BITCOIN IS OVERBOUGHT! RSI shows the price will go back downTo everyone that is overly exited with Bitcoin right now... Calm down!

Yes Bitcoin has rallied quite a bit for the past day, but don't jump on it too quickly because it is extremely overbought. As shown on the RSI, the price is largely above the 70 mark, meaning that people are buying excessively and that the price will soon come back down.

If you gained from the bullish movement, think about selling soon and buying again when the price will come back down because it certainly will according to the RSI.

Growth

CrowdStrike Buy ZoneThe area that interests me is the supply zone notated by the Orange Rectangle. Aside from an obvious supply zone, CEO Roxanne Austin has purchased nearly $6 million in shares over the New Year holiday. Some speculate that growth is a concern, but that is a concern with all growth stocks; what if they were to stop growing? There's always a risk investing money into any company, but CRWD demonstrates it's value to shareholder's through it's outstanding customer retention rate, most fortune 500 companies use Crowdstrike Software.

There is a solid short-term double bottom forming in the $90's. My price target is $104 short term and $150 + by EOY.

Scott's Miracle Grow WILL GROW!SMG strong buy ratings and solid financials make SMG a good Long Term Buy. The cannabis industry is helping build it's revenue from critical fertilizers and other materials that are it's core business. I honestly believe SMG is a stock that will double in the year. Mark my words Trading View! SMG will be a big winner!

Also, buying SMG while it's under it's major moving averages is a much better strategy than waiting for a large break-out and trying to time it perfectly. I think accumulating SMG the next few months is a wise idea.

LTC-USD : Assessing DemandI like what LTC could be ahead of its EoY forecasts.... this chart is a quick short term rally. Come Summer time the real festivities kick off. I will be adding LTC to the portfolio. I think its an excellent option for people who feel priced out of ethereum and bitcoin. The demand hasn't even really begun, anticipate steady demand & incremental climbs. Those who understand market will be able to leverage experience. Hypothetically bitcoin could go to 10k and i think consumer confidence would hold current pricing levels. Technicals signal strong buy.... and in discussions w/ peers we're in consensus on how good the return could be for LTC.

I could see steady demand intensifying the closer we get too Q4. Temporary cooling periods are getting shorter and shorter. Those who understand Litecoin, will understand why we're climbing in steps. LTC loyalists know what time it is. Circle the months of June, & July.

Bitcoin showing bullish signsBitcoin has been showing bullish signs over the last couple of days, as the price of the crypto has been steadily climbing. Many investors and traders are optimistic that the bottom may very well be in. The recent rally in price can also be attributed to an increase in demand from both retail and institutional investors, who are buying into the cryptocurrency as a hedge against inflation. The overall sentiment in the market is positive and many believe that this trend is likely to continue in the coming days.

January EffectHello guys! Have you ever heard of the "January effect"? It's a pattern that has been observed in financial markets where the prices of small cap stocks tend to go up in the month of January. Some people think this happens because of tax-loss selling (when investors sell stocks that aren't doing well in order to reduce their tax burden) or because more people are interested in buying small cap stocks at the start of a new year. It's important to remember that the January effect isn't a sure thing and shouldn't be the only reason you make investment decisions.

What do you think about this effect?

📉ZBC to test:↓0.008068 or ↓0.005084I have circled January 23rd on my calendar as a date to observe how ZEBEC's price behaves at a certain intersection. As a high frequency trader who is accustomed to volatility and high risk, I am concerned about the lack of price stability. It is essential for the management to clarify their direction. I am puzzled by the unsustainable 300% APY on a 5-day lock-up and 50% on a 30-day lock-up offered. You know who else did that, companies like CELSIUS, VOYAGER, 3AC, and FTX. These token offerings seem more like a liquidity dump to me.

Communication needs to be improved as well. Currently, there are two Twitter accounts, one Discord, and six or seven Telegram channels, which makes it difficult to keep track of updates. There isn't enough video content. A more centralized and organized approach to communication would improve social cohesion. I am also not a fan of the "zebec army" mentality. If we are not at war or planning to go to war, why act like an army? The constant farming for engagement and regurgitation of facts has taken away from my enjoyment of the project. Trying to cut through the noise is a minor annoyance, as i am empathetic.... but now we have an "army of ambassadors". To some its semantics, but to me i take it seriously. I like mass adoption w/out self-obstructing hurdles.

I applied for the ambassador program, but have not heard back about when it will be implemented or who will be selected. Additionally, I have not received my USDT prize after participating in a giveaway two weeks ago. This has made me hesitant to participate in small giveaways. I only ever do so as a way to test a project's reliability. It seems that I am not the only one who has not been paid out...

ZEBEC is currently running on Solana and BSC, but it is not as popular as the recently released memecoin called #BONK. Furthermore, the project has caused issues with GALXE and Cyberconnect, two major web3 schedulers on BSC. Now, the team is working with crew xyz, and after that, Quest or until we build our own... its going to get increasingly difficult to get the message out.

I am located in a North America, and am focused on business and growth. However, I have become disenchanted with the way the project is being run. The farmed engagement is bot-like, which has taken away from my enjoyment of the project. I am rather patient, so don't take any of this as being harsh. The parroting is just noise, but its annoying. Perceived criticisms are intended to be guiding directions.

As a ZEPOCH Node operator who is committed to the project, last i checked an insignificant number of nodes had been sold. However, I am not able to trade or sell my node until the 30,000th node is sold. While I am not interested in selling nor trading my node, I do have a vested interest in the project and believe that improvements need to be made...

I'm hopeful things will turn around, but I'm not expecting an overnight makeover. Of course a bull run could change everything and anything.

BTC Dominance Structure Today I leave you with a rather interesting comparative analysis, introducing the much-studied and used concept of market capitalization dominance, in our case of Bitcon versus the rest of the crypto market.

The graph structured by TView gives us in this case a percentage of market dominance, that of Bitcoin against altcoins,

ideal for establishing migrations from bitcoin to altcoins according to their profitability at certain times or vice versa.

In general, it is well known that altcoins take a little longer than bitcoin to raise their prices, but when this happens they skyrocket above their profitability,

in the case of falls it is similar but inversely if bitcoin falls the alts tend to have much larger falls.

The comparison that we bring today with the graph in red shows us the concept of numerical dominance, without percentages, in this case the amount in the top 80 Cryptos that are in annual profitability above Bitcoin.

A very interesting concept that we will develop further in further analysis.

-------------------------------------------

Hoy os dejo un análisis comparativo bastante interesante, introduciendo el tan estudiado y usado concepto de dominancia de capitalización de mercado, en nuestro caso de Bitcon frente al resto del criptomercado.

El gráfico estructurado por TView nos da en este caso un porcentaje de dominancia de mercado, el de Bitcoin frente a las altcoins, ideal para establecer migraciones de bitcoin a altcoins según su rentabilidad en ciertos momentos o viceversa.

Por lo general es bien sabido que las altcoins tardan algo mas que bitcoin en levantar sus precios, pero cuando esto se da se disparan por encima de su rentabilidad, en el caso de las caídas es similar pero a la inversa si bitcoin cae las alts tienden a tener caidas mucho mayores.

La comparación que traemos hoy con el gráfico en rojo nos muestra el concepto de dominancia numérica, sin porcentajes, en este caso la cantidad en el top 80 Cryptos que se encuentran en rentabilidad anual por encima de Bitcoin. Un concepto muy interesante que desarrollaremos más a fondo en nuevos análisis.

TAL1T forming a nice cup and handle There has been significant insider buying in Dec 14th 2022 and also the passenger count has increased 80% in 2022 compared to 2021. Despite shareholders being diluted during covid and the company struggling during covid times, the recovery and the future looks good for Tallink and the revenue and profit are getting back to pre covid levels. This might be a good time to buy, as the stock could rally up to 40-50% in the coming year.

The technical also looks good forming a cup and handle pattern, should be a good time to accumulate, the rally might start with the price breaking above 0.55 and might test the resistance at 0.60 and 0.68.

STILL BEARISH ON S&P 500From past analysis of mine, which I was heavily bearish on Stocks due to fundamentals implications like the rise in interest rates and the loss of Jobs, all of which makes the Stock market not a good place to pour in money to invest

Based on technicals, Price is simply accumulating. I reckon that price would form some sort of AMD formation. Price would manipulate it's way to the FVG and probably the Daily Brearish Breaker Block before distributing to the sellside Liquidity below the current Price

Study, Compare and contrast my past analysis on CURRENCYCOM:US500 to this current one.

ETHUSDT - Break Out (Short Term Fun)From Dec 28th and onwards we see intense consolidation... its in the earliest hours of the New Year we see Eth in trajectory for a breakout. It would be interesting to see if current levels held. I like the probability of it rallying on the day beyond $1280--$1330 in price, that is where i have my hopeful eyes steered. However I'm quite content to get there in steps, I like a steady climb. . Its the start of the New Year and the whales will be getting their Fins wet w/ or without you.

The 1.8% bump for ETH/USDT, was an uptick in Market Cap volume reflective of $3Bn+ over a 2 hr time frame

It could be a good day for Ethereum hodlrs. The building on ETH is endless.

Lmao where are these so called "Ethereum" killers... Solana is down 95.3%

Technicals on the time frames indicate strong leaning towards it being a worthwhile hodl & I share similar if not the same sentiment

RoadMap:

Last year was Merge, this year is "SURGE" so upgrade 2023 will be in terms of scalability w/ sharding and rollups. As the gran daddy EVM other projects follow in its footsteps. We could see 100,000 TPS (if we're lucky)

Concurrent Ecosystem Chain Upgrades: The Verge, The Purge, & the Splurge

NFA/DYOR: Not your keys, not your crypto

Tesla price action down trendFundamentally, the company is strong. From pandemic till now its earnings just keep growing.

Hence the company itself continues to make money.

Price action, however says its downtrending which makes sense in that Elon did sell off a lot for twitter.

Once that normalises, the price action will again follow the fundamentals.

As long as Elon is the lead, I can firmly believe tesla will continue to do good as it leads in continuous innovation.

If you're in long term investing, expect heavy bullish sentiment. If you're a trader, then ride the down trend.

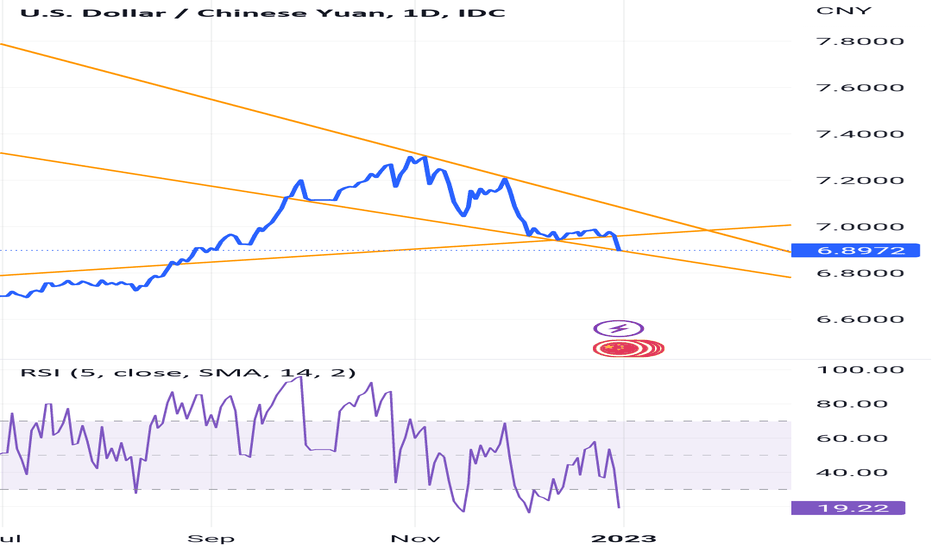

Usd Chinese yuanAll information priced in the price.

China has one main issue and that is how to deal with covid because it seems to repeat.

China has hopes as it can still bounce to the ceiling, but what ever policy is set; drives their economy.

Here's my prayers to the Chinese. Zero covid isn't working because people get sick, but they also get stronger.

Exercise and vaccines help. China should consider assistance from the US on how to get back to normal.

Presearch Holder/Price divergenceI've been following up with the project for a few years now, patiently watching developments and keeping track of their growth.

- Team/Project survived previous bear market.

- Project has +4M daily searches

- From 500M supply, around 250M are being staked

- There are around 70000 nodes servicing the system in a decentralized manner worldwide.

- Still waiting for trend reversal on daily (TSMA-50-100-200)

- Number of new wallets and holders started growing faster than usual since Sep 2022 (diverging from price movements)

- While there's always room for more pain, selling pressure has been flattening since Jul-2023

- Technical developments are slow/steady, regardless market conditions, which shows resiliency from team/project.

Overall, I'm watching this closely, project has great potential, seems quiet undervalued at the moment, charts shows smart money accumulating during this pain period, and the token is getting more scarce as the liquidity crunches unfold.

*I'm not an expert and this is not financial advice, do your own "Presearch".

* Be advised, this is highly volatile region we are due to low liquidity.

Show your love if you want to keep following Presearch developments with me.

TSLA REBOUNDS OF 105!!!!TSLA having a massive buy presence in the premarket this morning. Could this be a sign good things are coming? I think not, over the last 5 trading sessions TSLA dropped a eye watering 21% !!!

Here are some factors of why TSLA has declined a MASSIVE 72% this year :

Inflation -> Fed tightening -> Risk-off assets looking more attractive

Elon has sold $23bn worth this year alone to finance the twitter acquisition. If advertisers continue to flee, he will need to sell more to finance debt payments from LBO.

He has pledged not to sell anymore till 2024

There have been large concerns from major investors around Elon's time commitments as CEO given Twitter acquisition.

Fears of a global recession next year are causing concerns around luxury car demand. Consumers will be reluctant to spend $80,000 on a new car with used car prices tanking.

No $30,000 Tesla car yet.

Concerns about Chinese demand given COVID cases and lockdowns hurting demand for luxury vehicles.

No wide FSD rollout, No Cybertruck

Ouch......

AUDJPY SHORTDXM : 46% LONG = Still high !!!!!!! Most of retails are still LONG, think in the other side.

Seasonnality : neutral then bull during january but SHORT accordy to the "pattern prediction".

COT Strategy : AUD is reaching a strong resistance around -5 on the COT history Chart AUD.

No FLIP.

Sentiment score :

Daily sentiment : Negative thanks to China covid policy...

Supply/Demande area :

We're on a strong resitance of 89.23.

Support/Resistance :

Strong resistance at 83.23 on DAILY.

Trend :

Under all SMMA = Bearish

Economic News :

*Rapid reopening movements, easing of policy. Are we going to see economic recovery? Morgan Stanley says YES! And raised its 2023 China GDP forecast to 5.4% from 5. But in reality...it's not for today.

*China realizes that opening up is doing too much harm and even though quarantine is no longer mandatory as of January 8, 2023, hospitals, deaths and cases are exploding (not good). There is a good chance they will reverse their decision so this indicates AUD SHORT. If no recovery in China = AUD weak because no or less exports to China since there is less demand.

*Less growth in China means les importation and an impact on the AUD.

The Bank of Japan, in a move that surprises the market, is extending the cap on the control of the 10-year yield curve to 0.50% instead of 0.25% previously. In other words, it is starting to be more hawkish, although it still maintains a strong control. The yen is strengthening and the Nikkei is falling.

GBPCHF SELL**Fundamental view :** the British pound could be the main victim of a strengthening euro, "as the Bank of England (BoE) is closer to the end of its tightening cycle than the Fed and the U.K.'s large current account deficit makes the pound vulnerable in a global slowdown.”

Pound Slumps as BoE Forecasts Recession for UK

The Pound (GBP) was initially boosted by stronger-than-expected GDP figures on Monday. Persistent expectations of a recession kept GBP’s upward movement limited, however.

Mixed jobs data on Tuesday largely weighed on the Pound. A rise in unemployment undermined a bump in wage growth. This, along with a drop in inflation on Wednesday, saw markets pare back their BoE rate hike bets.

Thursday’s interest rate decision from the central bank pulled Sterling lower. Dovish forward guidance alongside the **50bps interest rate hike** dented confidence in the Pound.

Finally on Friday, an unexpected slump in November’s retail sales deepened GBP’s losses.

****"We therefore think short GBP/CHF is the best relative value expression of policy divergence essentially long EUR/GBP with a “BTP hedge” - Goldman Sachs.****

UK bonds slumped on speculation a wave of extra supply will drive down prices as the Bank of England prepares to push on selling its sovereign holdings at the start of the new year.

Yields on 10-year gilts jumped as much as 16 basis points to 3.48% on Monday, the highest since early November

**Central Banks view :**

Actual is **3.5%** but more to come. The BoE, which is battling double-digit inflation that has unleashed a cost-of-living crisis that is pushing the economy deeper into recession, ** (www.reuters.com)** by a combined **325 bps in 2022** alone to their highest since late 2008.

UK rates began rising in December 2021, making the BoE the first of the world's major central banks to kick off a monetary policy-tightening cycle.

This is to a financial advice, just my own analysis.

ECONOMIC CYCLE & INTEREST RATESHello traders and future traders! The state of an economy can be either growing or shrinking. When an economy is growing, it typically leads to improved conditions for individuals and businesses. Conversely, when an economy is shrinking or experiencing a recession, it can have negative consequences. The central bank works to maintain a stable level of inflation and support moderate economic growth through the management of interest rates.

What is an economic cycle?

An economic cycle refers to the fluctuations or ups and downs in economic activity over a period of time. These cycles are typically characterized by periods of economic growth and expansion, followed by periods of contraction or recession. Economic cycles are often measured by changes in gross domestic product (GDP) and other economic indicators, such as employment, consumer spending, and business investment.

Economic cycles can be caused by a variety of factors, including changes in monetary and fiscal policy, shifts in consumer and business confidence, and changes in global economic conditions. Economic cycles can also be influenced by external events, such as natural disasters or political instability.

Understanding economic cycles is important for businesses, governments, and individuals, as it helps them anticipate and prepare for changes in the economy and make informed decisions about investment, hiring, and other economic activities.

How is an economic cycle related to interest rates?

Interest rates can be an important factor in the economic cycle . During a period of economic expansion, demand for credit typically increases, as businesses and consumers borrow money to make investments and purchases. As a result, interest rates may rise to control the demand for credit and prevent the economy from overheating. Higher interest rates can also encourage saving, which can help to balance out the increased spending that often occurs during an economic expansion.

On the other hand, during a period of economic contraction or recession, demand for credit tends to decline, as businesses and consumers become more cautious about borrowing and spending. In response, central banks may lower interest rates to stimulate demand for credit and encourage economic activity. Lower interest rates can also make borrowing cheaper and more attractive, which can help to boost spending and support economic growth.

Overall, the relationship between interest rates and the economic cycle can be complex and dynamic, and the direction and magnitude of changes in interest rates can depend on a variety of factors, including economic conditions, inflation expectations, and the goals and objectives of central banks and other policy makers.

I hope you leant something new today!

Retest 18k for BTCToday is 11 of Dec and in 3 days we have the latest FRS event in this year.

My idea based on sentiment, fundamental and waves analysis.

Market expects 4,25-4,5, and in case of success we have all chances to test 18k level.

Following Elliott waves theory, we observe 4 growing wavers of 5, and the latest wave should be higher than 3. Then will be 3 waves of corrections.