USDJPY AnalysisThis is a long term analysis!

USDJPY has hit a resistance on the monthly time frame and choch has occurred on its chart on the daily time frame!

And we have the possibility of falling to the following targets:

TP 1 >>> 129.72 ✅

TP 2 >>> 116.352 ✅

TP 3 >>> 111.254 ✅

of course the analysis will be updated!

Choch

USDCHFprize is in a downtrend. though it has reached a probable Demand zone it has made a new LL. now it is approaching the H1 POI that that broke structure to the downside. once it gets there we will waith for a proper confirmation to go short since it s coming from a demand zone. we will take our profits at the 50 Fib discounted prize zone since there is a high probability of it making a choch

GBP/CHF: Long Reversal running & FED commentGBP/CHF: Long Reversal running

> Higher high and higher low printes

> inner trendline break

> quadruple bottom

> POC below current price

We are seeing broad GBP-strength, also visible in GBP/CAD, GBP/AUD, GBP/JPY and GBP/NZD. GBP/CHF checks all the criteria for a long entry according to our H/L Wall Street System.

Post Fed Meeting

The dust has settled since the FEDs epxted 75bps interest rate hike. During the press conference Powell communicated what we call a "dovish hike". The FED did hike interest rates, but the forward guidance is not as strongly hawkish as in the past anymore.

Now, the FED ist data-dpendent, which is a softer stance on rate hikes. The consequence is a risk-on reaction in the markets: Stocks are rising, USD and JPY is weakening and Crypto is rallying.

Please always remember:

Trading is a game of probabilities. This means that a single trade is not important. A system plays out over a large number of trades (i.e. 100-200 trades). Every trade should be taken with a risk as a % of your capital. Risk management is absolut key. A win rate of 70% means: Out of 100 trades, you will have 70 wins and 30 SLs. Do not risk your account on the 30 SLs.

Best

Meikel & Team WSI

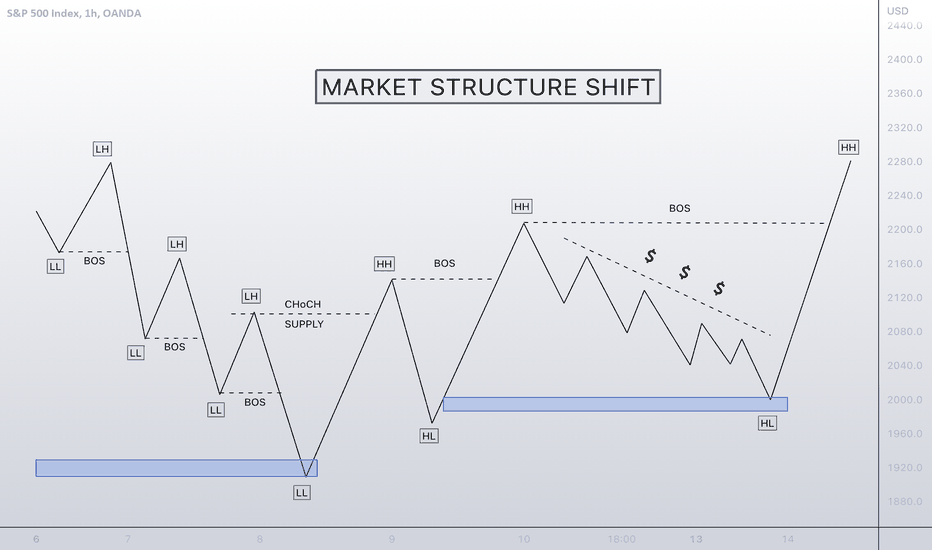

🤓 🤓 MARKET STRUCTURE SHIFT! SMCMarket structure in Forex trading or price action is how many people take advantage of the markets. No indicators, and no volume. Because the market does not have a centralised exchange. Forex traders often swing trade the market based on the structure to take advantage of the opportunity.

Structural market change is broadly defined as a shift or change in the way in which a market or economy functions or operates.

I have tried my best to show you in the easiest possible way to look out for. Save this to your notes for future reference.

EUR/NZD: Bearish signs are increasingEUR/NZD: Bearish signs are increasing

> Double-top in the daily and H4 timeframes

> possible break of structure with current H4 candle

> first lower high and lower low outside of the upward trend shows change of sequence

> POC above current price levels

> Head and Shoulder formation

Look out for our new stream tomorrow (Tuesday) at 8:00pm Berlin time!

Meikel & Team WSI

EUR/AUD: Watchlist Long Trade for next weekEUR/AUD: Watchlist Long Trade for next week

> High Volume POC below current levels

> 3 touch inner upward trend

> inverse Shoulder-Head-Shoulder

> Need a break of the last falling high + 2 touch inner downward trend break

We are looking for a break of structure + change in sequence. This will be achieved once the last lower high is broken to the upside.

Check out our last Stream by Wall Street Trader Meikel Mokry:

www.tradingview.com

Meikel & Your Team WSI