GDP

Forex Reaction to GDPWhen someone mentions Macroeconomics, they are automatically talking about the big picture of the economy. Macroeconomics is concerned with the large-scale view of an economy and there are usually four main factors that make up this subject: GDP, Inflation, Unemployment, and Interest Rates. In most cases, changes in these factors could drive the Forex market in one way or another. Among the most important economic indicators that capture the whole economy’s behavior is GDP.

GDP is the accumulation of the economic output that represents where the economy stands in the business cycle. With increasing GDP readings, the economy is witnessing an expansion; hence, the currency appreciates. While decreasing GDP readings signal that the economy is deteriorating and witnessing recessionary periods; hence, the currency depreciates.

NZDCAD about to make new lows (TA and FA)According to the elliot wave theory, FX:NZDCAD . is at its correction phase, and using the fib extension we get T1 for the small ABC wave and T2 for the bigger wave; T1 is short term while T2 is mid/long term

Another thing to keep in mind, is that China is expected to report on Monday that economic growth cooled to its slowest in 28 years and this means that CNH is going down and we all know that CNH is positively correlated to both AUD and NZD.

AUDJPY: Reversal candlestick forming at hor. and Fib resistanceHere we have a potential short setup in the AUDJPY pair. The daily chart shows an important resistance close to current prices, aligned with the 61.8% Fibo retracement level. The pair has been in a downtrend for quite some time, and the price correction may be about to end. The daily candles show a Shooting Star/Evening Star reversal pattern, which still needs to be confirmed by the close of today's candle. The pair has seen some buying pressure recently, mainly on hopes of a US-China trade resolution, but the Australian dollar has been also hit by a slowdown in the Chinese economy (China's GDP q/y slowest in a decade). China is a major trading partner for Australia, and slowing Chinese demand for Australian goods/natural resources may cause a deterioration in Australia's terms of trade (in the long run.) In the short-run, we'll wait for this short setup to be confirmed by the candlestick pattern before entering with a sell order.

What you NEED to know before trading this week!Chinese GDP growth rates will most likely set the tone in the forex and stock markets this week!

SPX Looking WeakSo upon looking at several factors I believe the price of stocks are fully priced atm, and that 2900 was the top for the SPX, I believe the bottom will be around 1580 or 1800 and will take about a year for us to reach the bottom, so by the year 2020 we will see bullish momentum again and that is when I will be looking to enter stocks again. Right now in my opinion the best asset to hold is bitcoin and gold,

Reason for 2900 being the top,

1. End of 5 wave count based on elliot wave analysis

2. Stocks are overpriced based on Marketcap over GDP

3. Time analysis, we have been in a bull market for 10 years

4. Stocks look similar to the late 1930's

EURCAD let's short 1.515 resistance, CAD GDP data at 8:30 ESTHey everybody, I'll be shorting EURCAD today, after some underwhelming core CPI data this morning (2,1% forecast, 2.0% actual). As you can see, we just made contact with the 200 WMA and 100 SMMA, and I'm expecting a retracement back to 1.505, or lower. With Canadian GDP data coming out within the next couple hours, stronger than expected numbers will push this pair right down.

USDJPY Short, Let's try this again...Preliminary GDP Q/Q came out today under expectation a little bit, and the yen buyers were willing to put in a little bit earlier. A strong engulfing bar on 5M (17:00 UTC Bar), with sellers immediately below it, which indicates yen buying order flow (They are placing sell stop entries below that level and subsequent signal bars).

There is a 3rd test to the upside on D chart, and I think it's a good short signal for the rest of the week at least- who knows- maybe into next. That price action resistance, combined with the less than positive prelim U.S. GDP numbers I think will be the start of a larger leg to the downside. There seem to be a lot of market making today, at least for a lower volume time like this, at the end of the year.

EURUSD Pair Has Negative Bias to the Downside...Be CautiousBy looking at the 4-hour chart and the daily chart, the EUR/USD currency pair has taken a turn to the upside. The pair had rebounded from 1.1211 a hair below our hypothesized bullish entry point of 1.1215. The pair had a 2.5% probability of falling lower than our hypothesized support area. However, we deduced that for something like that to happen, there would have had to be some kind of dovish catalytic speech/sentiment uttered by the European central bank president Draghi or similar dovish news.

Therefore, we suspected that sooner or later the pair would attempt to claw back to its hypothesized moving average of 1.1506, but before that happened, the EUR/USD pair would’ve had to elevate toward our 1.1215 mark, which it did. Now, we are convinced that it will continue in the short term toward our next hypothesized target of 1.1361 before it finally gets back to its moving average sweet spot of 1.1506.

There is a strong possibility that the pair could surpass its hypothesized moving average of 1.1506 and continue toward our next target of 1.1652 and possibly 1.1798, but this is as far as the pair will go up the charts because fundamentally, the Euro zone economy is weak, and the Eurozone’s economic cycle is nearing its peak. In fact, the EU economy is already acting as if it has commenced its recession cycle.

Please click here to see the entire article.

US Interest rates, Recession to fuel USDZAROn average the $USDZAR is not having a great time. There's so much emotional and negative news in South Africa, Gold is no more such a great haven and USD looking real strong.

Defaults of Argentina/Turkey and possibly US interest rates can only let the Dollar strengthen more against all emerging currencies.

$EURUSD is about to break previous low too.

I see the Currency slip to around 16.28 with ease before it will retract.

Let's see

Market recap for week of Aug 27-Monday=Markets reacted to Fed governor Jerome Powell's speech on Friday which knocked the USD lower. SPX makes a new high.

While political turmoil in the Australian govt weaken the AUD but the recovered towards the end of the trading week

-Emerging markets currencies were pretty weak last week with majority of them plus one percent

-WSJ reports issues on China & US that 40% could be dealt with immediately but 20% are intractable & non-negotiable.

uk.reuters.com

www.cnbc.com

-US and Mexico are closing in a trade agreement between the two countries, Trump tweets "A big Trade Agreement with Mexico could be happening soon"

-Profit for China's industrial firms up 16.2% to 75B in June, missed estimates.

-Australia's new Prime Minsiter Scott Morrison makes changes to his cabinet.

-Germany's business climate index climbs to 103.8 improving off of July's reading

www.reuters.com

-Turkey's Finance Minister Berat Albayrak to meet with France's Finance Minister

-Iran's economy minister was removed from his post by Iran's parliament.

www.cnbc.com

-Tuesday

-Stocks again strengthens due to Positive sentiment on a new NAFTA deal

www.businessinsider.com.au

-China gains control of the Yuan's slide against the USD once they announced reintroducing the counter-cyclical factor in setting the rate each day.

-French President Macron comments on Brexit deal, will not make a deal at expense of EU's integrity but respects Uks decision.

-Canada's Foreign Minister Chrystia Freeland to head to US for negotiations today.

-Trump comments that he will rejects China's efforts to negotiate a deal. Chinese officials want to suspend talks until after elections in November.

-Trump to begin his emergency agriculture plan after Labor Day.

www.wsj.com

-UK's Prime Minister Theresa May comments on ongoing Brexit negotiations. Mean while Trade Secretary Liam Fox is in Singapore talking about UK inclusion into TPP's Comprehensive & Progressive Agreement. They are taking credit for the trade deal.

www.cnbc.com

-Wednesday

-US consumer confidence strong reading in August 133.4, Trumps tweets a story from CNBC

-WSJ interviews Dallas Fed Pres Robert Kaplan. Expects 2 more hikes this year and another 2 next year

www.wsj.com

-China creates a way for its bonds to be included in global indexes. Another attempt to rid the US dollar as the global juggernaut. China Premier Li comments will tighten intellectual property rules.

www.cnbc.com

uk.reuters.com

-Prime Minister Luigi Di Maio claims nation may break the EU's rule of breaching its 3% public deficit limit.

-EU's lending sector see's improvement

-US states that for a deal to be reach with Canada Friday will be the deadline.

-Senate confirms Richard Clarida to become Federal Reserve vice chairman.

-2nd estimate of GDP data release 4.2% increased, a 0.1 percentage point greater than the previous release of data back in July

-Florida's race for governor is determined between Andrew Gillum a progressive backed by Bernie Sanders while GOP runner will be Ron DeSantis one who has defended Trump.

www.wsj.com

-Brexit deal as a date set for a deadline for an agreement Oct 18. Bloomberg reports they may extend it to mid Nov.

www.bloomberg.com

-Consultancy group wood Mackenzie forecasts India to beat out China for oil demand.

www.cnbc.com

-South Korea's government proposes largest budget increase in a decade.

www.wsj.com

-Thursday

-Greater than expected draw for Crude Supplies saw Crude oil prices gain a good percentage on Wednesday

-News out of Europe as EU negotiator Michel Barnier spoke some positive words for cutting a deal with the UK , the EURGBP had a high to low range of 1.51% price movement.

-Now it is the Argentina's peso turn to have large down move against the USD dollar, President Macri asked the IMF to speed up its delivery of a $50B bailout. The USDARS surged over 20% on the headlines.

www.reuters.com

- Corporate profits jump to 16.1% in Q2 from a year earlier, largest year-over-year gain in six years.

www.wsj.com

-President Trump is providing some relief for countries on steel & aluminum quotas.

www.reuters.com

-Friday

-Trump threatens more tariffs on China imports. According to Bloomberg he plans to impose another $200 billion more. A lot of other thoughts also coming from Trump linking capital gains taxes to inflation. Also to may withdraw from WTO if it doesn't shape up.

twitter.com

-Emerging market currencies have been the focus this week as Lira, Argentine peso and Rand all losing again this week against the USD

-German Finance minister Olaf Scholz comments hard to tell if there will be a Brexit agreement.

uk.reuters.com

-EU economic sentiment down to 111.6 points in August from 112.1 in July.

uk.reuters.com

-Oil surplus looks to be lowering as traders are expecting a more losses in supply due to the Iran sanctions. Atlantic Basin crude supplies have nearly doubled in lower supply. This is oil that has not found a buyer yet.

uk.reuters.com

-China's manufacturing PMI up for july 51.3 vs a 51.2 from July. Exports shrinks for third strength month, while a rise in inventories of finished goods.

www.cnbc.com

-Brazil's economy grew with GDP reading for 2nd qtr up 0.2% from 1st qtr. Despite a trucker strike.

uk.reuters.com

US Economic Growth: charting the GDP+GDI averageThe latest GDP number suggests inflation-adjusted annual growth of 4.2%.

However, gross domestic income (GDI) (produced by the Bureau of Economic Analysis )

Both the GDP and GDI are estimates of economic growth (with one focused on expenditure and the other on income).

The GDP-GDI average suggest economic growth rate to be in the 3% range.

This average may prove to be a useful early warning of economic conditions as investor worries grow over "peak growth" and anticipation of the next recession.

This average can be charted using data from FRED & Quandl:

('QUANDL:FRED/A261RL1Q225SBEA'+'QUANDL:FRED/A191RL1Q225SBEA')/2

More info:

www.bloomberg.com

Short on USDCHF for the rest of the Quarter?Today I am going shorton USDCHFand other dollar pairs. Donald trump has been aggressive towards china with the tariff threats so I see an intense week ahead for the bearish USD to finish out the wee, month and possibly even the quarter. Happy trading keep in mind my setups are intraday and the trends can change at any moment. Manage you risk and take educated trades. HAPPY TRADING !

Long on GBP?? I think yes!I am placing a buy here with the bulls on GBPUSD because here after careful review, trend analysis and pattern recognition on the 1hr time frame for entry I have identified an opportunity to buy for the pair with confluences to match. Take a look at my analysis I would love your feedback. My trades a specifically for intra day trading I am completely out of the market by 5pm EST each day with my profit or loss taken.

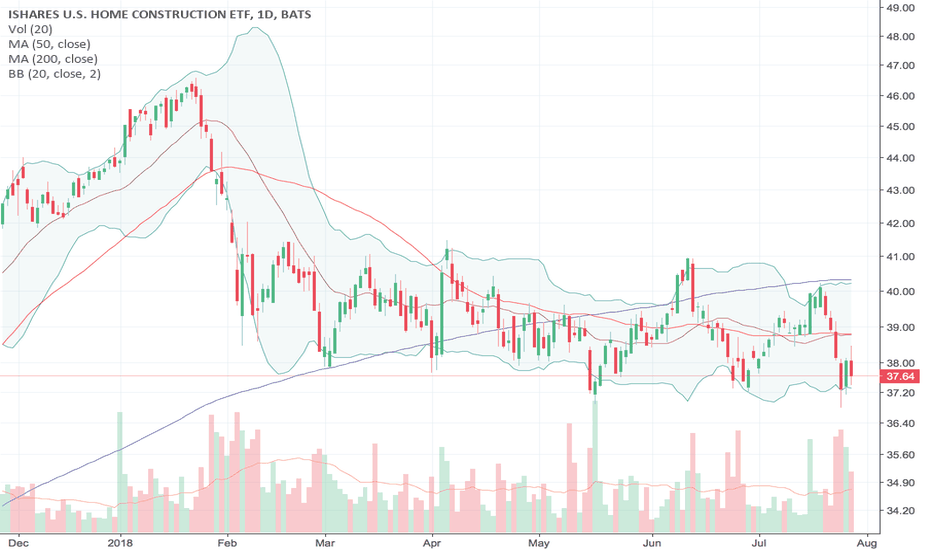

Housing Market Review – A Wobbly Edifice As Builders Break Down Alongside bearish trading action in builder stocks, July’s housing market data may have delivered confirmation of persistent investor fears.

"Housing Market Review – A Wobbly Edifice As Builders Break Down And Data Weaken" drduru.com $ITB $DHI $MTH $KBH $PHM $TOL $TPH #housingmarket #housingwatch #homebuilders #stockmarket #economy #gdp

US GDP data could hit the dollarThe dollar continues to consolidate at the top and cant develop a corrective movement that has matured for a long time. In this regard, today's data on US GDP for the second quarter (preliminary) may well play the role of a trigger.

On the one hand, the data is expected to be simply magnificent: according to different estimates, the growth rate will be 4.0-4.2%. For the largest economy in the world, this is a phenomenal result. The last time such rapid growth was observed in late 2014. There are reasons for such an impressive pace. This is the effect of the Trump tax reform, and the seasonal factor, and the overall good state of the US economy, and the potential positive effect for the US trade balance of the Trump trade wars.

The dollar should only be bought on a such background. But we believe that everything is not so unambiguous. To begin with, the figure of 4% is already considered in the price and by and large the surprise does not bear. But any estimates below 4% may well provoke investors' disappointment and lead to local dollar sales.

Are there any grounds for expecting weaker estimates? Judging by the fact that a few analysts just lowered their forecasts on the eve of the publication, they are there. Recall, one of the reasons for the sharp acceleration of GDP growth, the US was called the reduction in the US trade deficit because of Trump's protectionist policy. So yesterday, data on the US trade balance were published. Unexpectedly for many, the deficit not only did not decrease, but also grew quite sharply (from $ 64.85 billion it increased to - $ 68.33 billion). As a result, a few leading analysts lowered their forecasts (as a result, the median expectation dropped from 4.2% to 4.1%). For example, JP Morgan lowered its forecast from 4.4% to 3.9% (!). In our opinion, this is a very serious signal in favor of the fact that the dollar today may be subject to sales. Analysts' anxiety was caused both by the data on the trade balance and durable goods inventories.

It is also not worth writing off Trump's factor - his recent attacks on the Fed (dissatisfaction with tight monetary policy), as well as a strong dollar worried investors and traders. And accordingly, several shook the groundl under the feet of the dollar.

So, we continue to recommend selling the dollar while it's on the top. But at the same time, of course, do not forget to monitor the data.