BITCOIN GOING 4% DOWN THIS WEEK?This weekend bitcoin pumped and created another gap on the CME chart.

In 35 minutes CME should open the week and I do suppose it would be the right time for CME to fill that gap.

Just something to be aware of as its possible this will start the next bigger retracement.

My target is $9600, what's yours?

Cmegroup

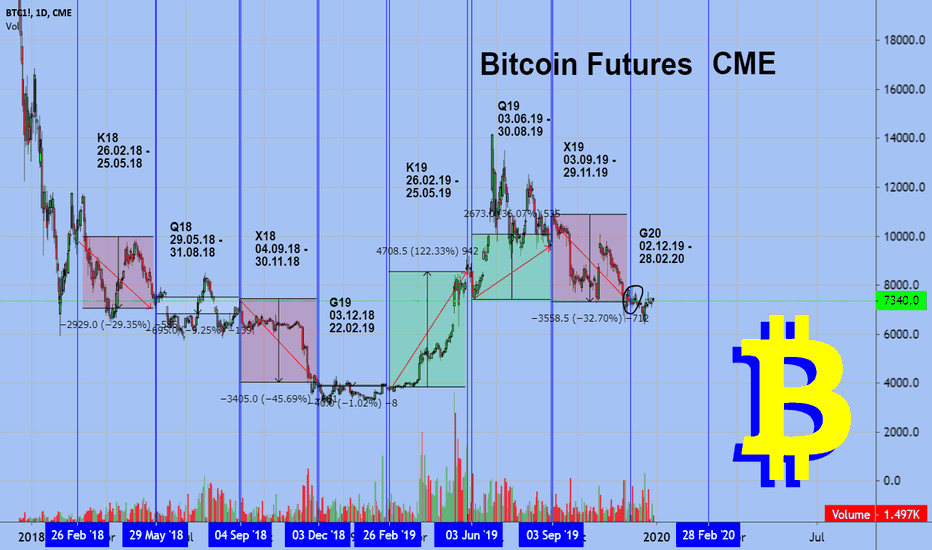

Bitcoin Futures CMEOn December 15, two years ago, the largest American company CME Group launched Bitcoin futures.

CME is the only one who provides the opportunity to trade bitcoin futures in the United States and they are the first to enter the territory of derivatives instrument for the cryptocurrency market and now they have no competitors.

CME futures are one of the most manipulative instrument on the cryptocurrency market.

And the opening and closing of their futures suggests when the bottom will be.

December 15, 2017. two contracts were opened

3 months until March 29 - opening price 20631 - closing price 7070

6 months until June 29 - opening price 20631 - closing price 5800

Before bitcoin futures, large players did not have a high-quality tool for the global short market - and the Chicago exchange provided this opportunity

After 3 months, bitcoin fell by 67%

The market go up a little, but by the close of the 6-month contract, the market fell by 71%

On July 2, another 6-month contract was opened and closed on December 28

40%

detailed table of the start and end dates of all contracts.

CME does not save this data, for this you can like it under the chart

docs.google.com

And the most interesting

I think you remember the growth of November 25-26 at $ 3000 up

If you look a little in the table, then you can see the contract F20 from 10.28.19 to 01.31.20 - the conclusion from this until January 31 we will not see a price above 9200

On December 16, the first annual price contracts were opened in the $ 6,600 zone and I am sure this factor will push the price up

But already today, December 30 will be open semi-annual contracts M20 12/30/19 - 06/29/20

And today, a two-year contract opens and this fact will also push the price up.

Perhaps someone doubts that the price of bitcoin in 2 years will be lower than 7000? write a comment

Best regards EXCAVO

Could we fill the CME Gap ?Since this massive spike it seems the bullish sentiment is expanding quickly. Which is excellent. Bullish sentiment is something that we need in order to continue the run up.

However, when taking a closer look at the recent leg on larger time frames. It appears to be nothing other than a simple retest of the major resistance line down, and the bottom of the daily pennant that was broken down from just a few weeks back.. Until these lines are broken it will be very difficult for me to add leverage positions with confidence.

Demonstrating the retest and major resistance:

Since I not leveraged, I am doing my best to search for major support. At the moment, it seems that 8700 could be that level .

Here's why:

1. At 8700 we have the 50% retracement from the recent top. Which is also the same retracement level that we hit this last bounce from the top.

2. Based on the range that we created the first weeks of October, 8700 should provide decent horizontal support.

3. Last but not least, 8700 also marks the bottom of the CME gap that was created over the weekend!

Now I have never been a gap trader, however with the additional technical support, it seems like a good place for me to put my money.

Also note: We have yet to break back above major resistance. Trade carefully.

I hope you all enjoyed this article and maybe even found it a bit interesting!

Wish you all the best of luck!

bitcoin manipulationdo you need any more info than this chart?

pomp- tone vays- all refuse to see that bitcoin grew because futures are invloved and used that it was world interest.

the intrest was big money men buying and buying and selling then shorting on launch of futures,

bitcoin made them very rich while the hodlers search twitter and youtube for fomo....

Another Descending Triangle for Ethereum.Or maybe a bear flag / bull flag.

Keep in mind that looking for bull patterns in a short term bearish trend with the backing of the federal reserve is not an easy task.

Also, in one of my previous posts I spoke about the CME futures that have launched on Ethereum that are similar to the ones launched in late 2017 for Bitcoin, and we all seen what happened there.

Time will tell per usual

RBOB Gasoline Futures (Jan 2020) - Rectangle in formationNYMEX:RBF2020

Clear rectangle on the January Futures of the RBOB Gasoline.

A breakout could lead to an interesting trend to ride.

When trading commodities and futures contracts you should always take into account the specifications of each contract to calculate exactly how many contracts to buy or sell short on the basis of your risk management and position sizing.

www.cmegroup.com

CME Bitcoin Futures downswing Fibonacci retraceContinuing from my previous chart. Fibonacci downswing retrace is always 61.8%

All vertical lines are the CME Bitcoin Futures expiry dates

Each orange vertical line, shows a CME date that was preceded by a bounce

Following those dates (orange), there is a short retest of the recent high

The price then drops all the way back down to test the start of that bounce

After testing the lower trendline, the downswing Fibonacci retrace is always 61.8% (to meet the upper trendline)

This cycle repeats until the price breaks down to a lower plateau trendline

Nasdaq 100 - If you're a BULL, this might be how it plays outNQ1! - Plenty of opportunity to capture points up and down. However, if your bias is to the upside, here is how it may end up playing out. In my opinion, what will be a last leg up before new LO's.

Yellow lines are areas of targets for resistance and support (as high as 6870). We may have already seen the support (6245) for higher moves put in on Friday, otherwise, a sightly lower level for support below (6170).

With that road-map in mind, I will look for entry patterns as opportunities to get in trades. As of late, taking 35-50 pts a clip. After I collect my profits, any continued move only serves as psychological compensation for being correct with the trade's direction. No FOMO here. Plenty of volatility to go around.

NQ LevelsNew market, old levels. I am finally dipping my toes in the traditional markets after I got a future account setup with AMP Futures .

Very Curious to see how the trusted TA from crypto will perform here.

The big distribution wedge I am talking about:

Big Trend obviously extremly bullish , would like to get a long entry at my yellow levels below.

--------------------------------------------------------------------

Keep the leverage low and dont get rekt.

Futures CME / 6C 03-18 / D6H2018 (CAD/USD)The best entry point to Buy

Futures CME / 6C 03-18 / D6H2018 (CAD/USD)

Chart 4 hours

Buy by Market = 0.77340

Stop Loss = 0.76885

=======================================

For those who have last worked Stop Loss,

You can go back to the position!

Buy by Market Futures on Canada (6C 03-18)

Gold Future (CME)Double Re-penetration Pattern. Trade setup with Buy Stop position (EP) at 1337.5, Stop Loss (SL) at 1333 and Take Profit (TP) at 1342.

Money Management

I have 22,800 USD in my portfolio. I can lose 5% of the port which is 1,140 USD.

Position Sizing

1 Tick = $100

1 Contract size need IM = $3,850 (I can open not more than $22,800 / $3,850 = 5.92 Cons)

It is 4.5 Tick from EP to SL, with 1 Con, I will lose 4.5 * $100 = $450

To lose 1,140 USD I need to open 1,140 / 450 = 2.53 Con

Then I will put 2 Contract

If I win, I will gain (1342 - 1337.5) * $100 * 2 Con = $900

Gold Future (CME)Turtle Soup. Trade setup with Buy Stop position (EP) at 1336, Stop Loss (SL) at 1329 and Take Profit (TP) at 1350.

Money Management

I have 22,800 USD in my portfolio. I can lose 5% of the port which is 1,140 USD.

Position Sizing

1 Tick = $100

1 Contract size need IM = $3,850 (I can open not more than $22,800 / $3,850 = 5.92 Cons)

It is 7 Tick from EP to SL, with 1 Con, I will lose 7 * $100 = $700

To lose 1,140 USD I need to open 1,140 / 700 = 1.62 Con

Then I will put 1 Contract

If I win, I will gain (1350 - 1336) * $100 * 1 Con = $1,400

GOLD FutureGold minor correction for uptrend. Trade setup with Buy Stop position (EP) at 1344, Stop Loss (SL) at 1329 and Take Profit (TP) at 1354.

Money Management

I have 20,800 USD in my portfolio. I can lose 10% of the port which is 2,080 USD.

Position Sizing

1 Tick = $100

1 Contract size need IM = $3,850 (I can open not more than $20,800 / $3,850 = 5.40 Cons)

It is 15 Tick from EP to SL, with 1 Con, I will lose 15 * $100 = $1,500

To lose 2,080 USD I need to open 2,080 / 1,500 = 1.38 Con

Then I will put 1 Contract

If I win, I will gain (1354 - 1344) * $100 * 1 Con = $1,000