Harmonictraders

USDCHF LongTime Frame: 4H

Symbol: USDCHF

Entry: 0.95807

TP: 0.96883

SL: 0.95096

Bias: Long

Currently the price pattern of this instrument is pointing towards a bullish directional bias. The overall trend and momentum is not of high probability opportunities but there is still a ray of hope for a bullish trade.

EURUSD, BOUNCE OF LOWEST LOW SINCE 2002?Pair: EURUSD

Timeframe: 4H, 1D

Analysis: Round number level, trend line, volume profile, support and resistance, lowest low

—————

Key Takeaway: Approaching the lowest low since 2002, we are most definitely expecting a bullish bounce from this level

—————

Level needed: need a close by 1.0000

—————

Trade: Long

RISK:REWARD —

SL: —

TP: —

—————

DO NOT ENTER OUR SETUPS WITHOUT CONFIRMATION

BANKNIFTYHello and welcome to this analysis

Bank Nifty after a stupendous run has reversed from a Bearish Harmonic Alt Shark suggesting a probable 38-50 Fibonacci retracement of the entire run since mid June.

Harmonic patterns are formed when structures synergize with Fibonacci ratios thereby giving higher probabilities of reversal confirmations.

This view will be valid till SPOT does not break above 39850

Risk Reward appears to be very good for a bearish trade.

GPBCAD CONTINUATION SETUP?Pair: EURJPY

Timeframe: 4H, 1H

Analysis: Round number level, trend line, volume profile, support and resistance, pennant pattern, inverted head and shoulders

—————

Key Takeaway: Seen a break of resistance, head and shoulders pattern for more confirmation, just need a push through high volume and round number level

—————

Level needed: need a close by 137.555

—————

Trade: Long

RISK:REWARD 1:5

SL: 44

TP: 230

—————

DO NOT ENTER OUR SETUPS WITHOUT CONFIRMATION

EURJPY INVERTED HEAD AND SHOULDER BREAKPair: EURJPY

Timeframe: 4H, 1H

Analysis: Round number level, trend line, volume profile, support and resistance, pennant pattern, inverted head and shoulders

—————

Key Takeaway: Seen a break of resistance, head and shoulders pattern for more confirmation, just need a push through high volume and round number level

—————

Level needed: need a close by 137.555

—————

Trade: Long

RISK:REWARD 1:5

SL: 44

TP: 230

—————

DO NOT ENTER OUR SETUPS WITHOUT CONFIRMATION

WILL WE SEE AUDUSD BREAK THIS VITAL SUPPORT?Pair: AUDUSD

Timeframe: 4H, 1H

Analysis: Round number level, trend line, volume profile, support and resistance, descending triangle pattern

—————

Key Takeaway: Need a break of support, already seen a break of high volume level, we also need some strong bearish momentum

—————

Level needed: need a close by 0.68500

—————

Trade: Short

RISK:REWARD 1:7

SL: 21

TP: 146

—————

DO NOT ENTER OUR SETUPS WITHOUT CONFIRMATION

USDJPY KEY LEVELS BREAK OUTPair: USDJPY

Timeframe: 4H, 1D

Analysis: Round number level, trend line, volume profile, support and resistance, pennant pattern

—————

Key Takeaway: Need a big push up with alot of bullish momentum as we have already broken key levels of resistance and using them now as support

—————

Level needed: need a close by 136.890(bullish)

—————

Trade: Long

RISK:REWARD 1:6

SL: 29

TP: 243

—————

DO NOT ENTER OUR SETUPS WITHOUT CONFIRMATION

Possible Double Bottom, 22k StillPossible Double Bottom with good Buying.

Double Bottom pattern target is 1x above the neckline - this would be around 21,950-22k. The 0.886 fib X-D also meets here, which would create a potential bearish harmonic .

If this does happen, my profit target will be the 1.618 and 3.14 fibs - around 20k and 18.3k.

There is a descending triangle , but I won't be shorting here - I have a feeling it will break upwards.

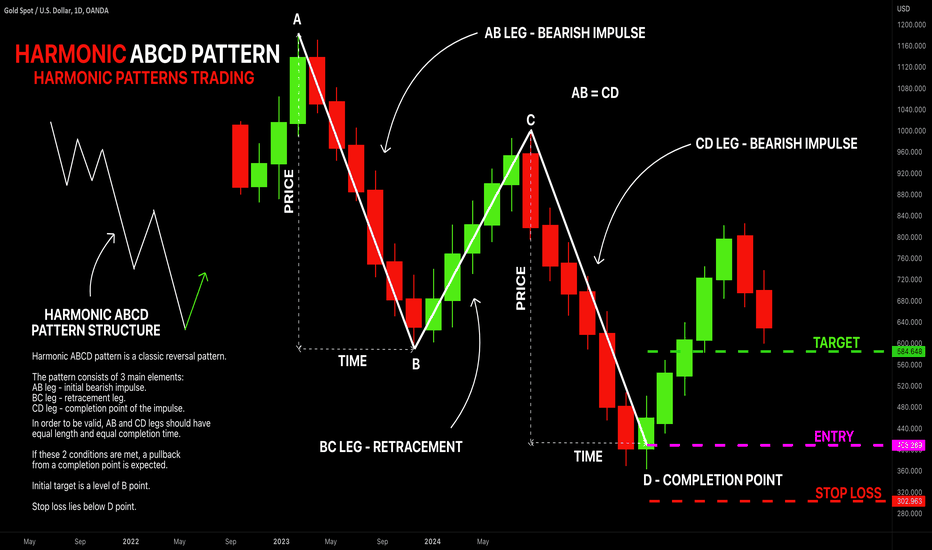

LEARN HARMONIC PATTERNS TRADING | ABCD PATTERN 🔰

Hey traders,

Harmonic ABCD pattern is a classic reversal pattern.

This pattern is composed of 3 main elements (based on wicks of the candles):

1️⃣ AB leg

2️⃣ BC leg

3️⃣ CD leg

The pattern is considered to be bullish if AB leg is bearish.

The pattern is considered to be bearish if AB leg is bullish.

AB leg must be a strong movement without corrections within.

A is its initial point and B is its completion point.

BC leg is a correctional movement from B point after a completion of AB leg. The price may fluctuate within that.

B is its initial point and C is its completion point.

CD leg must be a strong movement without corrections within.

C is its initial point and D is its completion point.

❗️ABCD movement is harmonic if the length and the time horizon of AB and CD legs are equal.

By the length, I mean a price change from A to B point and from C to D point.

By the time, I mean a time ranges of AB leg and CD leg.

If the time and length of AB and CD legs are equal, the pattern is considered to be harmonic, and a reversal will be expected from D point at least to B point.

🛑If the pattern is bullish, stop loss must be placed below D point.

🛑If the pattern is bearish, stop loss is placed above D point.

Initial target level is B point.

Usually, after reaching a B point the market returns to a global trend.

What pattern do you want to learn in the next post?

❤️If you have any questions, please, ask me in the comment section.

Please, support my work with like, thank you!❤️

CADCHF BEARISH CONTINUATION TRADEPair: CADCHF

Timeframe: 4H

Analysis: Round number level, trend line, volume profile, support and resistance, descending triangle

—————

Key Takeaway: Need a break of support

—————

Level needed: need a close by 0.73760

—————

Trade: short

RISK:REWARD 1:6

SL: 13

TP: 79

—————

DO NOT ENTER OUR SETUPS WITHOUT CONFIRMATION