Biostage - moving up during Corona downturnHow many tickers, other than companies making vaccines and manufacturing N95 masks, have gone up this week?

Some one is accumulating this ticker as it is about to go into human clinical trials. Animal trials were spot on.

Tech not quite there for full organ manufacturing, but tissue regeneration is in prime time

Biotechnology

9EMA Support of the Gods and Bounce to the HeavensI will keep this one simple. We are closing in on a major bullish breakout. As we approach the top of the larger daily flag, you can see the smaller time frame Flat top setup.

Here is the beautiful part of this pattern in pattern play. we are sitting on Super strong support of the 9EMA, Its tight Its right! That 9 EMA will help push through the Flat top for a Flat top Breakout!

AND THEN!!!!!

Boom that Breakout power will push us through the Flag into the unknown ( $2?? $5??? $10??? $1M?????(lol))

All we need is a Catalyst!! OH DAMN we got um incoming!!!

SEE you all on the moon!!

Buy BUY BUY!!

Ladies and Fellas Start your Engines!!!We are ready!!! The presentation today will create the catalyst needed for Greatness and Glory!!!

We have put up with that Bear crap for the last time, now lets make us some millionaires and cure some F**kin Cancer!!

Notes:

OBV: About to Break through top of its Trend!

-Chart shows a slightly modified(Accelerated) Price projection.

-Coming out a strong accumulation phase.

-Continuation of Longer term Cup and Handle.

Buy Buy Buy

Let me know your Thoughts!!!

IBB - Biotech BounceWhats up Traders -

Stealing a CNBC idea, but i like it and agree with it. Biotech has bounced back to its past highs. IN all liklihood we will bounce around here for a bit -

Entering a Call Credit Spread

1 x 123.5 Call Sell

Jan 31

1 x 125.00 Call Buy

Jan 31

Have a look and see if you. Best of luck.

- Nix

Nasdaq Healthcare: Closing on January 17thFriday's session presented a retracement on the 20 EMA Line, as predicted. I still believe in the continuation of the bullish trend. However, the bearish divergence needs to be monitored, since further price correction could occur.

Disclosure: My ideas contain statements and projections based on assumptions on capital markets, and therefore inherently subject to numerous risks and uncertainties.

Before buying or selling any stock you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

I am not a financial advisor

Nasdaq Healthcare: Closing on January 16thToday's session generated a bearish divergence on CCI. I am still bullish, but always ready for a trend retracement on the 20 EMA Line.

Disclosure: My ideas contain statements and projections based on assumptions on capital markets, and therefore inherently subject to numerous risks and uncertainties.

Before buying or selling any stock you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

I am not a financial advisor

Nasdaq Healthcare: Closing on January 15thIf you like this idea, don't forget to support it clicking the Like Button!

Positive session for Nasdaq Healthcare that gained 0.39%. However, I still see the possibility of a retracement over the basis of the Bollinger Bands indicator (orange crosses). I was waiting with anxiety today's session to check for a signal of retracement, and it comes with the third candles (17:00 - 19:00)

The situation is also confirmed by RSI and CCI indicators.

Disclosure: My ideas contain statements and projections based on assumptions on capital markets, and therefore inherently subject to numerous risks and uncertainties.

Before buying or selling any stock you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

I am not a financial advisor

Nektar is reaching fair valueNektar and Bristol-Myers Squibb announced today the companies have agreed to a new joint development plan to advance bempegaldesleukin (bempeg) plus Opdivo (nivolumab) into multiple new registrational trials (source: Yahoo Finance).

The 19% jump is making Nektar trading around its fair value. Likely, profit-taking will take place in the next sessions. I'm expecting the stock price to consolidate around $23 level.

Disclosure: My ideas contain statements and projections based on assumptions on capital markets, and therefore inherently subject to numerous risks and uncertainties.

Before buying or selling any stock you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

I am not a financial advisor.

Don't forget to support this idea, if you liked it, and to follow me here on TradingView.

Investing Fellow

Pfizer: Wide Moat and Interesting Ichimoku CloudsAfter the massive price drop at the end of July, Pfizer is pivoting its strategy selling Upjohn Unit to a new joint venture with Mylan and focusing on the new BioPharma business (mainly focusing on Ibrance, Xtandi, Inlyta, etc.). The new strategy provides Pfizer with a wide economic moat. I think the market currently undervalues the stock.

The current price is above Ichimoku Green Cloud, and it coincides with the Lagging Span. I will expect a bullish progression of the price in the long term with the market correctly evaluating the new strategy. However, I see a risk of profit-taking in the next sessions anyhow, not so significant to let the stock test the upper support of the green cloud.

Please, note that this analysis applies to long term positions.

Don't forget to support this idea, if you liked it, and to follow me, here on TradingView.

If you have another trading plan, please share in comments!

Investing Fellow

Disclosure: My ideas contain statements and projections based on assumptions on capital markets, and therefore inherently subject to numerous risks and uncertainties.

Before buying or selling any stock you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

I am not a financial advisor.

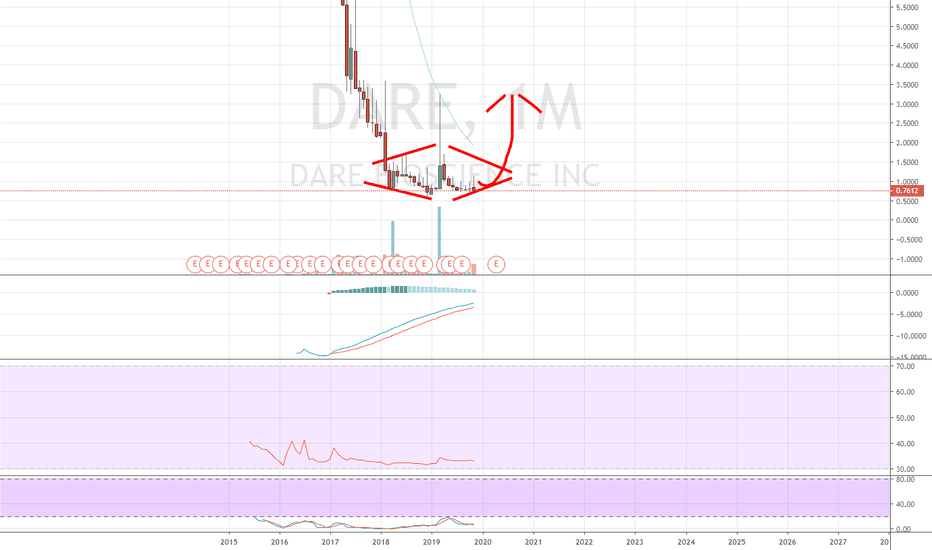

*Speculative* $DARE - Long to $2-$3Women's healthcare company - Lots of upcoming catalysts through 2020. New acquisition this week of Microchips. Could see this fall to .50s if earnings are garbage - which is definitely a possibility, but target is still $2-$3 next year. This is speculative, but I will hold 5k shares from .79 avg.

Alexion: Today's opening is confirming the bullish assumptionGood spot for Alexion Pharmaceuticals. The stock is trading above the Ichimoku Cloud Support (red line of the green cloud).

I was waiting for today's opening to confirm a bullish position.

Furthermore, Alexion trades below its normal Price/Ebitda ratio of 41.13 (currently trading at 11.89).

Disclosure: My ideas contain statements and projections based on assumptions on capital markets, and therefore inherently subject to numerous risks and uncertainties.

Before buying or selling any stock you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

I am not a financial advisor.

Biogen: Further GrowthAfter the stock price touched new highs in October 2019 ( management confirmed rebooting of aducanumab's development), Biogen started a consolidation phase.

I plotted the Ichimoku Cloud on a daily chart, together with the Bollinger bands, to highlight the volatility and confirm the consolidation phase. Currently, from a technical point of view, we are in an exciting phase, testing the high line of the cloud with a bullish configuration, as also confirmed by the Stochastic.

The upward trend is also confirmed by fundamental analysis. Biogen counts on a strong collaboration with Roche in oncology, and on growing revenues thanks to Ocrevus (Multiple Sclerosis), as well as to a significant pipeline.

Furthermore, the complexity of Biogen's drugs makes the production of Biosimilars difficult.

Disclosure: My articles contain statements and projections based on assumptions on capital markets, and therefore inherently subject to numerous risks and uncertainties.

Before buying or selling any stock you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

I am not a financial advisor

Acadia: Stochastic Oscillator UpturnStochastic Oscillator shows upturn for Acadia. Ichimoku Cloud support is very important in this case since today's session is not breaking it and could demonstrate positive trend force.

Please note that biotech companies present high uncertainty.

Disclosure: My articles contain statements and projections based on assumptions on capital markets, and therefore inherently subject to numerous risks and uncertainties.

Before buying or selling any stock you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

I am not a financial advisor

Xbrane moving out of DowntrendXbrane Biopharma AB is a biotechnology company which develops and manufactures biosimilars. Xbrane has a patented protein production platform and world-leading expertise within biosimilar development.

Xbrane’s headquarter is located in Solna, just outside of Stockholm, and the company has research and development facilities in Sweden and in Italy.

Biosimilars are approved pharmaceuticals that are similar to a biological reference product in terms of quality, safety and efficacy. They are approved in highly regulated markets such as the EU and the US.

Biosimilars are so far typically launched with a 20-40% discount vs. the reference biological drug improving significantly the accessibility of the treatments and generating massive cost savings for private and public payors.

Xlucane - Lucentis® - Phase 3 - Global annual sales € 3.2 billion

phase III trial was initiated Q1 2019 with primary aim to evaluate comparative efficacy in terms of change in visual acuity 8 weeks after initiation of treatment. Xbrane has acceptance for the study design from both EMA and FDA. The target is to launch the product upon patent expiration in Europe beginning of 2022.

Preclinical drugs

Spherotide - Decapeptyl®

Xcimzane - Cimzia® - Global annual sales € 1.4 billion

Xoncane - Oncaspar®

Xbrane has entered into a co-development agreement for Xlucane with the German generic/biosimilar company STADA. Under the agreement Xbrane is responsible for development of the product and STADA for sales and marketing. Development expenses and profits generated from sales of the product are shared 50/50.

Amgen Bull Flag: Just What the Doctor Ordered?Biotechnology stocks surged in the fourth quarter thanks to some takeovers and buyers returning to the health-care sector.

Amgen is the biggest of all the biotechs with $144 billion of market cap. It's also one of the few big names that's broken out to new highs. (Along with Vertex .)

AMGN's been climbing a wall of worry about competition since the summer. The flurry of good news began in June when its AMG 510 cancer compound successfully shrank lung tumors. Then, earnings beat in both July and October as its new biosimilar franchise surprised the naysayers.

Now's the first real pullback since breaking out. AMGN's bullish flag may create potential for a continuation move higher, with Friday's low of $236.24 as a level for risk management. The next earnings report is estimated for Jan. 28.

APTOSE BIOSCIENCES INC - NASDAQ: $APTO Rounding BottomSince October, shares of APTOSE BIOSCIENCES INC - NASDAQ:APTO appear to be forming a rounding bottom and recently, have witnessed the recapture of its 200 DMA as well as a noticeable pick-up in volume as we can observe from the Daily chart above.

In addition, APTO now finds itself trading above all of its important moving averages 20/50/200 DMA's, which is suggestive of a healthy technical posture.

While further work is required, both investors/traders may want to continue to monitor the action closely and in particular, should APTO be capable of taking-out the $2.45 figure at any point in the days/weeks ahead, such development may just trigger its next advance into higher ground with and initial $3 - $3.50 objective.

Nonetheless, the recent action in APTO is encouraging and both investors/traders may want to put the name front-and-center on their radars for further clues/evidence that things may be about to pick-up n earnest.

Can TTNP Actually Gap Fill Or Is It Forever Going To Trade Here?TTNP has been catching attention on volume scans this month. Ever since gapping down on October 16, the daily action is noticeably greater than before. But is this a good or bad sign for the penny stock? Currently trading around $0.20. OS is around 17 million so it's not the biggest out there but not the smallest either.

Titan Pharmaceuticals is a company that develops treatments for chronic diseases using its ProNeura platform. Titan announced a $9 million public offering a week ago. While the company’s stock took a price hit due to the per-share pricing of the offering it is okay.It is okay because ever since the company did this, a surge of volume has entered the stock. In addition to this, analysts are taking notice of the company too. Maxim Group upgraded TTNP stock from “HOLD” to “BUY” this week and gave a $1 price target.

ABOUT TTNP

Titan Pharmaceuticals Inc is a specialty pharmaceutical company. It is engaged in the development of pharmaceutical products. Its product pipeline consists of Probuphine for Opioid addiction, Ropinirole for Parkinson's disease, Triiodothyronine (T3) for hypothyroidism. It generates revenue principally from collaborative research and development arrangements, technology licenses, and government grants.

QUOTE SOURCE: 4 Penny Stocks Catching Biotech Investors By Surprise

Is 22ND Century trading in a descending triangle?Maybe a bull flag or ascending triangle as well. It looks like they're trading above the 200 Day MA, which is bullish for the stock in determining the direction of the trend at times.