NASDAQ to continue in the upward move?NAS100USD - Intraday

The 261.8% Fibonacci extension is located at 17117 from 16568 to 16773.

A Fibonacci confluence area is located at 17184.

There is scope for mild selling at the open but losses should be limited.

Previous resistance, now becomes support at 17000.

The medium term bias is neutral.

We look to Buy at 17000 (stop at 16900)

Our profit targets will be 17250 and 17290

Resistance: 17117 / 17184 / 17200

Support: 17000 / 16902 / 16801

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

NASDAQ 100 CFD

NDX Will Fall! Short!

Here is our detailed technical review for NDX.

Time Frame: 4h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is approaching a significant resistance area 16827.06.

Due to the fact that we see a positive bearish reaction from the underlined area, I strongly believe that sellers will manage to push the price all the way down to 16266.68 level.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Like and subscribe and comment my ideas if you enjoy them!

NASDAQ Starting a double Top rejection towards the 1day MA200.Nasdaq / US100 is pulling back after a Double Top formation at 16970.

The 1day RSI is already inside a Channel Down, much like the patterns of the July 19th 2023 and February 03 2023 Tops.

They both declined by -9.00% on average.

Sell and target 15850, which is slightly over the bottom of the Rising Wedge (Rising Support) - 1day MA200 - 0.5 Fibonacci Support Zone.

Previous chart:

Follow us, like the idea and leave a comment below!!

NASDAQ: Potential correction to the 1D MA200.Nasdaq is on a bullish 1D technical outlook (RSI = 60.007, MACD = 103.260, ADX = 29.522) as since January 5th it reversed before testing the 1D MA50 and is near the R1 level (16,980). The last three 1D candles have been flat and with the RSI trading downwards (Bearish Divergence), it is a first sign of a potential technical decline. This is like the top pattern of July 18th 2023, also on an RSI Bearish Divergence. In accordance to that price action, we expect yet another decline under the 1D MA50, for a close test of the 1D MA200. Our target is at the top of the S2 Zone (TP = 15,800).

See how our prior idea has worked out:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

TSLA Caught in Vortex of Conflicting TechnicalsPrimary Chart : TSLA's 2D Price Chart with .618 Fibonacci Retracement of Decline from All-Time High to Jan. 2023 Low and Various Degrees of Trend Represented by Conflicting Channels

SUMMARY:

1. TSLA's technicals are unclear and conflicting. The trend from the 2021 all-time high remains downward until broken. The trend from the January 2023 low remains upward but somewhat choppy and unstable. The trend from the July 2023 high remains choppy and downward until broken.

2. Institutional buying into year end may be supportive of prices, allowing short-term traders to buy dips to well-defined support / risk levels into early January 2024. Until more structural change occurs providing more clarity, it's difficult to have confidence in any trend other than the shortest ones.

3. Once the next multi-month trend move occurs, some may look back and say that its was obvious and inevitable, offering post hoc arguments based on data that can be manipulated to support opposite outcomes. But today, unambiguous data pointing to a clear directional outcome is lacking (especially on intermediate and longer-term time frames).

4. Severely inverted yield curves suggest pressure on the economy and equity markets in the coming year or two. But as the lessons of the dot-com crash have taught us, markets can rally violently into their own recessionary demise.

The downward channel from the July 18, 2023, swing high has been the only pattern working lately. The last decline in late October 2023 was bought, and this dip fell to support at the downward sloping parallel channel. Bulls may see this as a bull flag, and it might be, but a breakout above the downward-sloping trendline from TSLA's all-time high stands in the way of a potential flag-breakout. Further, bears may reasonably see the channel from January 2023 as a bear flag within the larger downtrend from 2021. These conflicting technicals are worth watching over the coming weeks and months for resolution.

Supplementary Chart A

If one zooms out on TSLA's chart and looks at the past two years of price action, price action has largely been sideways in a trading range. This is despite the vicious decline starting November 2021 and lasting for over a year as well as the violent rallies and choppy uptrend in 2023. This sideways range seems to contain both the bear and bull markets of 2021-2023. Trading ranges are also known as chop, which is why trends on all time frames have likely been less predictable, disappointing many traders and investors during this time unless they have major equity cushions from many years ago or trade only the shorter time frames.

Supplementary Chart B

Because the larger degree trends over a two-year to three-year period has been primarily sideways, the trends within it have been less reliable and more likely to chop up TSLA investors.

Anchored VWAPs shown below also confirm this analysis of choppy, sideways action that is less predictable overall. Over the past year, notice all the failed breakouts above and below the key VWAPs anchored to major turning points. There are many.

Supplementary Chart C

Supplementary Chart D

Supplementary Chart D shows how the moving averages also are tangled, messy and sideways, presenting conflicting signals.

In conclusion, TSLA's technical charts remain conflicted and unclear. Many disciplined traders or investors with a short-term to intermediate-term time frame may wish to define risk clearly and keep losses small or else stay away. The Primary Chart reveals just how challenging TSLA's price action is for trend traders and investors. A downtrend from TSLA's all-time high remains unbroken as the downward sloping parallel channel shows. An uptrend from TSLA's January 2023 low also remains relatively stable despite the volatility seen this year. And a 4-month downtrend channel has been in play since July 2023. Any one of these technical trendlines could break one way or the other, but as of Thanksgiving, none have been broken and these data points remain unavailable for market participants wanting long or short exposure to TSLA.

What should traders and investors do? Some may vent the useless nature of a post that says a stock can go up, down or sideways on intermediate to long-term time frames. Others may see that TSLA doesn't have a clear directional play except on the shortest time frames, which is based on the currently available data. So perhaps wait patiently for more data and simply do nothing—the hardest thing for fidgety trader and DIY investor types, right? Those sitting on a large equity cushion may wish to tighten stops a bit to $200 (assuming their entries are much lower). Those with no position may want to just wait for more clarity.

Short-term traders who believe institutional flows into year end will buoy markets broadly and lead to higher prices into year end (and first week of January 2024) may wish to keep an eye on critical support at $200-$220 evidenced by the green VWAP anchored to October 2023 lows as shown on the Primary Chart. If this author were to have a bias, it would lean in this direction into year end and early January 2024, but it's a weak bias that can't be strongly held.

Such a thesis, like any other trading viewpoint, isn't guaranteed at all even though it may have a reasonable probability of being correct. This is why a stop (risk level) is needed. Upside targets in such a scenario would require a decisive move above the .618 Fibonacci retracement level and for that level to hold first. It's possible that the move off October 2023 lows could be consolidated first, where bullish TSLA traders may watch $200-$220 support levels. If a dip were to create a better entry for traders into year end, then upside targets might be considered as follows:

Conservative: $250-$255

Aggressive: $275-$280

Extremely Aggressive: $300-$310

As always, risk should be well managed so that the reward / risk ratio remains higher and the losses kept small. And keep in mind that TSLA-related news catalysts, including the ones from this past week, may have a tendency to yank price around and create formidable volatility.

________________________________________

Author's Comment: Thank you for reviewing this post and considering its charts and analysis. The author welcomes comments, discussion and debate (respectfully presented) in the comment section. Shared charts are especially helpful to support any opposing or alternative view. This article is intended to present an unbiased, technical view of the security or tradable risk asset discussed.

Please note further that this technical-analysis viewpoint is short-term in nature. This is not a trade recommendation but a technical-analysis overview and commentary with levels to watch for the near term. This technical-analysis viewpoint could change at a moment's notice should price move beyond a level of invalidation. Further, proper risk-management techniques are vital to trading success. And countertrend or mean-reversion trading, e.g., trading a rally in a bear market, is lower probability and is tricky and challenging even for the most experienced traders.

DISCLAIMER: This post contains commentary published solely for educational and informational purposes. This post's content (and any content available through links in this post) and its views do not constitute financial advice or an investment or trading recommendation, and they do not account for readers' personal financial circumstances, or their investing or trading objectives, time frame, and risk tolerance. Readers should perform their own due diligence, and consult a qualified financial adviser or other investment / financial professional before entering any trade, investment or other transaction.

NASDAQ Post Cup & Handle rally in motion. There'll be pullbacks.Nasdaq (NDX) has completed a giant Cup & Handle pattern and since the late October 2023 bottom, it has started the post Handle rally. This rally historically tends to be a very long-term one but with its fair share of corrections to at least the 1W MA50 (blue trend-line).

As you know 2022 was the year of the Inflation Crisis (left side of the Cup) while 2023 was its recovery (right side of Cup). Going back to the 2 most recent Bear Cycles, the 2008 Housing Crisis and 2002 Dotcom Crisis, we can observe similar Cup & Handle patterns, with identical 1W RSI sequences (oversold on their bottom and starting a Channel Down when the Handle begins).

The rally that followed after the Handle in 2011 and 2005 started another pull-back to the 1W MA50 (ellipse) just a few months after when the 1W RSI hit the top of its Channel Down. The chart shows that we might be in a similar situation right now. As a result, long-term investors may seek an additional buy entry as close to the 1W MA50 as possible like the late October bottom.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

US100 ENTRIES FOR SHORT,Longs All Trap Zones for 5th Jan.2023This analysis is only for my honorable followers.

Click on the chart above

and study it closely, before taking any trade today: Ofcourse if you want to win.

I will buy if these conditions hit. if one of them do not hit, the bulls will get trapped hard

30 min close above 16425

US DATA TODAY VERY STRONG for nasdaq,gold, etc

but negative for the U DOLLAR

and if retracment after 30 minute closing

firm above 16425

My first target will be 16820

Here I will solve out my short hedge that I have opened

at 16853, and take Profit. But I will add more longs too,

and all longs that are active,but hedged will run along

SELL CONDITIONS: I would ell US100 ONLY and ONLY, if these conditions met. Otherwise the downward move will be a bear trap

16275: I would open a short , below this price only

if:

1. it reache 16244 or 16223

2.I will wait for a pullback to 16275

3. if it cannot break above that level,

t hen I would open the short.

Profit levels are as lower mentioned.

At 15939 we have 0,382 Fibonacci of Hourly and higher

Time frame(that is very strong support level no. 2)

TRAP ZONE 1

THE OPEN PRICE TODAY

is below yesterdays range, but

it is not rejected

tHIS IS AN INDICATION THAT the market is

accepting the lower price, and the sentiment ha not been changed

Both bulls and bear will get trapped very often in this range

16356-16416

TRAP ZONE

BULLS got trapped

in this zone twice this week

I will AVOID TO ENTER THIS ZONE AND

GETTING TRAPPED

BETTER: I WILL WAIT

If You are Gold Digger and speculate

to take some pips

your Risk Reward ratio will be high(Higher RISK THAN REWARD)

As at this point the market quickly changes sentiments

Follow the price The trend is your friendCut losse quickly, Let the profits run. Dont predict the market. Intelligent traders follow these principals only.

Nsadaq Bullish, Breakthrough only if Dollar and Bonds bearishNASDAQ TREN CHANGE

52W BULLISH49-51W BULLIH

30W BULLISH

1-20W BULLIH

Also complete green signs on lower Timefame.

CPI DATA far below expectations, that dropped US Dollar and Bonds down, while pushing up NDX

Core CPI m/m

0.2%

0.3%

0.3%

USD

CPI m/m

0.0%

0.1%

0.4%

USD

CPI y/y

3.2%

3.3%

3.7%

The inking Dollar Periode is starting now, DXY dropped -1% while the treasuies follwed

The gap at 13200 is still active, but with changing fundamental data, now my ia is ,,BULLISH,, again, also other Indices following NDX.

RTY 52W still beaish, but it might change soon.

The 25 Strongest NDX Shares, based on their weight, broke all trends up, that is additional Vitamin BOOST for Nadaq. The End year ralley can begin.

Tomorrow on Nov. 15th 2023 we are looking and waiting for Core PPI m/m

Empire State Manufacturing Index

PPI m/m

Retail Sales m/m

If these data are below expectations, or majority of them, then NDX will soon reach the next level higher targeting 16000

16050 16150 16250 ...16772 ,before the rally to 17000 begins

Upper gap is at 15850-15950.

If the data are mixed or stronger, then we may have a fall back to 15794 15695 15500 15390

It epend on how strong the data will be this week, before the next week starts

Ue always Stops, to protect your capital.

Good Luck

U.S Equity Index’s Overview – A Repeating PatternU.S Equity Index’s Overview – A Repeating Pattern

The Bull Thesis – Ascending Triangles

The 200 day (blue line on each chart) is squeezing price up towards each red resistance line making each chart look like an ascending triangle (evident on every chart). With the 200 day as underside support for price and the 200 day sloping upwards, things remain positive.

The Bear Caution – Throw overs, Transportation Lag and the Hidden Wedge

We need to be aware and cautious of a throw over top on each chart which is always a possibility. Price on each chart would need to fall back below the red support line (pricing having only been thrown over the red line to come back down again).

The DJ:DJT – Transportation (Chart 1) is lagging behind all the other charts and has not taken out its Nov 2021 or Jul 2023 highs. This relative weakness in Transportation is worrying as this index offers an early indication of potentially less manufacturing and goods being transported, with this chart lagging and failing to take out its highs, it could be an early indication of a more pronounced slowdown in the economy. This chart we need to keep a very close eye on. If DJT fails to rise above its red line and loses the 200 Day, this could be a very bad signal.

We also need to be aware of how one important chart is showing a rising wedge pattern (Chart 3 – Major Market Index TVC:XMI ). This old school chart is watched by the OG traders and investors as a more general market chart. Lets keep an eye on the upper diagonal on the rising wedge for resistance on this one. A rejection here could be something of an early warning sign and obviously losing the red support line would confirm this.

Charts 4 - 6

4. S&P 500 SP:SPX

5. NASDAQ NASDAQ:NDX &

6. US Small Cap 3000 TVC:RUA

All these charts appear to be about to break into all time highs, however they are slightly lagging the Dow Jones Industrials TVC:DJI and the Major Market Index TVC:XMI which have broken all time highs. In the Charts 4 - 6 break out above their red lines (above recent all time highs), this could be another confirmation signal of bullish momentum. Obviously a rejection at this level does not bode well.

SUMMARY

In this hard to navigate market environment we need to pay attention to DJT (Chart 1) and XMI (Chart3) as they provide clear boundaries that we can watch for hidden bear signal warnings. On the contrary, in the even these charts and charts 4 - 6 breach their respective resistance levels mentioned above we can be assured that the wind is at out back in this currently confusingly bullish market.

If you like this overview please let me know and I will complete similar overviews for other markets and indices.

Thanks for reading

PUKA

7 Dimension Trade idea For Nasdaq 😇 7 Dimension Analysis

Time Frame: H4

1️⃣ Swing Structure: Bullish

🟢 Structure Behavior: Break of Structure (BoS)

🟢 Swing Move: Corrective move, indicating a Point of Interest (POI) for potential reversal. Vigilance is required for a bullish reaction at this level.

🟢 Inducement: Not done yet; waiting for a proper internal bullish BoS.

🟢 Internal Structure: Currently bearish, anticipating a shift with a bullish BoS.

🟢 Decisional Order Block: About to be mitigated.

🟢 Demand Area: Identified via FVG, indicating a discounted area.

🟢 Time Frame Confluence: Daily and H4

2️⃣ Pattern

🟢 CHART PATTERNS: No significant chart patterns observed.

🟢 CANDLE PATTERNS: Various signals: Record Session count, Shrinking long wick, Change in guard with engulfing, Doji, Momentum, Inside bar, and a blended combo suggesting a potential reversal.

3️⃣ Volume

🟢 Fixed Range: Bullish dominance in these areas.

🟢 Volume during Correction: Comparatively less during correction than in impulsive moves.

4️⃣ Momentum RSI

🟢 Zone: Extremely Bearish

🟢 Range Shift: Waiting for a potential shift from bearish to sideways. Two strong bullish divergences indicate weakness in bearish momentum.

🟢 Loud Moves: Conventional RSI theory suggests an extremely oversold market, possibly signaling a reversal.

🟢 Grandfather Father Son Entries: A robust 7-star buy signal.

5️⃣ Volatility Bollinger Bands

🟢 Price is already under the Middle band.

🟢 After a strong expansion, the market is moving into contraction, indicating a potential bullish sideways move.

🟢 Squeeze breakout awaited.

🟢 Walking on the band not yet.

6️⃣ Strength According to ROC

🟢 Values: Nasdaq shows the highest rate of bullish sentiment compared to all other indices.

7️⃣ Sentiment

Price action signals a clear long entry, but other dimensions like momentum and volatility tell a different story. Waiting for final volatility and momentum confirmation for a long position.

✔️ Entry Time Frame: H4

✅ Entry TF Structure: Bullish

☑️ Current Move: Corrective

✔ Support Resistance Base: FVG demand area

☑️ Candles Behavior: Bullish signals intact - RSC, Long wicks, Doji, Inside, Momentum.

☑️ FIB Trigger Event: Occurred

☑️ Trend Line Breakout: Breached but not confirmed.

💡 Decision: It's prudent to wait until the price provides a proper internal structure breakout. Once a bullish BoS is confirmed, consider a buy. I will update entry, take profit, and stop levels when triggered.

🚀 Entry:

✋ Stop Loss:

🎯 Take Profit: 2nd Exit if Internal Structure changes, also Exit 3rd Trendline Breakout, FOMO.

😊 Risk to Reward Ratio:

🕛 Expected Duration:

SUMMARY: The analysis suggests a potential bullish reversal but advises caution until the price demonstrates a clear internal structure breakout. Various signals indicate a reversal, and a detailed plan will be updated upon market confirmation.

SPX Cash AnalysisWe're now getting a confirming signal that last week's top was at least a local top. Primary analysis (in Blue) however, because we did not make a new high in the SPX like the DJIA and NDX, the black (B) wave count is a valid EWT count. I do not favor the black pathway mainly due to our MACD signal, the other major indices hitting new highs, and lastly the price action I have as of today.

Best to all,

Chris

$DJI now in short term downtrend, NDX, SPX & RUT already wereLooks like the TVC:DJI is in a short term downtrend.

NASDAQ:NDX SP:SPX & TVC:RUT all are in short term down trends which begin couple days or so ago.

TVC:VIX is at higher end of the recent pattern and it keeps poking it.

*(TOOK THIS FROM ANOTHER POST

Remember, the more something is poked the weaker it becomes

Picture paper holding a marble

Poke with a needle

Poke enough & that marble falls

Same works to the upside)*

The TVC:TNX or10 yr #yield looks to be setting up decently on the 4hr intraday.

#stocks

IXIC - Higher High Double Top Contained within this upward channel a double top could form at the top of this channel, however with it being a higher high we can assume further bullish movement after the double top proceeds.

A higher high suggests there is more steam left in the run. Which evidently there is a lot of steam for the NASDAQ.

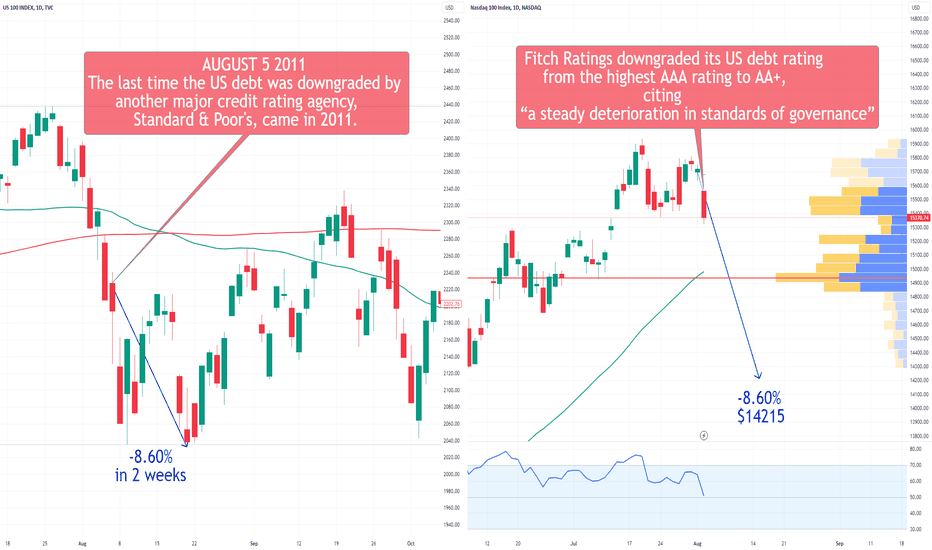

NDX Nasdaq100 Fell 8.60% After the Last U.S. Credit Downgradeitch Ratings downgraded the US debt rating on Tuesday, moving it from the highest AAA rating to AA+, citing concerns about "a steady deterioration in standards of governance."

This downgrade happened following last-minute negotiations among lawmakers to reach a debt ceiling deal earlier this year, raising the risk of the nation's first default.

In the past, a similar credit downgrade had a significant impact on the NDX, which fell 8.60% in just two weeks. Back in August 5, 2011, Standard & Poor's, one of the major credit rating firms, downgraded U.S. debt after another major debt ceiling battle.

Jim Reid, a strategist at Deutsche Bank, pointed out that while the news of Standard & Poor's being the first to downgrade 12 years ago was substantial, investors had already adjusted their perceptions of the world's most important bond market, recognizing that it was no longer a pure AAA. Nonetheless, Fitch's recent decision to downgrade is still significant.

In the current scenario, the U.S. 10-year Treasury yield has risen to 4.15%, reaching its highest level since November 2022.

As for the price target for this year, it remains at $16650, as shown in the chart below:

Looking forward to read your opinion about it!

QQQ Nasdaq 100 ETF Price Prediction for 2024This was my price prediction for QQQ in 2023. I was bullish, but not enough:

Considerations about 2024:

In the July 2023 meeting, the FOMC chose to raise interest rates to a range of 5.25%–5.50%, marking the 11th rate hike in the current cycle aimed at mitigating heightened inflation. The prevailing consensus among market experts hints at a potential shift in strategy, suggesting that the Fed might commence rate cuts later in 2024 as inflation gradually aligns with the Fed's 2% target. Statistically, historical data indicates that approximately 11 months after the cessation of interest rate increases, a recession tends to manifest. This pattern places us around June 2024, aligning with my prediction of a dip in the QQQ to approximately $370.

Given that 2024 is an election year, there's an additional layer of complexity in predicting market behavior. Despite the anticipated mid-year dip, my inclination is that the QQQ will conclude the year on a bullish note. This optimistic outlook hints at the onset of a 3-5 year AI bubble cycle, with the QQQ boasting a year-end price target of $460.

The integration of artificial intelligence into various sectors is expected to catalyze market growth and innovation, propelling the QQQ to new heights by the close of 2024.

TARGET REACHED for Nasdaq at 16,956 now what?Nasdaq finally reached our first target of 16,956.

The price then started off on a bad note in 2024.

The USD is starting to strengthen again, which brings down the general markets.

So right now, there is no definitive price analysis for the Nasdaq.

We can only expect a form of consolidation to create the next pattern before it chooses a direction.

SO right now we are Neutral with a slight short term bearish tinge to it.

NASDAQ Hit the Channel's Top. Mid-term correction expected.Nasdaq (NDX) hit (and marginally broke above) its November 2021 All Time High (ATH), completing the expected Megaphone pattern we shared with you on November 16 (see chart below):

Last Thursday (December 28) the index hit the Higher Highs trend-line that started on the August 16 2022 High and can be treated as the top of a Channel Up pattern. The key here is the 1D RSI, which is developing a Channel Down, i.e. Bearish Divergence, similar to the July 19 2023 High.

As a result, it is highly likely to see a good medium-term pull-back, which within the Channel Up pattern has been around -8.50% on average. Such a decline would approach the 1D MA200 (orange trend-line). Our target is 15550.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

$DJI vs $NDX vs RatesSince the "outside" day. The DJ:DJI index has flip flopped above and below the top part of the outside day line.

It wants to push higher but when NASDAQ:NDX craters, like it's doing today, it's a lil tough.

Since we're doing intraday charts, let's do DJ:DJI as well.

What's the biggest thing that sticks out to you on the last chart?

Hint: Look at the bottom 2 panes.

It could all tie in with a bump in higher rates. IMO not a top. Not enough euphoria. But could be a short term top. We'll see.

Nasdaq - First Quarter Might Be Red➡️Hello Traders, welcome to today's analysis of Nasdaq.

--------

➡️I will only take a trade if all of the rules of my strategy are satisfied.

➡️Consider hitting that like button for more free, daily analysis. Your support means a lot!

--------

➡️Let me know in the comment section below if you have any questions.

➡️Keep your long term vision.

Can Nasdaq Make a Major Move in 2023?

Sharing my technical analysis on Nasdaq NASDAQ:NDX , sharing what the critical levels to watch, trend analysis, and potential trading opportunities are.

I hope you are enjoying the analysis. Do you agree with my analysis?

Follow, so you don't miss out on future technical analysis reviews.