CCIV (SPAC for Lucid Motors) Looks Poised To Break Out ViolentlyAlthough it's possible that the Lucid merger could result in a common "buy the rumor, sell the news" scenario, given how beat up the stock has been in recent months, this scenario seems less likely. Furthermore, the coiling price action right next to a major resistance line in the past trading day suggests that bullish pressure is building.

Lucidmotors

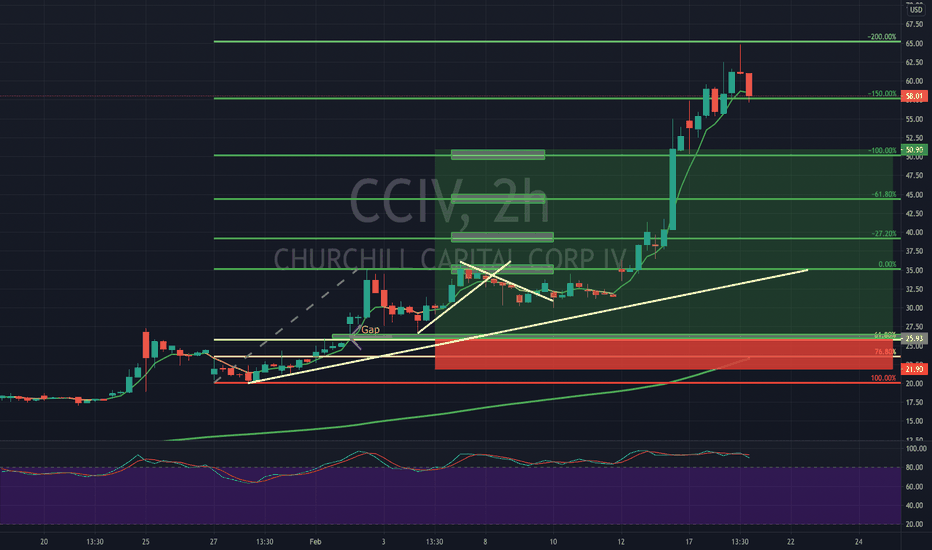

CCIV Lucid Motors Merger Looking for a place to get in?by iCantw84it

05.25.2021

SPAC Churchill Capital IV gains after Lucid Motors tweet about event tomorrow

May 25, 2021 12:06 PM ETChurchill Capital Corp IV (CCIV)Churchill Capital Corp IV (CCIV)By: Josh Fineman, SA News Editor3 Comments

SPAC Churchill Capital IV (NYSE:CCIV) rose 3.6% after a Lucid Motors tweet about a Lucid User Experience event tomorrow.

Electric car maker Lucid Motors is going public through a deal with SPAC Churchill Capital IV .

Earlier this month, Lucid Motors CEO won't commit to 20,000 electric cars in 2022.

See Seeking Alpha Catalyst Watch about CCIV event scheduled for tomorrow.

CCIV - We need some positive newsAfter the reversal end of February, we are in dire need of big news from Lucid Motors.

They need to deliver on their plan of making 20-30k cars in their new facility in Arizona.

Leading up the the sell off/reversal, people were buying into the rumour.

Until it sold off right after the news hit that the merger is going to happen.

The stock needs some good catalyst from Lucid Motors and get their sales rolling ASAP.

Otherwise, we are testing the $20 support too often, and could break and find a new box in the $16-$20 range.

Doesn't seem like a good idea to hop in on hype because it already passed.

We are left with actual implementation of their idea.

CCIV PT 04/2021 UpdateLong haul play, worth it IMO. Inzayne upside potential with the elliot patterns. It's squEEZin.

Redrew impulses, updated PTs.

CCIV lucid dream completeLast post I said it was lucid dreaming, following that post we saw around 50% drop. I think CCIV is almost done day dreaming and will see a rebound soon. Sitting right on the 200ma on the daily, I have the 8ma pulled up and expect a ride up/continuation here.

Thank you for checking out the post! Good luck trade safe

CCIV - a hungry bullFinally a green volume on daily chart and we are back at 50 MA with positive moving average and RSI. 1.9T USD stimulus passed the house yersterday and will be approved by Biden soon.

much volume incoming the stock market.

And announcement 17. Mar from Lucid, can bring us up over $30.

Churchill Capital ---- Descending Wedge ---- Potentially BullishWe have a classic descending wedge forming on CCIV. This has been quite the pump and dump, a true buy the rumor and sell the news type chart pattern. I think if we get a break to the upside we can expect a price rebound to $30- 40. This is not trading advice!

$CCIV NYSE:CCIV Looks bearish on lower timeframes. The daily trend hangs in the balance of how this week works out. Either price bounces from strong support in the 20s, or accumulation will take this lower. If wave 2 of another move higher is in, then we should see this play out higher in the next few weeks.

CCIV - WHAT YOU HAVNT NOTICED - A QS REPLICA? As you can be by the following my previous idea was based was QuantumScape. The new opportunity arised when i saw that the 2 charts, are mostly identical in terms of price action and technical analysis.

1. CCIV have had 5 major waves down, finishing off at the 2.618 trend-based fib-Extension. QS has the exact same level of 2.618 where it bounced of the last time.

2. On the 15min chart we can see that QS and CCIV are hovering around the same RSI level: 18. If this is true, CCIV is likely to break up here.

3. After the QS long, QS had a return of 75%. If the compare the two it should put CCIV at 42 USD.

Remember to give this a like, and i will keep this updated with daily technical analysis.

May the chart be with you.

Previous QS IDEA:

$CCIV Long Road AheadI've had the downward ray drawn in the same spot since before big breakout. It signaled it, in fact.

Seems like we're going to continue sliding down that slope for some time. Ticker conversion may prove to be a catalyst, but nothing else indicating a rally right now.

The $60 Jan 2022 contracts are very attractive at current prices, IMO.

$CCIV

$CCIV bigger picture Elliot Wave Please see notes,

Seems like 1st wave was finished and the heavy dump is a 0.618 0.786 fib retracement which is typical for wave 2 corrective.

If we assume we are in the 2nd wave then it's time to head towards the 3 wave which is 1.618 of wave 1 fib extension.

Can we see $CCIV reaches $115 ???

LMK BELOW

CCIV - ABCD pattern As I told before, I'm bullish on CCIV.

I added ABCD pattern in the chart to show how it will evolve.

After all the noise is gone, it will hit back to the trending channel in the middle and up.

CCIV - Back to the moonLooks like we have support here and just turned back from 26 range as I told before on one of my other analysis.

RSI was too oversold and now pushing back above oversold level.

MACD just crossed.

NASDAQ just made double bottom, and 10 year bond could not reach above 1.51, good signs for bullish.

Based on Fibo level and RSI

Price target 1: 34

Price target 2: 42

Price target 3: 46

CCIV - Oversold potentially 10x stockI was one of the few who did an analysis where I told that CCIV would drop a lot.

but this is absolutely an oversold level. People may be totally crazy, this stock will be pushing back!

Support at 26, 20, and 16.

Push back more likely from 25-26 range, good support here.

CCIV - Time to buyDouble bottom at 30 ish now and RSI too much oversold(PEOPLE ARE CRAZY).

CCIV keeps inside both trendlines, this is absolutely the best time to buying in NOW.

The fundamentals and projected revenue will price in soon.

And I don't think the price will be below 40 in coming weeks.

Support - confirmed

Fibo level - confirmed

RSI oversold - confirmed

Trendline - confirmed

BUY and HOLD, we are bullish

TESLA - COMING EV BUBBLE CRASH? | FUTURE OF TESLA / MARKET RESETProposition:

EV Stocks have exploded in value from all types and all countries in all sectors

Tesla has been among them as the most explosive stock over the last year

Price has inflated far more than the company has grown

It is without a doubt that Tesla is a highly prosperous company and will continue being the leader in innovation and services so the long term forecast is bullish regardless

However, there becomes a point where euphoria, hype and overbought territories are reached and breached

As a result, I believe Tesla and the whole EV market along with the renewable market (solar and clean energy products and services) will pop and implode to a healthy level

Justification:

I could not recommend Aswath "The Dean Of Valuation" Damodaran enough. He is a natural-born teacher, highly competent and knowledgeable individual on investing, valuation and finance

He is a highly respectable, humble and intelligent person and his over 700 videos as well as numerous courses, are available for free to the public via youtube and his website

I highly recommend his talks, videos and views with regards to markets, finance, investing and the likes

Using his Tesla valuation model with a 0% probability of failure, his model outputs Tesla's fair valuation at ~$380

Tesla's TTM P/E ratio is at absurd levels with its current value at 1160

Price has distanced itself vastly with respect to the 200 WMA

RSI has broken out of a triangle and look to continue its breakout downwards

Stochastic levels look well-posed to reverse and cycle through to oversold levels on the weekly

Volume price indicator shows most of the run-up has been unsustainable with little volume zones apart from all the way down to its base

The fibonacci extension levels are in confluence with Mr Damodaran's valuation model and all of the above leads me to forecast future price to correct to $400-500 levels and potentially lower

Aswath Damodaran:

Tesla Valuation + Spreadsheet: youtu.be

Youtube: www.youtube.com

Website: people.stern.nyu.edu

CCIV huge drop coming!I think the first day will be totally panic selling, due to the "bad" merger deal just released. Try to buy in at the buy zone. hope for better wednesday.

CCIV need a break. MA 50 and fibo level at $45. We will test this target.

RSI down to 40

MACD in downtrend

disclaimer: I have CCIV in my portfolio and I'm not a shorter, just following the trend.

CCIV - Churchill Capital- What is a fair price?CCIV - Churchill Capital- What is a fair pre-merger price? As investors pile into CCIV, we have to consider that there has not been an official Lucid Motors merger announcement. We also have to consider that other Tesla competitors that are already listed are at this same pre-merger price. NIO is at $54. Xpeng XPEV is at $41. GM is at $52. Meanwhile, CCIV, a company that is not in the automotive industry yet is priced at $58 already. Of course, market cap matters, but does CCIV have an edge on these other companies? All of this makes you think of whether some news or dilution of shares will happen. It is hard to think that CCIV will go above $100 before a merger is even announced. In todays world, anything can happen. I think we would all feel better if the merger is officially announced. Not Financial Advice.