Technology Index Simple Chart AnalysisTechnology index - More or less, we need to respect the main klse tech index also. If this area break, tech sector will continue its run. That's the reason I take profit most of my tech sector today & wait for another round.

Prove of selling source that I am earning Rm200k = USD45k can visit my link in my signature.

Bursamalaysia

CIMB | Sign of rebound with volume in within the dayAfter a huge fall from last week, CIMB is showing sign of price bottom & price up with volume yesterday.

Although high volume in daily chart might scared some investors away. But the major volume created yesterday was done at the price bottom & maintaining the price at higher level.

FBMKLCI Simple Chart AnalysisKLCI - Possible a rounding bottom to be form under the administration of new Government which led by unity government.

How to view the guidance via chart ( Refer back to pin message guidance if to trade )

Red Line = Support

Blue Line = Resistance

Light Blue = bullish/bearish pattern

Arrow = Double/Trip top/bottom

Red Chip = $$

Green Chip = XX

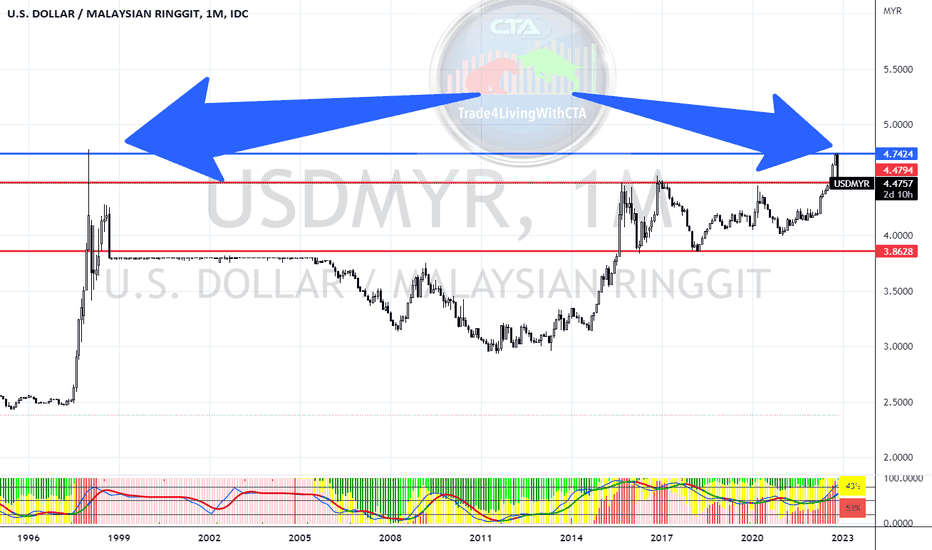

USDMYR Simple Chart AnalysisUSDMYR - This chart can use to monitor our country economy too, hopefully the double top here can indicate that our MYR can continue to be strengthen under the unity government.

How to view the guidance via chart ( Refer back to pin message guidance if to trade )

Red Line = Support

Blue Line = Resistance

Light Blue = bullish/bearish pattern

Arrow = Double/Trip top/bottom

Red Chip = $$

Green Chip = XX

Nasdaq100 Simple Chart AnalysisLooking at Nasdaq chart, is still maintaining its support area here & all it takes to move bull might need to wait 23rd Nov. If data is unfavourable, it will retest back support.

My Personal Market Review

Market Review

Quarter Result Month

Nov 23rd

Core durable goods, initial jobless claims, new home sales & FOMC meeting minutes.

Nov 24th & 25th Thanksgiving day ( Holiday )

Good morning 1 Malaysian, seem we had a hung parliament on going & i am going into such politic view here cause no one will know what will happen to our KLSE but guidance already given earlier to be conservative on it despite a mini bull run at US side. Let's the party leadership to decide as i believe everyone already did their best vote out there. All i can say god bless our KLSE.

Let's focus more on US market cause any big movement from this will impact the entire market out there. The only important event we will have on the coming week will be 23rd FOMC meeting minutes. It might have the projection to start off their 1st cut or continue with raise rates which will determine the next market direction. Base on the latest economic data, inflation had been declining & this will bring positive movement towards tech sector. If we view the index chart, retracement is on going & if this continue to last long with the positive data, I assume Feds result might be a positive ahead than all of us shall have a Christmas Rally to run.

Conclusion, I will still maintain my strategy to be conservative for KLSE till a government form & optimistic that US side will run a mini bull. Let's see if that will happen. May the bull be with us all.

Aemulus Simple Chart AnalysisFor KLSE tech, don't hope too much 1st cause there are still election on going. So just be conservative by trading a few tech will do.

420 area break will be indicate a good sign ahead here. Since 375 area looks supported, it can be use as support. I assume it will follow SOX movement for the time being. Red chip does appear recently but is not that wild yet.

Selling pressure is in HARTA

*refer to the image link*

Today HARTA is trading with high volume at the high price in the morning, while price is not marking higher.

This indicates the big boys have no intention to mark the price higher & a price retracement is on the way.

High volume price down happens around 11:40 & 12:15 shows the selling pressure is in.

We see a few glove makers are having the same price & volume movement. Today shows the first day of high volume sell down within the day. We expect price retrace in the next few days.

KLCI On Going To $1206 Price | Bearish Movement | 111022 | It has been an excellent rollercoaster for KLCI Indeks.

We are in the midst of a downturn in pricing when the price of Ringgit will not stand a chance to recover in the next 2 years.

While we are in the midst of dissolution in Malaysia. We do not have any current prime minister running for management.

While this dissolution only makes the settlement in not go in order. While all the companies in Malaysia are still having a downturn in profit.

In order for the index KLCi on going to the trend, I can't see anything on the clear road except bearish.

The CPI index accumulates and all the housing price is on the going rising to make the purchasing powerless.

The breath and health of the current demand is not in favor.

I predict the price of KLCi bearish to $1206.

ANNUM (MALAYSIAN STOCKS) INTRADAYExpected to rebound at 0.40 MYR.

Targeted resistance at 0.50 MYR.

(1) The price inclining while the volumes insisted prior to previous prices. Expected on continuous bearish trend if the price couldn't break the resistance.

(2) Within the current global economy onto further OPR leads to underperformance in markets.

DATAPRP heading to 0.15 and expected to rally upDATAPRP is showing good potential in technical analysis. Based on my Fibonacci, its already entered the reversal zone on the monthly chart and now it is heading to the short-term reversal zone. Normally, the price will form a price action reversal pattern before its rallies. Let's wait and see the result soon.

RESINTECH BHD OUTLOOK 21/04/2022RESINTECH BHD :-

After a continue uptrend movement now this counter is expected to shoot up to a point 1.19 and recently break the resistance of 1.130 and is indicating to move up and if breaks the next resistance of 1.190 then can make a new high of 1.220.

It is making a candle chart formation of breakout pullback formation and the entry point is 1.100.

Resistance:- 1.130,1.190.

Support:- 1.040,0.960

The Relative Strength Index (RSI) :- 59.49

Can be a good option for a Long Term Buying.

RCE Capital BHD Outlook 18/04/2022RCE Capital BHD

CMP:-1.870

After a long uptrend last week this counter is expected to continue this trend this week with some news release.

recently broke the resistance point of 1.850 and is expected if breaks the next resistance point of 1.900 will make an high of 2.000 can be considered for long term buying

The Relative strength index (RSI) is at 78.03

OPCOM Holding Bhd Outlook 14/04/2022OPCOM Holding Bhd

This counter after a Downwards Trend for almost last 2 week is now ready to take some correction a uptrend Movement is expected.

according to the candlestick a Bullish Flag Formation is Forming up Can cross the last 2-week high and the resistance point 0.985 and if crosses the second resistance point of 1.020 then the price expected shoot up can be up-to 1.060.

Support:-0.950, 0.925.

Resistance:- 0.958, 1.020.

The Relative strangth Index (RSI) is now trending at 68.22.