CGC

Looking Exhausted, Step off the Bike and Cool DownPeloton has miraculously revitalized the Trend of In-Home Aerobics crap

You all remember the 80s-90s when Mom and Dad spent a fortune on crap they only used for a year or less?

Yep we are seeing it again, This time its with the Credit Card everything generations.

Very big bubble, could inflate much higher - like Pot Stocks or Impossible Meat

LONG CGCExpecting bounce from extremely oversold weekly and daily levels. If stop breached, be prepared to catch new daily reversal on lower levels with a tight stop.

CGC $12-$13 BottomBeen calling $12.5 for a couple weeks now, and a few things making this setup perfect.

1. It's reaching this level in extreme oversold conditions

2. Overall market on fire at ATH rn.

3. Santi Claus is coming?

Looking for a really nice monthly bounce. Below are my targets, and whether or not I take profit at 1 or 2 depends on how we get there.

Target 1 = .382 Fib of the drop from ATH ~ $23

Target 2 = .5 Fib of the drop from ATH ~ $27

Target 3 = .618 Fib of the drop from ATH (Main Target) ~$33

Risk:

Will be scaling into OTM APR options to maximize my R/R, and taking on 100% risk, as I am confident we WILL get a bounce at some point soon because of how extended we are. Wheter it's $13, $12.5, or even $10 it doesn't really matter, I'll just have to lower my targets.

GL to all my MJ bulls. Better days ahead.

-ill

cgc quick chart @cryptoknee do I know exactly whats going on here?, not really, Do I love this count?...NO. I do know the sector is getting slaughtered RN and any bounce is dumping pretty hard. Will I trade off this chart, yes, but will less capital at risk. Gut/greed is telling me 10$ but..I do have a count that goes to 4$. I also see some geometry here where we may bounce a bit. Gaps usually happen in the 3s, when they happen in the 3 of 5 it can signal exhaustion... Im keeping my eyes peeled for ext 5ths and diags in CGC. but for now im looking lower...

CGC - DAILY CHARTHi, today we are going to talk about Canopy Growth Corp. and its current landscape.

Canopy Growth Corp it's receiving growing attention of the market today as had reported disappointing results on this quarter, the company now along with Tilray that also reported disappointing earnings, sets the context of what Canopy described as short-term headwinds on the cannabis sector. The problem for these Canadian companies seems to be attached to the overpriced inventories, that reach the reported level of almost 328,000 kilograms by the end of August. A situation aggravated by the concern of a regulatory crackdown, due to the unclarity in mergers and acquisitions transactions, concerning the possible conflicts of interests. Regulators have discovered that in some cases, members involved in the transaction, held an undisclosed financial interest in one of the company's embroiled on the deal.

These problems set a problem for the industry that will need to improve itself to survive. However, for the long term, the cannabis sector still poised to grow as the spending on its products continues to rise, as the reports of Tilray have shown a growth of its sales in Europe five times bigger than last year, demonstrating the latent potential that the sector holds.

Thank you for reading and leave your comments if you like.

To have access to our exclusive contents, join the Traders Heaven today! Link Below.

Disclaimer: All content of Golden Dragon has only educational and informational purposes, and never should be used or take it as financial advice.

Canopy Growth Corporation trade planAs we see the end of wave C, looking for the buy on the break of the trend line. Multiple confirmations on it so a break is a good trigger.

Company has $7.01B market cap, industry is on the rise.

Good Luck!

Canopy Growth Corp: Above $21.70 increases the odds of a bottomConsider also, this stock is heavily shorted and earnings could start a short squeeze higher.

LONG CGCExpecting bounce from extremely oversold weekly and daily levels. If stop breached, be prepared to catch new daily reversal on lower levels with a tight stop.

THE WEEK AHEAD: CRON, TLRY, CGC EARNINGS; EWZ; VIXHIGH RANK/IMPLIED EARNINGS:

CRON (32/82) (Tuesday Before Open)

TLRY (50/97) (Tuesday After Close)

CSCO (44/27) (Tuesday After Close)

WMT (48/23) (Thursday Before Open)

NVDA (24/43) (Thursday After Close)

AMAT (17/34) (Thursday After Close)

CGC (95/87) (Thursday Before Open)

JC (30/43) (Friday Before Open)

Notes: Looks like it's the "Week of Weed" with CRON, TLRY, CGC announcing and all in states of high implied/high rank ... . If you're hesitant to go into single name here, MJ (47/51) has decent rank/implied metrics, although it's less liquid than I would like.

EXCHANGE-TRADED FUNDS:

TLT (56/12)

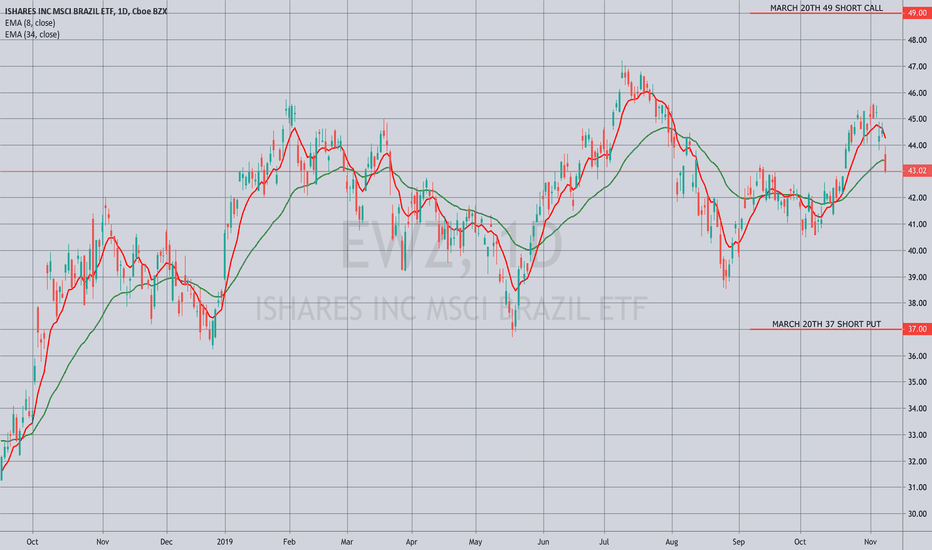

EWZ (47/28)

SLV (44/22)

GDXJ (37/31)

GLD (34/11)

EEM (33/16)

First Expiries In Which At-the-Money Short Straddle Pays >10% of Stock Price:

TLT: January of '21

EWZ: March: 5.64 verus 43.02 (13.11%)

SLV: April: 1.72 versus 15.70 (11.0%)

GDXJ: January: 3.99 versus 36.33 (11.0%)

GLD: January of '21

EEM: June: 4.97 versus 43.68 (11.4%)

Notes: Pictured here is an EWZ delta-neutral short strangle camped out at the 20 delta in the first expiry in which the at-the-money short straddle pays greater than 10% of the value of the underlying. Paying 1.61, it has break evens of 35.39/50.61 with delta/theta metrics of -.36/1.49; .40 at 25% maximum; .80 at 50%.

BROAD MARKET:

Broad market premium selling simply isn't paying here in short duration (an understatement).

FUTURES:

/6B (72/9)

/NG (74/60)

/SI (44/21)

/GC (34/12)

/ZS (32/20)

Notes: Natty is frisking up, which should be no surprise. Having put on a bullish assumption seasonality play in UNG way back in August at lows, I'm just waiting for things to top out in January or February before doing something in the other direction.

VIX/VIX DERIVATIVES:

Term structure trades* in VIX remain viable for the December, January, and February expiries with the correspondent futures contracts trading at 16.05, 17.33, and 18.07 respectively.

On the other end of the stick, continue to consider a VXX Super Bull or similar setup to potentially catch a modest volatility expansion running into the end of the year without sticking your entire pickle in the grinder, particularly if VIX continues to trundle along at 2019 lows: the December 20th 16P/-18P/18C/-20C pays a small credit (.17), has a 17.83 break even versus spot of 18.64, and max profit/max loss metrics of 2.17/1.87, with max being realized on a finish above 20, which does not exactly require a massive pop from here.

* -- Generally short call verticals with break even near where the correspondent /VX futures contract is trading (e.g., the December 20th 15/18, paying .90, with a 15.90 break even versus the December /VX contract trading at 16.05; the January 22nd 16/19, 1.00, with a 17.00 break even versus 17.33; February 19th 17/20, with an 18.00 break even versus 18.07).

CGC - LONG UPDATECAN YOU SAY BREAKOUT ?!?! DIVERGENCE TRADE CAME THRU ONCE AGAIN. LET'S SEE IF THERE'S GOOD CONTINUATION. 50% RETRACE IS ABOUT 35 DOLLARS AND THERE'S A GAP TO BE FILLED AT 31 AREA TOO.

Drake started from the bottom, but not with Canopy?Or did he?

I mean, technically Drake could have been invested in Canopy for many years now, he's a very business savvy guy, not just rapper / icon. So who really knows what his average cost is.

Anyway, on a 3 month & 6 month chart we can clearly see lower high after lower high, and this recent move may become just that, another lower high... The rsi is very overextended & it looks like an inverse H&S already played out there... But on the actual chart, it appears as though a Inverse H&S may still be forming, only time will tell I guess.

CGC Far Oversold into Earnings, Holding at SupportCGC is oversold and its sitting at strong $20 support. Heavily news driven, and as the sector leader, most likely to absorb the spike when it comes. If positive news comes near a strong earnings, likely to run to $35 near the 200 Day.

GWPH Long IdeaMJ Sector heating up. GWPH is a buy here IMHO. CRON, MJ, FLWPF, HEMP, CGC, CVSI all look like a good starting point.

CGC Critical Support|Falling Wedge|Bullish Divergence|Open GapHello Traders!

Update on CGC – Canopy Growth Corporation, testing critical support in a potential falling wedge pattern that has a bullish divergence coming to fruition, will CGC have a relief rally from here?

Points to consider

- Trend Bearish with consecutive lower highs

- Major structural support being tested

- Resistance at .50 Fibonacci

- EMA’s giving price resistance

- Stochastics projected upwards

- RSI converging from price

- Volume below average

- Open Gap

- Technical target in confluence with .50 Fibonacci Level

CGC has been trading in a distinctive bear trend within this falling wedge formation that has yet to be broken. We have consecutive lower highs as the trend comes into its probable apex zone.

Major structural support is getting tested, currently holding true, this is critical as it’s in confluence with the falling wedge’s apex zone. A break of this level will negate the formation, leading to local support being more probable to be tested. Resistance on the other hand is at the .50 Fibonacci level, this is a key area as it is in confluence with the technical target of the falling wedge…

The Stochastics is projected upwards; momentum is in favour of the bulls if price where to break up and above from current resistance line. The RSI is currently putting in higher lows; divergence from price as it puts in lower lows, this just further confirms the theory of a bullish divergence playing out.

Volume is below average at current given time; we need to see an influx of volume upon breakout to ensure that it’s not a fake out. A breakout and an influx of volume will make the EMA’s cross bullish which will confirm the trend reversal as currently it’s giving price heavy resistance.

Overall, IMO, CGC is more probable to break bullish from this formation as we are testing a critical support level, we also have an open gap, and gaps always tend to fill if you look at price history. The technical target for the falling wedge will be met at the .50 Fibonacci which is in confluence with structural resistance.

What are your thoughts on CGC?

Please leave a like and comment,

And remember,

Don’t worry about what the markets are going to do, worry about what you are going to do in response to the markets - Michael Carr

Canopy Growth Price Action - Is the Bottom in for Potstocks?We are now near the bottom of the previous wave 4 of one lesser degree, and IMO it's about time for shorts that have rode this down to take their profits and flip long.

I've updated my count and I now have A as a leading diagonal, and I have this whole correction as a standard ZigZag. Whatever we have here is in 3 waves, and this count seems to work, especially the fib relationships when I did a deep dive.

Wave C looks pretty straight forward with 5 waves in a channel. The extended wave 3 hit the 1.618 x A target right on the nose; It'd be hard to argue that that 5 wave move is not an impulse. Question is, where are we in the final 5th wave? I can't get a great count on this one, and see two possibilities:

1. Wave 5 is some sort of diagonal, and has completed. What I like about this is the wave A and C equality of the the large red ZigZag. What I don't like is the ending diagonal is messy.

2. We are still in wave 3 of 5. My target for this case is $14.5. Here's why:

a. It's the target for wave 1 and 5 equality. (Last blue wave 5 would be equalt to wave 1)

b. $14.5 is a level of interest as it was the top in November 2016.

c. It could satisfy the wave C target using the channeling guidelines (pink channel)

d. I also noticed that price is reacting to the slope of a channel using the top of blue (A) of the larger red B wave. Check out the fib channel and how price has reacted to it. Even the overshoot hit the .236. Not sure why, but seems as though algos are reacting to

something here. Take a look at where this channel intersects with the pink channel. You guessed it, the golden ratio .618.

My plan is to wait for it to play out, and will be watching my indicators closely at the $14.5 area. If instead we break out of the C wave channel (specifically the TL joining the top of waves 2 and 4), I will also go long. This change in price behavior would let me know that wave C has completed.

GL All!

-ill

CGC Bullish Break PendingWatch for a break of the downtrend channel. Wait for a bullish breakout on other MJ stocks. Trail stops up after the break. Bullish daily divergence on PPO/RSI.