2nd target on the chart

#SNT

[SNT/BTC] STATUS NETWORK COULD BE BOTTOMING [ 25-300% PROFIT]#SNT / BTC ( Binance, Bittrex )

Buy Range : 570-600

Stop Loss : Not recommend

Target 1 : 860

Target 2 : 1346

Target 3 : 1815

WEEKLY CHART

- TD sequential setup suggest bottom could be near ( Positive )

- Trying to consolidate after 2 weeks ( Positive )

- CCI turning slowly from the lows and maybe in 2-3 weeks can turn into green ( Neutral )

- RSI touched 35 which is a good level to reverse ( positive )

DAILY CHART

- RSI is rising after touch oversold

- MACD is going up and showing positive strenght

- CCI shows some indecision due low volume on selling/buying ( neutral )

- SAR showing positive trend as price stays sideways and on accumulative phase

- Ichimoku cloud remains above candle ( Negative )

- Moving averages remains above candles ( Negative )

- Selloff candle ended at 516 sats where price started to reverse ( positive )

4H CHART

- Candles are "playing" with EMA20/50 But can't consolidate above it ( Neutral )

- MA200 remains above candle. However , it's going down soon and it could be touched if this coin get any poisitve impulse ( Neutral )

- Volume is not enough ( Negative )

- Downtrend has been stopped and SNT remains consolidate ( Positive )

- RSI is trending high ( Positive )

CONCLUSION

SNT has reached 4400sats/0.7$ around 9 months ago. Price has been dropped too much like other altcoins and is showing some potential signs of bottoming on the last weeks.

SNT could be need some weeks/months of consolidation like other altcoins. It highly depends of major ones when this one start to rally.

However, we should be really near of bottoming according to the low prices and some other indicators. This point is a very interesant spot to buy and wait.

There is a possibility for the beginning of an uptrend in SNTBTCTechnical analysis:

. StatusNetworkToken/Bitcoin is in a range bound and the beginning of uptrend is expected.

. The price is below the 21-Day WEMA which acts as a dynamic resistance.

. The RSI is at 47.

Trading suggestion:

. There is a possibility of temporary retracement to suggested support zone (0.00000510 to 0.00000460). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (0.00000510)

Ending of entry zone (0.00000460)

Entry signal:

Signal to enter the market occurs when the price comes to " Buy zone " then forms one of the reversal patterns, whether " Bullish Engulfing ", " Hammer " or " Valley " in other words,

NO entry signal when the price comes to the zone BUT after any of the reversal patterns is formed in the zone.

To learn more about " Entry signal " and the special version of our " Price Action " strategy FOLLOW our lessons:

Take Profits:

TP1= @ 0.00000582

TP2= @ 0.00000646

TP3= @ 0.00000710

TP4= @ 0.00000880

TP5= @ 0.00001008

TP6= @ 0.00001375

TP7= @ 0.00001672

TP8= @ 0.00001980

TP9= @ 0.00002390

TP10= @ 0.00002928

TP11= @ 0.00003740

TP12= Free

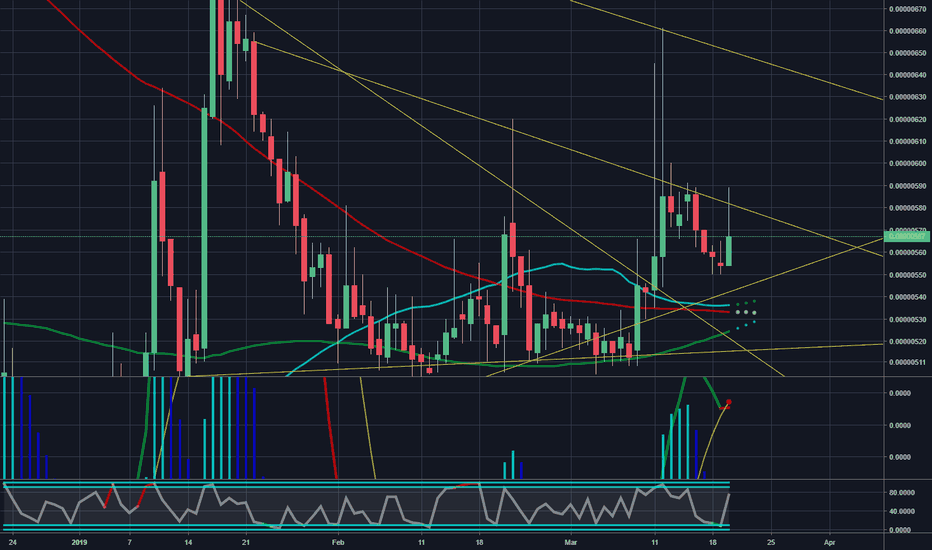

Status Network Token Prints High Volume (Already In Profit)Status Network Token (SNTBTC) is another altcoin that is starting to move.

We already have an active trade in profits for this one, you can find it here (we are looking at 35%+ profits already):

But I wanted to do a quick analysis on this chart for you, as there is lots of room left available for growth, so here are the signals:

We can see a recent break above EMA10, EMA50, and EMA100, which is really bullish supported by big volume.

We can clearly see an increase in green volume, a significant increase. This is really bullish and supports the recent break above resistance.

Last time SNTBTC broke above resistance without good volume supporting it (marked blue circle), it quickly fell back down.

So we have the high volume breakout and a follow up with the next day candle which is green.

The MACD is entering the bullish zone, and the RSI is strong and trading above all resistance.

Status Network Token is set up to generate some good gains in the coming weeks, but things can change...

Conditions for change: If SNTBTC loses momentums, breaks down and closes below support (EMA10, 50 and EMA100), then the above signals are invalidated and a new analysis is needed.

SNTBTC is now bullish and additional bullish action is expected.

Feel free to hit like if you were entertained or learned something by the content of this post. Or simple hit like to show your support.

Thanks a lot for reading.

Namaste.

There is a possibility for the beginning of an uptrend in SNTBTCTechnical analysis:

. STATUSNETWORKTOKEN/BITCOIN is in a range bound and the beginning of uptrend is expected.

. The price is below the 21-Day WEMA which acts as a dynamic resistance.

. The RSI is at 50.

Trading suggestion:

. There is a possibility of temporary retracement to suggested support zone (0.00000510 to 0.00000460). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (0.00000510)

Ending of entry zone (0.00000460)

Entry signal:

Signal to enter the market occurs when the price comes to " Buy zone " then forms one of the reversal patterns, whether " Bullish Engulfing ", " Hammer " or " Valley " in other words,

NO entry signal when the price comes to the zone BUT after any of the reversal patterns is formed in the zone.

To learn more about " Entry signal " and the special version of our " Price Action " strategy FOLLOW our lessons:

Take Profits:

TP1= @ 0.00000582

TP2= @ 0.00000646

TP3= @ 0.00000710

TP4= @ 0.00000880

TP5= @ 0.00001008

TP6= @ 0.00001375

TP7= @ 0.00001672

TP8= @ 0.00001980

TP9= @ 0.00002390

TP10= @ 0.00002928

TP11= @ 0.00003740

TP12= Free

SNTBTC is about to move upwards, prepare yourself for the rise.Technical analysis:

. StatusNetworkToken/Bitcoin is in a range bound and the beginning of uptrend is expected.

. The price is above the 21-Day WEMA which acts as a dynamic support.

. The RSI is at 42.

Trading suggestion:

. There is a possibility of temporary retracement to suggested support zone (0.00000505 to 0.00000460). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (0.00000505)

Ending of entry zone (0.00000460)

Entry signal:

Signal to enter the market occurs when the price comes to " Buy zone " then forms one of the reversal patterns, whether " Bullish Engulfing ", " Hammer " or " Valley " in other words,

NO entry signal when the price comes to the zone BUT after any of the reversal patterns is formed in the zone.

To learn more about " Entry signal " and the special version of our " Price Action " strategy FOLLOW our lessons:

Take Profits:

TP1= @ 0.00000582

TP2= @ 0.00000646

TP3= @ 0.00000710

TP4= @ 0.00000880

TP5= @ 0.00001008

TP6= @ 0.00001375

TP7= @ 0.00001672

TP8= @ 0.00001980

TP9= @ 0.00002390

TP10= @ 0.00002928

TP11= @ 0.00003740

TP12= Free

There is a trading opportunity to buy in SNTBTCTechnical analysis:

. StatusNetworkToken/Bitcoin is in a range bound and the beginning of uptrend is expected.

. The price is below the 21-Day WEMA which acts as a dynamic resistance.

. The RSI is at 42.

Trading suggestion:

. There is a possibility of temporary retracement to suggested support zone (0.00000510 to 0.00000460). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (0.00000510)

Ending of entry zone (0.00000460)

Entry signal:

Signal to enter the market occurs when the price comes to " Buy zone " then forms one of the reversal patterns, whether " Bullish Engulfing ", " Hammer " or " Valley " in other words,

NO entry signal when the price comes to the zone BUT after any of the reversal patterns is formed in the zone.

To learn more about " Entry signal " and the special version of our " Price Action " strategy FOLLOW our lessons:

Take Profits:

TP1= @ 0.00000582

TP2= @ 0.00000646

TP3= @ 0.00000710

TP4= @ 0.00000880

TP5= @ 0.00001008

TP6= @ 0.00001375

TP7= @ 0.00001672

TP8= @ 0.00001980

TP9= @ 0.00002390

TP10= @ 0.00002928

TP11= @ 0.00003740

TP12= Free

There is a possibility for the beginning of an uptrend in SNTBTCTechnical analysis:

. StatusNetworkToken/Bitcoin is in a range bound and the beginning of uptrend is expected.

. The price is below the 21-Day WEMA which acts as a dynamic resistance.

. The RSI is at 41.

Trading suggestion:

. There is a possibility of temporary retracement to suggested support zone (0.00000510 to 0.00000460). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (0.00000510)

Ending of entry zone (0.00000460)

Entry signal:

Signal to enter the market occurs when the price comes to " Buy zone " then forms one of the reversal patterns, whether " Bullish Engulfing ", " Hammer " or " Valley " in other words,

NO entry signal when the price comes to the zone BUT after any of the reversal patterns is formed in the zone.

To learn more about " Entry signal " and the special version of our " Price Action " strategy FOLLOW our lessons:

Take Profits:

TP1= @ 0.00000582

TP2= @ 0.00000646

TP3= @ 0.00000710

TP4= @ 0.00000880

TP5= @ 0.00001008

TP6= @ 0.00001375

TP7= @ 0.00001672

TP8= @ 0.00001980

TP9= @ 0.00002390

TP10= @ 0.00002928

TP11= @ 0.00003740

TP12= Free

Status Network Token Bullish Falling Wedge (Trade Inside)We've been profiting massively from these altcoins, and after a retrace comes another run.

Remember the Bitcoin Cash ABC falling wedge? Here is another one. After a high volume breakout you can expect this playout.

The target will be the top of the wedge.

Support is being found above EMA100 (blue line). If this level breaks you can expect more downside. But if it holds you can expect a move up.

Let me add one of my SNTBTC trades below for your entertainment:

This trade is from January 2nd.

Status Network Token

BUY: 0.00000450 - 0.00000480

(Feel free to use your own buy in)

TARGET:

(1) 0.00000530

(2) 0.00000666

(3) 0.00000820

(4) 0.00000890

STOP: Close daily below 0.00000370.

Enjoy the upcoming profits.

Namaste.

There is a possibility for the beginning of an uptrend in SNTBTCTechnical analysis:

. StatusNetworkToken/Bitcoin is in a range bound and the beginning of uptrend is expected.

. The price is below the 21-Day WEMA which acts as a dynamic resistance.

. The RSI is at 49.

Trading suggestion:

. There is a possibility of temporary retracement to suggested support zone (0.00000530 to 0.00000460). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (0.00000530)

Ending of entry zone (0.00000460)

Entry signal:

Signal to enter the market occurs when the price comes to " Buy zone " then forms one of the reversal patterns, whether " Bullish Engulfing ", " Hammer " or " Valley " in other words,

NO entry signal when the price comes to the zone BUT after any of the reversal patterns is formed in the zone.

To learn more about " Entry signal " and the special version of our " Price Action " strategy FOLLOW our lessons:

Take Profits:

TP1= @ 0.00000646

TP2= @ 0.00000710

TP3= @ 0.00000880

TP4= @ 0.00001040

TP5= @ 0.00001400

TP6= @ 0.00001685

TP7= @ 0.00001980

TP8= @ 0.00002380

TP9= @ 0.00002900

TP10= @ 0.00003740

TP11= Free

SNTBTC #SNT holding strong support, set to give 70-104% profit#SNT holding strong weekly support at 573

Accumulation going on.

4hr chart looking reversal, nice time to

take some entry position.

TA : RSI, MACD BULLISH

BUY AROUND 573-599

TARGETS :

(1) 0.00000638

(2) 0.00000678

(3) 0.00000958

(4) 0.00001291 (MOON SHOT)

STOP-LOSS : 0.00000550

DISCLAIMER: For Educational Purpose only, make sure you do full study and analysis before making or doing any type of investment.

Status/bitcoin bullish pennantDaily chart showing a clear bullish pennant forming. Wait for breakout and buy on retest. Breakout could lead to a long opportunity with +10% profit. Stop loss should be placed on the lower trendline of the pennant.