Interestrates

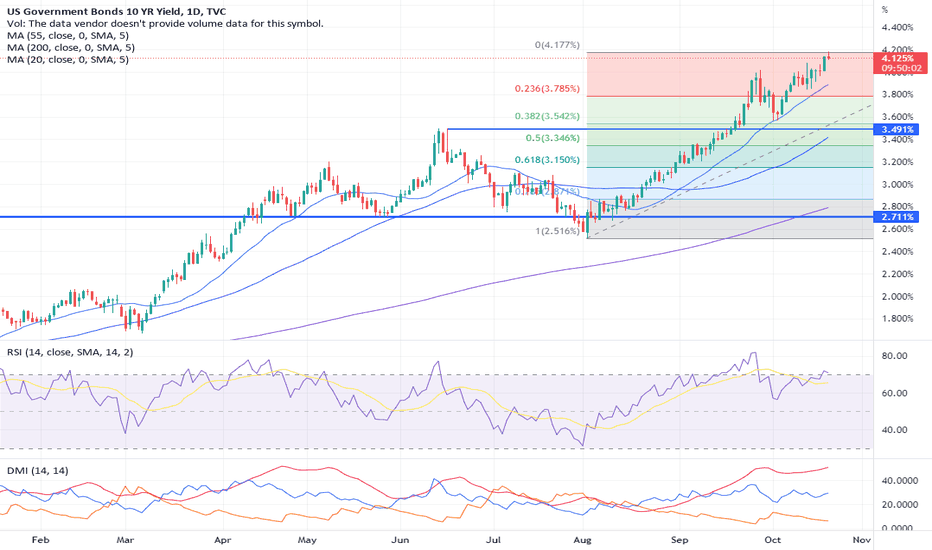

US 10Y yield convergence of resistance levels around 4.19/20We have a convergence of levels around the 4.19/4.20 zone of the chart, it is a long term double Fibonacci retracement and represents significant lows seen in 1998 and 2001.

Will be quite interested to see if the market pauses here in order to consolidate sharp gains that have been pretty relentless since August.

Disclaimer:

The information posted on Trading View is for informative purposes and is not intended to constitute advice in any form, including but not limited to investment, accounting, tax, legal or regulatory advice. The information therefore has no regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Opinions expressed are our current opinions as of the date appearing on Trading View only. All illustrations, forecasts or hypothetical data are for illustrative purposes only. The Society of Technical Analysts Ltd does not make representation that the information provided is appropriate for use in all jurisdictions or by all Investors or other potential Investors. Parties are therefore responsible for compliance with applicable local laws and regulations. The Society of Technical Analysts will not be held liable for any loss or damage resulting directly or indirectly from the use of any information on this site.

Terminal rates - How FX traders can benefit on TradingViewOne of the more watched interest rate settings in markets is the so-called ‘terminal’ interest rate – the point in the interest rate futures curve that reflects the highest point of future rate expectations – said differently, where the market feels a central bank could take its key policy rate by a specific date.

For those who really want to understand fed funds futures far better, this research piece from the St. Louis Fed is good - files.stlouisfed.org

As an FX trader, I am not too concerned as to the exact pricing in the rates market, a basis point here or there is no great issue - I loosely want to know what is priced by way of future expectations. This lends itself to more fundamental, tactical or thematic trading strategies and obviously day traders won’t pay too close attention, although, it’s worth considering that when rates are on the move you do see higher intraday volatility and that is a factor they have to operate in – where one of the core considerations for any day trader is ‘environment recognition’ and the assessment of whether we’re seeing in a trending or mean reversion (convergence) day.

We also see terminal pricing correlated with FX and equity markets – certain if we look at the relationship between fed funds futures April contract and USDJPY we can see the correlation.

Some will just use the US 2-year Treasury, as this is the point on the US Treasury curve that is most sensitive to rate pricing. The good thing about the fed fund's future though is we can see quantitatively the degree of rate hikes being priced for a set date.

Using the logic expressed in the St Louis Fed research piece we can see that the market sees the highest level where the Fed hike rates is March – subsequently, this is priced off the April contract, and currently, this sits at 4.90%.

Using 4.9% as our yardstick, interest rate traders would make a call if the expected fed funds effective rate was either priced too high, or indeed too low and could push above 5% - if new economic data emerged that suggested the Fed needed to go even harder on hiking than what is priced, and the terminal rate moves above 5% then the USD will find a new leg higher. Conversely, if the market started to trade this down to say 4.70% to 4.5% then the USD will find sellers – and notably USDJPY is the cleanest expression of interest rate differentials.

For TradingView users we can use this code in the finder box - (100-ZQJ2023). I put these codes into a watchlist and add a section' for heightened display. Again, this tells me where the peak pricing/expectations are in the interest rate curve. You can see the corresponding codes needed for each contract.

Terminal rates matter – if we're to see this trending lower, most likely in 2023, then it may be one of the clear release valves the equity market needs – for those looking for the Fed to pivot – the terminal rate will be one way to visualise it

The beginning of the BIG short !Another wave another short, a BIG short !

After the bearish confirmation with the break of the $3636 level on Sept. 27, the first bounce wave ended on Oct. 5, and the bearish acceleration on Oct. 13 with the lows supporting Fibo 50%, yet another wave of technical bounce is about to end. The opening short area starts at $3750 with a more important area between $3800 and $3815 (highlighted in deeper red).

More acceleration could occur soon due to a confluence of factors : inflation data, FED interest rates, quarterly and the 50/100 weekly moving averages crossing downward (Death Cross).

I will open SHORT positions in the entire area from $3750 up to $3815, with larger positions between $3800 and $3815

The long-term trend remains unchanged as from the first analysis on August 26, with a long-term target in the $2200 area.

DXY Fundamental & Fibonacci AnalysisThe Covid-19 pandemic and Russia vs Ukraine war created supply shortages and imbalance in the global economy. In order to balance out the supply & demand and find equilibrium, demand needs to be reduced to meet supply. The way they can achieve this is by hiking interest rates, making things more expensive and making risk assets costly to hold. Until inflation has cooled down, the Federal Reserve will continue to hike interest rates, which means selling of risk assets by smart money in exchange for USD, so they can profit from Dollar strength and high interest rates even when markets are going down, like a safe haven. It is estimated that at least 2 more rate hikes are priced in. If the Fed doesn't hike interest rates before recession it would be disastrous for the economy, it's unfortunate for most of the population but it's tough medicine.

I expect continuation of the uptrend until the fundamental situation changes, which should happen sometime in 2023, possibly at the end of Q1, a year before the Bitcoin halving also. I expect DXY to break the Lower High at 121 and top out at 132, at the Golden Ratio of the previous swing impulse and the -0.272 Fibonacci extension.

If you appreciate my analysis, don't forget to like this post and follow my page. Share your thoughts in the comments. Thank you

DXY (Dollar Index) Full Top-Down Analysis Traders and Investors,

Dollar had a massive run for past year and is now inside an FCP zone. It is kind of stuck between 2 FCP zones and may consolidate there for a bit. On smaller time frames, there are few signs which can give us potential important hints on the next direction. Last week, showed a rejection pattern from the top which is still valid. if the market does not violate that it can still look for downward move at least for the short term. But as it has been very bullish, there may be a period of consolidation. On the other hand, EURUSD also showed a good bounce last week which can also be correlated with it.

On the bearish side of things there are several factors lining up for the dollar:

1. Completion of W pattern

2. price inside FCP zone

3. Trend Line touch a few days ago

4. Weekly divergence building up

As the market conditions are changing fast, risk management is a priority.

Please support this analysis by liking and sharing. 👍🙂

Rules:

1. Never trade too much

2. Never trade without a confirmation

3. Never rely on signals, do your own analysis and research too

✅ If you found this idea useful, hit the like button, subscribe and share it in other trading forums.

✅ Follow me for future ideas, trade set ups and the updates of this analysis

✅ Don't hesitate to share your ideas, comments, opinions and questions.

Take care and trade well

-Vik

____________________________________________________

📌 DISCLAIMER

The content on this analysis is subject to change at any time without notice, and is provided for the sole purpose of education only.

Not a financial advice or signal. Please make your own independent investment decisions.

____________________________________________________

Forecast: Can the dollar keep rising?The US dollar (USD) has strengthened against most other major currencies in recent months, reaching a 20-year high by regained ground above the 113 bouncing back from its weekly lows of around 110 and We've already had five rate hikes this year, but the Fed has not yet been able to contain runaway inflation. Inflation shows no signs of slowing, with 8.2% increase over the past year and rising by 0.4% from August to September. What I think with Next Fed meeting scheduled for early November I think we gonna have another aggressive rate hike

*Note:

This Trade will be valid if the price break 114.805 and closed above it

Gold Tests Lower LevelsGold has broken down from $1670, finding support at $1658 before equilibrating after the hotter than expect CPI data. Support was confirmed by a green triangle and we were able to recover, testing $1658 one more time before tending toward $1670 again. The Kovach OBV is pretty flat, suggesting we may waver around current levels before we see another significant move. We can expect a great deal of resistance above, especially at $1683, which is the lower anchor of our previous Fibonacci levels. If we break through $1658, there is a vacuum zone below to $1640.

Bonds Recover After CPIBonds took a dive to break lows and hit our target of 110'05. A green triangle on the KRI confirmed support and we immediately the dip was immediately bought back, and we recovered the range between 110'27 and 111'26. We are currently hugging the upper bound of this range. The move followed yet another hotter than expected CPI print and a slump in retail sales. The Kovach OBV is slumping, so we expect the range to hold as the markets digest this data.

Gold RetracesGold has retraced significantly from the $1700's. It appeared that we were ready to solidify this handle, however we faced a massive selloff with the rest of the risk-off assets, as the markets price in sobering data and a hawish Fed. We have broken through $1700 and our first two support levels in the upper $1600's at $1692 and $1683. We are currently finding support at $1670, but appear to be hanging on by a thread. Several green triangles are confirming support at current levels for now. If we are able to rally then $1683 is the next immediate target otherwise $1658 is the next level down.

GBPUSD LONG ANALYSIS TO $1.16📈I am expecting the Pound to rise against the Dollar, in a corrective play. We are currently seeing a correction take place on a bigger scale, playing out in an A-B-C wave.

Wave A - Complete✅

Wave B - Nearly Complete👇🏽

Wave C - Pending🔺

Drop me a follow for more free analysis✅

When USD Hits Resistance, That's When USDMXN Will Breakdown In today's video I will look into a detail analysis of USDMXN, which is doing quite well compared to the strong USD Index. So my assumption is that when USd index will hit resistance, possibly after the 10 year US notes completed the current fifht wave up, the USDMXN can easily break through the support and will be targeting Feb 2020 pandemic low.

Crude oil is also very important for the USDMNX. Price is higher for the last two weeks as the situation between Russia and Ukraine is getting worse. OPEC also decided in its first one-on-one meeting since 2020 to cut production by up to 2 million barrels per day from November. So it appears that EU will not have easy task to limit the energy prices.

If you like this video, please leave me a comment below and press like.

Thank you

Grega

S&P 500 Outlook - Non Farm Payrolls, Unemployment, Fed.How long will the rally continue?

What to watch to answer this question.

7 October Fed Critical Datapoints

Non Farm Payrolls and Unemployment Numbers

If more people are finding jobs and and unemployment is going down it will indicate a strong economy, which will lead to the Fed continuing rate hikes, which will put downward pressure on the S&P 500.

If more people are struggling to find jobs and unemployment rises we can assume that the economy is slower and the Fed might likely pivot and ease rate hikes, which will put upward pressure on the S&P 500 and cause a further upward rally.

Mid October. (Earnings Season)

Earnings are set to release, middle October, my prediction is earning will be weaker than expected and might lead to a continuation of the Bear Market we are in. If earning are flat or higher than expected, then we can see a further upward rally in the S&P500.

Goodluck.

Follow me for more.

Short AUD/USD -RBA Interest rate hike only 25BP, won't beat Fed.As seen in the video - I am short the Aussie Dollar against the almighty greenback.

The RBA needs to get more aggressive in hiking interest rates, in order to compete with the Fed in the US.

The Dollar USD will continue to be strong against all other currencies as they raise interest rates aggressively and be the defense trade in these uncertain times. Although other currencies will fight to not go lower against the divergence in interest rates against the USD.

Weekly gold, another short opportunityTraders will keep eyes on global bond markets for next week because if the Bank of England's strange policies continue, it could help gold to rise

while the Bank of Japan, which is concerned about high prices in USDJPY, should intervene in the forex market. In addition to buying yen, they can sell US bonds in the markets and witness fluctuations in bond yields.

The risk of the economic recession is the driver of the rise of gold. But in the short term, the attention of all traders is on contractionary policies and decisions of central banks, which can put pressure on gold.

As we told you in last week's analysis, any upside movement in gold will be short-term and provide a selling opportunity.

Because the US dollar is in the overbought zone and also the bonds are at their highest points, the take profits have the possibility of raising the price of the gold.

On the other hand, due to the hawkish policies of the central banks as well as the US central bank, this pressure on gold will not be removed

and as long as we observe the rotation of the monetary policies of the central banks, we cannot expect a stable rise for gold.

The world's largest bond market has fluctuated strongly in the last week due to the fear of the British debt crisis.

But, with the intervention of the BOE and the introduction of the government bond purchase program, the treasury bonds' price fall was compensated.

The trend changed as the Bank of England intervened in the bond market and it lowered the yield of American bonds.

Now, in addition to the policies of the Federal Reserve, other central banks also affect bonds and we have to care about them.

As we said in the analysis, gold is bearish in the medium and long term until we see a turn in the contractionary policies of the central banks

But this week due to the upcoming economic data and the possibility of correction of the US dollar index and US bond yields, there is a possibility of gold increase.

However, we predict a turbulent week and our suggestion to traders is to wait this week and sell gold from the high points.

$1700 to $1724 is our sightly range to looking short opportunity to the$1620 area

S&P 500 RECESSION ANALYSIS!1. LOWER HIGHS-LOWER LOWS: price action says the actions or pattern formed by the price itself. and the people who trade in the stocks makes up the demand and supply. therefore, this affects the inflation, and there could be a major correction, if recession is announced.

2. 3200 level is getting support by FIBONNACI RETRACEMENT(0.618 AREA)

3. RSI ANALYSIS: first i thought its a rsi divergence, but it looks like rsi is yet not completed its action fully, if the markets falls further, then RSI will correct itself, and will go in the around 22 level. to make my point prove, i have drawn one more resistance line, showing RSI's resistance towards it.

the arrows what i have drawn in RSI, is to say whether it is a pullback of RSI or not, but to say so, it does not looks a like.

4. DEMAND ZONE: after a recession, the next phase is depression or expansion. it does not looks like, US markets will face a depression, so i will go with the 2nd option itself(expansion), which is also know as demand zone. so the indices will enter the demand zone, which says that markets would have reached its bnottom, and can have a fresh entries.

5. FIBONNACI RETRACEMENT & WAVE THEORY: supporting the wave theory with the fibonnaci, it looks greatly the index is supporting the fibonnaci levels, and thus forming a good corrective waves. the 5th looks way clearer, and no need to comment on it furthermore.

FINAL STATEMENT:

hence concluding my analysis, if theres a recession being announed, S&P will reach 3200 LEVEL. AND MY STATEMENT WILL THEN BE CONFORMED IF THE INDEX WILL ENTER THE LAST AREA OF FIBONACCI, AND GOES BELOW 3500(GOING TO TOUCH THE BOTTOM OF DEMAND ZONE)

Can Gold Regain $1700?Gold prices have lifted as risk-off assets rally. We have clawed our way back through the mid $1600's and have hit $1683. We appear to be encountering resistance here, which is to be expected as this is a major level. The Kovach OBV has risen, but has flatlined, indicating that we will need more momentum to properly break out. If so, $1692 is our next target, and we are sure to encounter further resistance as we head toward the $1700 handle. If we retrace, anticipate support at $1670 or $1658.

Bond Market Gains from Risk Off ToneBonds appear to be gaining strength as yields relax and the US dollar pulls back hard. The Kovach OBV is edging up, but we have resistance confirmed by several red triangles on the KRI at current relative highs. We appear to be seeing a bull wedge forming, in an attempt to break through 113'00. If so, then 113'12 will be the next target. If not, we will find support again at 111'26.