Big Time Rewards - Longterm BUY and HOLD (Scared?)Not going to say nows the best time to buy - its probably not - but I'm willing to bet my left almond shares will be trading around $20 in a year or two.

Seems like an extremely safe yearish long buy and hold. Fun to let things build slow sometimes anyways.

Position size accordingly, look for dips to load up .

Adios,

Fishy

Chevron

Chevron downside targetsThanks for viewing,

After record (and very profitable) drops in Crude in the last few days, Chevron will be put under significant profitability pressure. Well, now we have dipped well below that due to:

- as yet unknown, but likely double digit reductions in global demand for crude oil,

- Russia not going along with the OPEC plan, which resulted in,

- Saudi Arabia (for some reason) discounting up to $6 per barrel and markedly INCREASING production,

- The stated aim of all this is to put higher US shale producers underwater - which may already be working.

It looks like there will be major pressure on all high cost oil producers (Saudi Arabia has an all in cost basis around $10 per barrel) for some time. I am not picking on Chevron especially - but considering their situation in light of their (and recently) likely break-even price above $40.

Where to from here? Probably a gap down when the markets open targeting below $72 in the short term, potentially much lower ($30 / share) if the price hangs around present (sub $30 per barrel) levels for any length of time. If Chevron gets that low, they make a lot of sense to pick up.

Any catalysts for a major price increase? Not while Iran is busy fighting their COVID-19 outbreak - they are likely too busy at the moment to continue their work destabilising oil refining and shipping in the middle east with drones and cruise missiles.

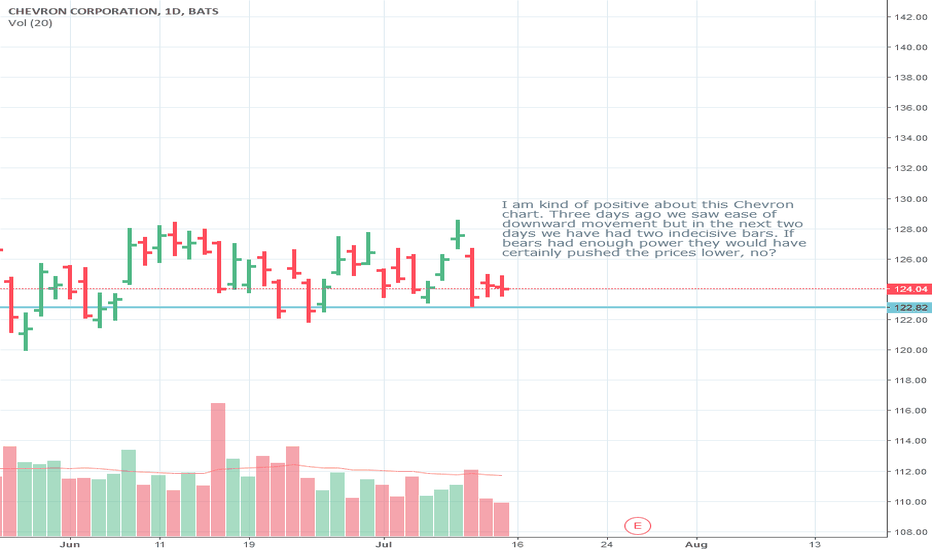

CHEVRON (CVX): Close To Key Structure

chevron is coming closer and closer to a key structure support level.

I would consider a buying opportunity from 103.0 level with a potential bullish reaction to 114 / 121 levels.

with a stop below the X the position will be protected against the volatility and occasional fluctuations!

good luck!

Chevron Corp swing trade ideaChevron Corp -

Breakout to $133 or breakdown to $103?

The price likely has a bullish trait as support awaits at approx $115.

I favour the bullish movement upwards right now as the upwards trending (green dotted) support line awaits price. However, as always, wait for price action to form to provoke your next trade move here.

Enjoy your weekend and have a great trading week ahead.

All comments welcome.

NATGASUSD 15-MINUTE TIMEFRAME SHORTNatural gas price seems to be moving in an uptrend. However, there appears to be a wedge-like formation in play, suggesting a possible small correction. If prices do reject the ceiling of this shape and go lower, i would consider going short. Due to the high risk nature of this type of trade, i would only consider opening a small position.

CVX SELL (CHEVRON CORPORATION)Hi there. For short term, price is forming a continuation pattern to the downside. Wait for the price to complete the pattern and watch strong price action for sell.

For longer term, wait for the price to hit the bottom of the bigger pattern and watch strong price action for buy.

Chevron analysisOil (purple line chart) sell off caused a big loss for oil companies' stocks, waiting for the bottom of oil prices will be a good time to go long on oil companies as well. Chevron being one of the biggest and oldest oil companies has broken through 200 SMA and buy support zone above 50% fib is tested now. 100 level being psychological barrier, it could be a setup for a long if we hear positive news about oil at the start of 2019, or short through.

#CVX - Descending triangle breakout alertBreakout alert descending triangle on CVX.

Chevron Corp. engages in the provision of administrative, financial management, and technology support for energy and chemical operations. It operates through the Upstream and Downstream segments. The stock is listed on the New York Stock Exchange.

CVX price formed an almost one year-long reversal pattern as descending triangle, with the lower boundary as strong support at 108.90 levels. The horizontal boundary has been tested several times during the chart pattern formation until its breakout.

In addition, we must bear in mind 3 relevant factors on the technical structure of the stock:

1.- Double top at 133.85 levels, without a higher high.

2.- Breakdown the trendline since 2015

3.- Breakdown the trendline since 1974

So that:

- A daily close below 105.63, confirms the breakout of the chart pattern.

- The possible price target of the reversal chart pattern is at 87.33 levels.

Please don't forget to give a like if you appreciate it :)

Note: Entry and exit prices are provided only as reference according to the principles of the classical charting. Each trader must take his own decisions depending on their own strategy and tactics. These levels do not indicate the specific entry and exit price, these levels only suggest a possible technical structure change.

Selling Chevron sharesAt the daily chart of CVX shares, the price has started a new downtrend, as the instrument has fixed below Alligator indicator with AO crossing below the zero line. Also, a sell signal was formed in a form of the fractal, breakdown of its level would be an optimal level to open short.

Chevron, CVX, Bull Put, Credit SpreadI am not licensed or certified by any individual or institution to give financial advice. I am not a professional Stock trader.

Chevron (CVX) gapped down today, big time; but it couldn't break the 100 Day Exponential Moving Average (EMA). If you look back to October 27, 2017 (see the purple arrow I inserted on the lower left of the chart to mark the date) Chevron did the exact same thing. It proceeded to go back up. I think it will repeat itself in the coming days. It used the 100 Day to bounce and will go back up. I typed up the strategy I used for this play and you should be able to see it on the chart. The 200 Day EMA is sitting just above $118.40ish giving this play more than $4.00 of cushion. Additionally, next week is a short trading week in the United States due to markets being closed on Monday in observation of Memorial Day. That means this Stock has four days to not go down more than four dollars, and the Credit from opening the play is kept. Yes, you could tighten the spread; but having the 200 Day EMA adds a little protection, and I'm still learning how to do Spreads. :)

Exxon_(NYSE: XOM)_May_14_2018The Exxon stock suffered setbacks after the Q1 earnings report where it emerged that the revenue did not grow in line with rising oil prices. Furthermore, the debt burden was quite huge at over USD 30 billion. Compared to competitors such as Chevron, Royal Dutch Shell, BP, XOM was lagging in key metrics.

This triggered a sell-off that brought the stock price to almost 2 year lows since oil prices crashed. Now the stock has surged past two key support/ resistance levels and there seems to be a bullish support underneath. However, if the oil price rally does not continue, I expect XOM to fall to $75-$80 trading range. On the other hand, if the oil price stays at current levels or move higher (which I doubt as the oil market itself has fundamentally changed; lot more focus on renewables and with shale oil, it is beneficial for the producers to just keep pumping more), I am confident that XOM will be soon staring at $90.

I am bullish on XOM in the long term. In the near term, I would wait to see if the price holds up at the key support level before taking on a position around $79-80. I will also wait to confirm that the slope of the 200 day SMA turns positive. The 20 day SMA has crossed the 50 day SMA in a bullish manner. For the confirmation of a long term bullish trend all three SMA need to have a positive slope with the short term SMA crossing the long term SMA.

CVX 10-Day-Ahead Prediction - 04/10-04/19 PeriodArtificial Intelligence/Deep Learning Enabled 10 Day Ahead Predicted values for Chevron Corporation ( CVX ) have been plotted on the chart.

The method used in this prediction is Deep Learning based, and using complex mathematical models/methodologies to extract hidden time series features in vast amounts of CVX related data.

The expected 5 Day Change is 0.822 %

The expected 10 Day Change is 1.409 %

Predictability Indicator is calculated as : 0.675

Predicted 10-Day Ahead Prices are as follows:

Mon Apr 09 Tue Apr 10 Wed Apr 11 Thu Apr 12 Fri Apr 13

115.01 115.20 115.38 115.54 115.70

Mon Apr 16 Tue Apr 17 Wed Apr 18 Thu Apr 19 Fri Apr 20

115.85 115.99 116.12 116.25 116.37

Please note that outliers/non-linearities might occur, however our Artificial Intelligence/Deep Learning Enabled predictions indicate the softened/smoothed moving direction of the stocks/commodities/World indices/ETFs/Foreign Currencies/Cryptocurrencies.

Feel free to contact us for your questions.

History Says Chevron (CVX) Is Set To Decline At Least 5%Chevron has climbed quick in the previous month. This could be due to hurricanes in the United States and/or OPEC manipulation. No matter the world and economic reasoning, the technicals have a response for this overexuberant movement; the stock will begin dropping soon. The history of this stock has been studied and the information is explained below.

The relative strength index (RSI) is at 80.3974. RSI tends to determine trends, momentum, overbought and oversold levels as well as likelihood of price swings. I personally use anything above 75 as overbought and anything under 25 as oversold. Currently the RSI is at an extreme level that has only occurred 26 times since 1973. The significance of this is outlined below and is the first signal of a pending downturn.

The positive vortex indicator (VI) is at 1.3839 and the negative is at 0.5046. When the positive level is higher than 1 and higher than the negative indicator, the overall price action is moving upward. When the negative level is higher than 1 and higher than the positive indicator, the overall price action is moving downward. The both values are near extremes and this in conjunction with the extreme RSI reading will be covered in the SPECIFIC ANALYSIS section below.

The stochastic oscillator K value is 95.0678 and D value is 83.0602. This is a cyclical oscillator that is highly accurate and can be used to identify overbought/oversold levels as well as pending reversals and short-term activity. I personally use anything above 80 as overbought and below 20 as oversold. When the D value is higher that the K value the stock is trending down. The stochastic is in overbought territory, but it could be another week before the D value is larger than the K value. In order for this crossover to occur, the stock would begin declining. We are looking to short the stock prior to this decline and more is explained below.

SPECIFIC ANALYSIS

I have created an algorithm (called SAG Gauge) which signals when stocks are truly overbought and oversold. The algorithm indicates when a particular stock meets multiple criteria culminating in an oversold or overbought signal. That signal will most likely occur within a few trading days after the stock has begun to move downward. Recognizing this movement and pending signal can increase profit by entering early.

Upon back-testing this indicator, it has signaled overbought status 111 times dating back to 1973. Seventy percent of the time, the stock drops at least 3% over the following 30 trading days after the indicator date. Sixty percent of the time the stock drops at least 5% and fifty percent of the time loses 6.5%. Even though a drop does not always occur, taking the below information into consideration makes us believe we are in that 60% of the time range.

As mentioned above, the RSI alone is at an extreme level that has only occurred 26 individual trading days since 1973. The stock always drops at least 1.58% from the date it reaches the 80.3974 level (which was just achieved on Sept 22) over the following 30 trading days. The median drop over this time frame is 5.71%, average is 6.81% and the maximum drop is 20.35%.

Since 1973, this stock always drops at least 5% when the RSI is at or above its current level, while the positive VI is at or above its current level and the stochastic is in overbought territory. These conditions have only been met four times and the instances were evaluated. The median decline for the stock has been 15.08% over the following 30 trading days. On three of these four occasions, the stock continued to go up for at least 2 more trading days. This additional climb resulted in a minimum stock decline of 6.75%.

Between all of the mentioned historics, I believe the stock could drop at least 5% over the following 40 trading days if not sooner. The best indicator is the simultaneous extremes that have been achieved by the RSI & positive VI. The RSI extreme alone supports this belief & the SAG helps.