Gold Setup Hey guys hope you are doing well

According to H1 Time Frame we Analyze gold will open as a bearish and go down up-to 120-150 pips

We will open the positions with buy after touching our expected targets but always remember use proper lot size or risk management

After 120 - 150 Pips gold would be bullish at the end point at 1714 - 1724 - 1735 - 1743

Best of Luck !!

Goldusd

XAUUSD Gold New Week MovementTechnical Analysis Chart Update

XAU / USD ( Gold / U.S Dollar )

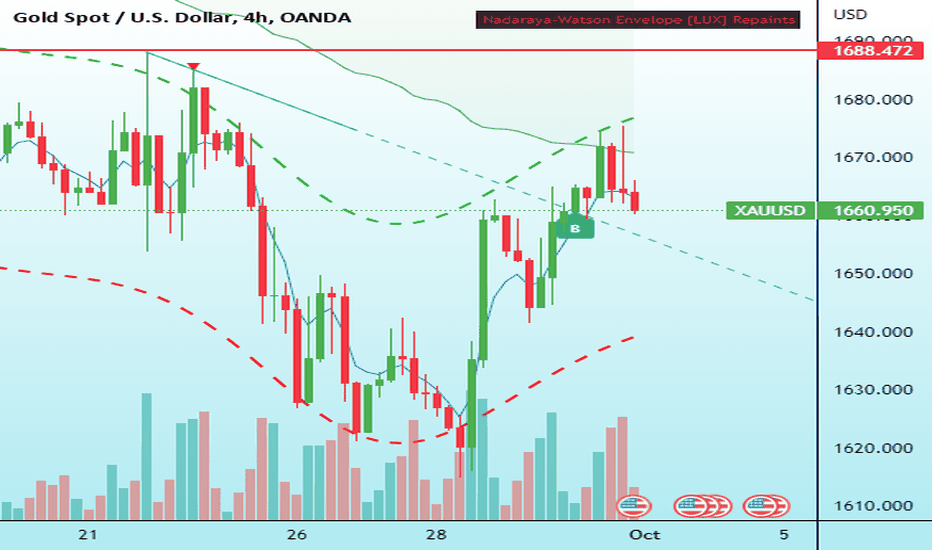

Time Frame - H4

Long Time Frame #LTF ( BEARISH CHANNEL )

Rejection from the Upper Trend Line #UTL

Possible Rejection from 1680 - 1686 if Breaks then Sell

It has completed the Impulsive waves in Long Time and Short Time it is now making " A " Corrective wave in Long Time Frame #LTF and " B " in Short Time Frame #STF

If Rejects from the Demand Zone then Possible it will Follow Head And Shoulder in Short Time Frame #STF

XAUUSD top-down analysis, UPDATED!!Hello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

XAUUSD top-down analysis, UPDATED!!Hello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

Gold Trade Idea GOLD ANALYSIS FRIDAY 7 OCTOBER -Aj Friday ha, Market ka akhri working day ha.

6 October, Gold open hua tha $1716, High $1725 banaya, Low $1705 banaya aur closing $1709. $7 ki kami hui ha 5 October ki closing sa.

Aj Gold, $1711.65 pe Open hua ha, $1713.24 ka high banaya, $1708.93 ka low banaya ha aur es waqt $1712 pe trade hora ha hai.

Aj Gold ki Support $1695 pe ha aur Resistance $1728. Trend aj ka neutral ha aur volatile bhi. Jesa Fundamental Data release hoga aus taraf Gold ki price jaigi toh Support and Resistance bht ziada important ha.

Aj Pakistan Time, 05:30 PM US Average Hourly Earning, Non Farm Employment Change aur USA Unemployment Rate k figure release hogay.

US Nonfarm Employment Change

Previous 315000

Market expectation 265000

US unemployment rate

Previous 3.7%

Market expectation 3.7%

En sab sa ahem event US Employment rate ha. Agr figures US$ k liye achay atay hain toh Gold ki price apni Support $1695 tak ghirsakhti ha.

Agr Figures US$ k liye bura atay hain toh Gold ki price apni resistance $1728 ya isay mazeed uper jasakhta ha.

Gold i think that's a bull trap when we look at the dxy chart.

in my opinion gold will complete m formation.

in case it doesn't here's some reversal point for gold and at the worst scenario it will go down to 1380.

As long as super trend doesn't give buy signal and making higher high I'm not buying it.

" TREND IS YOUR FRIEND " go with trend.

XAUUSD Gold Next Possible Technical Analysis Chart Update

XAU / USD ( Gold / U.S Dollar )

Time Frame - M30

BULLISH CHANNEL in Long Time Frame #LTF and Rejecting from the Upper Trend Line #UTL

Selling Divergence in #RSI

Break of Structure #BOS - 1718

Short Time Frame #STF BULLISH CHANNEL and Breakout the Lower Trend Line #LTL and completed the Retest

Symmetrical Triangle

Gold Trend 05/10 - 08/10Gold renewed the 3-weeks high yesterday. Carried the buying momentum from the day before, a new round of buying was triggered after the price cleared the resistance at 1700 early in the Asian session. The bullish trend continued until it touched the day-high near 1729 late in the US session. The day ended at 1725, up by USD 25.

After all the interventions and the news from the BOJ & the BOE, gold is trading above the critical support of 1680(1) again. The S-T trendline(2) can be used as a resistance reference for the current bullish trend. While the market is now shifting its focus to the US employment figures this Friday unless the price can clear the resistance at 1730, expect the price to remain in 1700-30 in the next 48 hours.

Since gold escaped the downtrend channel (4) and broke out from the 20 days MA, a bullish trend has begun on the daily chart. Unless the price can clear the 50-day MA and trigger a new round of buying, 1700-30 should be the range for today.

S-T Resistances:

1730

1725

1720

Market price: 1718

S-T Resistnces:

1710

1705

1700

If you like our work, kindly give our team a thumbs up. Feel free to leave a comment; let us know what you think!

P. To

Gold analysis: Testing key resistancesGold is back above $1,700, which is where it was in the middle of September, up 5% on the week.

A drop in Treasury yields and a weaker dollar have aided gold's rise as the market speculates on the end of Fed rate hikes.

From their 4% peak in September, US 10-year Treasury yields ( US10Y ) have decreased by almost 40 basis points in the last few session, and real yields ( DFII10 ) also dropped.

Simultaneously, the DXY index decreased from 114.1 on September 27 to 110.6. Overall, gold confirmed its inverse relationship with both the USD and real yields.

What does gold's chart analysis show?

Gold prices are currently testing a multi-resistance zone between $1,710 and $1,720, defined by the bearish trendline from March's 2022 highs, the 50-day moving average, and the 23.6% Fibonacci retracement levels of the 2022 high-low range.

Previously, gold prices encountered resistance at the 2022 bearish trendline and retreated in mid-August.

The MACD is forming a bullish crossover, and the RSI is moving above 50 for the first time since mid-August, according to the oscillator analysis, which supports a short-term upward trend.

If this multi-resistance region is broken, it could signal an extension of the bullish wave towards $1,788 (38.2% Fibonacci) and $1,800-1.810 (August highs) as potential short-term targets. If prices retreated from the resistance, $1,680 serves as the first support for placing stop.

Idea written by Piero Cingari, forex and commodity analyst at Capital.com

Gold breaks above 6 week trendlineCurrent price is above the six week valid downward slopping trendline (bullish); current price is above its very short term 13 day simple moving average (bullish); current price is above its 25 day minor intermediate term simple moving average (bullish); 13 day rate of change is above its zero line (bullish); 4 day rate of change is above its zero line (bullish); very short term AROON UP 5 day at 100% (bullish).

Conclusion: LONG positions can be technically supported for short term price target at $1,735 and intermediate term target at $1,860 in extension with stop at $1,615.

XAUUSD GOOD H1 TRADE BEARISHXAUUSD GOOD H1 TRADE BEARISH

Lets do the trade with margin of 100 pips in startup to catch 200 pips

strong resistance at 1710

use target 1 as 1690 the 1680 and last target as a 1658

This analysis are on basis of educational purposes so USE 1% OF YOUR INVESTMENT

All the best guyssss...

XAU/USD what to expect?!Despite dollar weakness, XAU/USD lacks bullish conviction on the prospect of aggressive monetary policy tightening by global central banks, including the Federal Reserve. Indeed, the US central bank will say last week that it will raise interest rates at a faster pace at its upcoming meetings to rein in rising inflation. This could continue to act as a tailwind for US bond yields and the dollar.

It's worth recalling that the rate-sensitive two-year US government bond yield rose to more than a 15-year high on Monday and the benchmark 10-year Treasury yield to the highest level. since April 2010. This supports the prospect of some buying on dollar declines. Aside from this, the risk boost could help keep a cap on any significant upside for non-yielding gold.

Even from a technical point of view, Friday's break below the support of a one-week trading range around the $1,654 area favors the bears. This, in turn, suggests that any further move higher could still be seen as a selling opportunity.

The data could be of little use to give a new impetus. However, XAU/USD appears to have snapped a two-day losing streak for now and remains at the mercy of dollar price dynamics. Aside from this, US bond yields and general market risk sentiment could allow traders to take advantage of short-term opportunities around gold.

If the breakout of $1,608 is not confirmed, we will return to $1,700. For now, everything points to a rise in the dollar due aggressive rises in bank interest rates.

Gold could possibly continue with it's bullish pressure all weekGold seems to be verify bullish this session, looking for a pullback to my 15M Gap for a possible entry.

Need to see some type of bullish rejection pattern such as a hammer.

Note: Gold could possibly continue with it's bullish pressure all week, it's the first bullish monthly candle in over 5-6 months.

Gold Road Mapping IdeaGold has been in a pullback ever since it hit new low at 1615, still very bearish in higher time frame.

Fundamentally central banks are going to continue to rate hikes and decrease the economic activity.

Sells at 1680 or breaks and retest below 1657.

Would only buy if we broke and close above 1680 and head to better SELL PRICE POINTS.

Trade safe.

LOOKING TO BUY GOLD ON PULLBACKThe market opened pretty bullish today and broke minor structure on the H1 to the upside, A slight gap was created in the market and I'm looking for a pullback to the area before entering long, Looking to see a hammer pattern or similar bullish candle stick pattern such as a tweezer bottom, morning star or bullish engulfing.

let's see what happens.

GOLD | OCTOBER FORECASTThe precious metal has a bad history of performing in Oct. For the last ten years; (2012 - 2021)

Bulls came out as the winner: 04

Bears came out as the winner: 06

This Oct'22 will remain bearish so sell on strength should be adopted.

As far as chart patterns are concerned, Gold has formed a double top near 2070 and just recently broke the all-important neckline support of 1680. The long-term target will come out to be 1300.

Trade your levels accordingly.

Gold : Intraweek Technical AnalysisIn previous week we were at the same point in gold where we are in SP500 now, there was not any support below 1660 and we were looking for a strong support below 1660. Now we are looking at a clear morning star formation on gold in weekly time frame. Which indicates an upside move towards 1700 which is the first resistance ahead.On daily time frame we are looking at three consecutive bullish candles with a morning star formation at the bottom. Which indicate the momentum can continue in coming week. In coming week we are looking at resistance found at 1675 with support at 1616. As the overall trend is reversing on higher time frames so we will be looking for long positions only . the adjacent support is at 1660 and 1645 from where we can expect long positions with intraweek target of 1675 and 1700 if the 1675 level is broken.

If you like this or if you think the opposite of this or if there is any other opinion, mention it in the comments. I am open to all kind of suggestions and critics.