Fvg

SPX setup 9/20/22Trading inside yesterday's move up and near the weekly opening price.

Currently inside a 15m+FVG on no volume so I'll be paying attention to this area for the time being. The times and sales and level 2 aren't showing anyone big trading for now, so we wait.

I'm neutral to bullish for the short term but if we trade near the daily and the 15m-FVG and reject, I don't mind reversing the position in the opposite direction.

Boring Monday into FOMC Week9/19/22 It was a slow moving day after a pretty nasty gap down over the weekend and coming into a FOMC week. I hope your bias was bullish because there was legit no bearish momentum unless you swung puts over the weekend. Besides that you probably got crushed being bearish today unless you were just being a scalp master. the entries were difficult to spot today but they were there as long as your bias was correct.

NAS LONGSRiding the wave

1:24 PM, Price almost completely filled 5min FVG. Reaction from this low created an SH & a clear BOS.

It's been playing ping pong but understanding where PA wants to go on HTF should be prevalent.

Bearish 3-tap setup on BitcoinWe have shot up to a new range high which got deviated and retested successfully (what looks like a double but it is in reality a triple top due to the swept high that preceded which is a stronger pattern to trade).

We can also notice a bearish divergence in RSI.

Targets marked; FVG and equal lows.

US30 into the Fed rate Light news week going into the Sunday opening until Wednesday when the interest rate is released. We could have one or two thing happen until the Wednesday release:

1) We see priced in data and a direction chosen into the lead up

2) We see price stall out until we enter the day into the rate release.

This is a market moving data release so this is one to take with precaution after the CPI data implied a 75-100 bp increase.

NAS 100 into the Fed Rate Light news week going into the Sunday opening until Wednesday when the interest rate is released. We could have one or two thing happen until the Wednesday release:

1) We see priced in data and a direction chosen into the lead up

2) We see price stall out until we enter the day into the rate release.

This is a market moving data release so this is one to take with precaution after the CPI data implied a 75-100 bp increase.

SPX trading into Fed rate releaseLight news week going into the Sunday opening until Wednesday when the interest rate is released. We could have one or two thing happen until the Wednesday release:

1) We see priced in data and a direction chosen into the lead up

2) We see price stall out until we enter the day into the rate release.

This is a market moving data release so this is one to take with precaution after the CPI data implied a 75-100 bp increase.

CPI Data release TradeFirst video ever. Once again not financial advice, this is simply to monitor and journal by trade ideas.

This trade was on the ES S&P 500 E-mini Futures. Shorted some contracts off the lunch hour consolidation into the new daily lows. Pretty simple and easy price action to trade today so long as your bias was bearish.

#ict #thestrat #spy #spx #options #futures

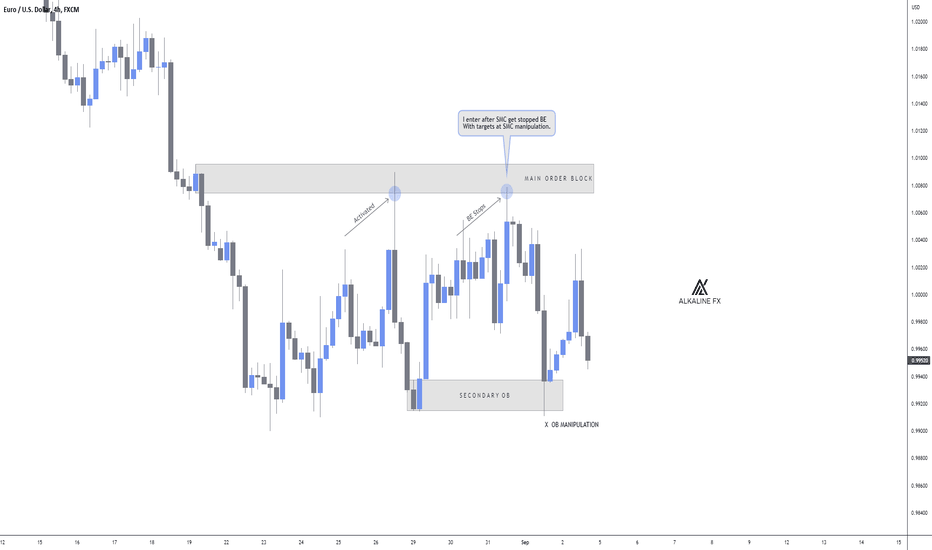

Smart Money Manipulation 🥊Alkaline is back baby! 💣

As smart money concepts gain popularity, liquidity increases.

I have taken a month away from trading to study the new forms of market manipulation and have been pleasantly surprised by what I have found.

Here is my discovery:

1) The market is currently focusing on taking liquidity from breakeven positions over fixed stop losses.

This is because emotional traders put their stops to BE quickly to avoid pain, especially during indecisive markets.

2) Order blocks are the perfect manipulation areas.

If you take time out to backtest significant order blocks, you will notice price will tap and lure or simply sweep above/below the zone before going in the intended direction.

3) That tight stop loss you are using is doing more damage than good.

Scale into your positions, trust me when I say this will reduce your emotions and give you a more relaxed trading style.

4) Use your brain, even if you are in denial.

If the majority of traders lose money, and the majority of traders now use smart money concepts, do the maths.

It feels good to be back after a long month of studying, I have lots of new things to teach and share.

I will be taking on new students shortly, have a great weekend everyone 👋

SPY Puts 9/2/22 NFP announcemt DayTook SPX puts from $6.10 on the red arrow and they ran all the way to about $80 each contract.

This was on 9/2/22, after announcement of the Non Farm Payroll (NFP) data, which was announced at 5:30am PST. It was as easy as you see it. Opened with a gap up, that lead to a slight pullback that did not fill the gap at first. It bounced and took out the previous days high, creating Buy side liquidity. Retail would think that the break out will continue hence buying in hopes of a move up. Price held for a while riding that high and never made a significant move above ever again. It then proceeded to dump and dumped hard, also right after Biden's speech. The targets are self explanatory. Sold some way to soon but its all good still got a nice move. #ict #thestrat #priceaction #spy #spx #puts #options

GJ SELL BIAS TO DISCOUNTDaily Analysis mapped out with a range FIB retracement - already modified before analysis

Price was at Premium Side of the market using the Daily POV, top down to the hourly chart and developed a sell bias as Sell side Liquidity was swept at Equilibrium and idea of imbalance filling up before price action and trend resumption