Bottom Officially IN. Final Dip Before TakeoffUsing the Hall and Co trading indicator a BSO (Buy Stop Order) has been triggered indicating a local top. We should've had one for BTC but it didn't rally high enough to trigger one. There WAS however a BSO event for ETH:

Looking back to the last consolidation period after the 2014 Bull we can see that there are two BSO Peaks and two massive dumps to confirm support at the bottom:

That is what we are seeing currently with the most recent dump in the past few hours. If anything it's happening rather soon, but it does also tie into the idea that we start going up properly in May.

Gameplan: buy as much of your favourite crypto once this hits rock bottom at the 3400 support area. If it breaks hard and wick down to 2k then that's a steal of a price. Most traders spread the "never catch falling knives meme" but really the bottom is in and the next final dump is commencing. We could have a third BSO Peak (which would be a never before seen BTC feature) but then it would bounce back to the lower 3000s again and find support. This 3k has been rock solid and I don't really see it breaking down.

Literally get as much fiat you have (that can be kept in internet funny money until 2023-2025) and put it all in when the dump finishes.

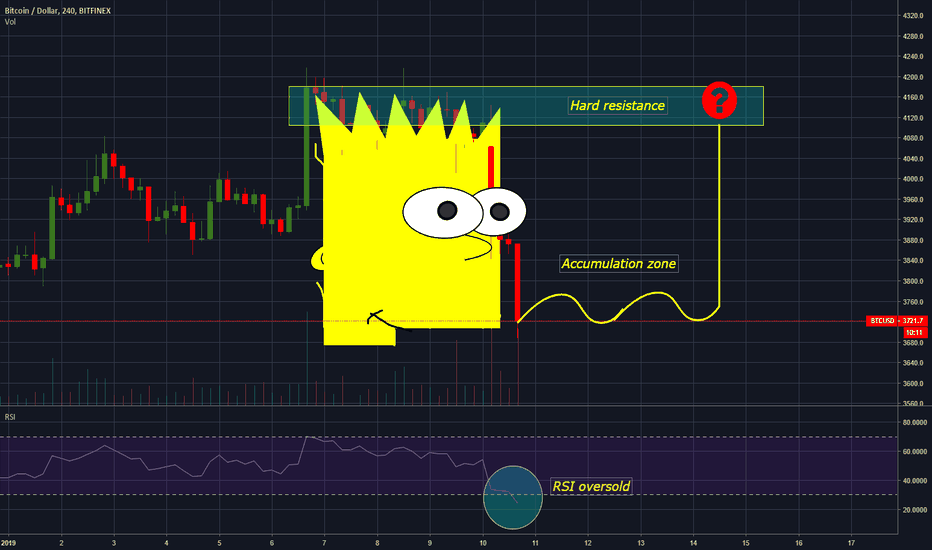

Bart

New Bart PatternA meme develop in the crypto community around this unusual price pattern seen almost extensively in crypto currencies, characterized by its sudden rise in price, sideways movement, then sudden drop which had been widely popular in the entire duration of bear market 2018.

It has become so popular that trader @JamesRkaye made a trending post about it. Check his post by clicking the next image.

Just recently I've been hearing bears here and there for the past two weeks taunting another bart pattern will emerge.

Well times have change, the bart pattern we saw now look like these.

It would be fun to see double barts in the upcoming bull.

BTC BartThe pump we just had looks to be fizzled out, with volume returning to normal as well. We may actually see it bart back down again. The past 2 months have been riddled with barts (implying low-volume price manipulation).

Unless we see some type of Chad staircase form then I suspect us barting down.

BTC Obvious BartThis is the most obvious bart in all of bitcoin history. Dead volume, sudden spike in volume and price, then dead volume and slowly bleeding price with a curving down RSI. Really if you don't understand how this space is manipulated by whales and exchanges to liquidate both shorts and then longs, then you should move over to forex or something.

Bitcoin: To Bart or not to Bart?The last huge bitcoin move has left the whole space climbing on rockets again, and usually that indicates that longs will get rekt. Will this time be different?

On the hourly chart (above) you can see price consolidating into the kumo after the last move. If there was enough momentum behind this move to continue the bullish trend I feel the follow through would have happened already: this looks more and more like another bart-move with his right cheek to form anytime now (or perhaps it will take a few days of sideways bleeding). The daily and weekly charts are still in bearish territory, and the hourly is about to move into consolidation territory,

Not very much more useful to say about this, it can go up, but looks more likely to go down. There’s no trade setup for either direction yet.

Price will have to hold the MTFA support at 3520 to remain in a bullish posture, if not I will start looking at short setups on this timeframe.

If you are trading this indicator, the long would be entered at 3425, and you should be out of this trade already.

4HR

The 4HR chart is on bullish setup, but again, my confidence in this setup triggering a trade is not high. If we remain stuck above the MTFA support at 3520 for a long enough time, the bullish setup will become more likely again. But for now I expect the bart-move to complete itself, and a brutal drop down to be the more likely outcome.

Daily

The daily chart puts the upswing in perspective, and shows that all still is bearish. However, there is a bullish case to be made. If we do get a bullish move, and break above the kumo on daily chart, there is a chance we may reach the 5000 level. But lets not get ahead of ourselves here..

Conclusion

If you didn;t get in on the hourly breakout trade, there’s no reason to chase the long at this moment. Wait for price to figure out where it wants to go: if the support breaks, look for 1HR short setups targeting the next MTFA support at 3390, and probably lower.

If the daily territory changes to bullish look for hourly long setups.

If any of those happen, you will hear from me again…

Until then, happy trading, and stay calm!

If you find this useful like and subscribe to get notified of updates and new ideas!

If you want to tryout the indicators and strategy, pm me and I’ll get you set up.

BTC breaks up & closes candle @ exact target of projected brkoutAlthough the falling wedge lost its 4hr chart validity when the red candle closed green giving it only two wick touches on each trendline, the break upward that has occured has conveniently closed its breakout candle at the exact breakout target the wedge would have had. I've yet to see a wedge this long breakout this prematurely so I think it may more likely be simply an inverted bart that has occurred shortly after a bearflag breakdown fakeout but the confluence of the breakout target of the inv bart with the wedge target is very synchonicious. Very curious to see how often a falling wedge has broken up this early on other charts on the past.

We're in another wedge! Buy in and set a tight stop lossThe Wedge Master is at it again. It seems, we're in another wedge, around 4am-12pm PST we will have huge movement again. With crypto, it is hard to predict which way wedges will break out. So my technique has been to buy as the wedge closes in and set a tight stop loss about 1-2% under the line of my wedge. Here I am anticipating more down to retest our previous low at 3200. We might possibly get a small inverted bart back up before the bear market continues to retest lows. If so, I'll take the profits as soon as the price spikes. No 6k hopium smoking for me just yet.

BTC and some big alts are forming a bart. Please short at top.BTC and some other alts are forming a bart (ETH is shown), which is similar to the previous pattern. When I said similar, I hate to say that they are identical.

Let's not predict where this is going. I am scalping this range before anticipating completion of the bart.

My previous analysis, which is bearish, is still in effect. If you are trading long term, you will not go wrong in shorting this.

Bitcoin (BTC) Bart Head pattern, it will reverse?Classic crypto Bart's Head pattern

"The reason for these sudden pumps and dumps is likely to burn margin traders, whether short or long, by manipulating the market. While some believe that this is done by the exchanges themselves — which is entirely possible due to the lack of regulations — this might be related to large crypto traders"

Where from here? we will see a revers head after some accumulations?

Or it will go even lower?

RSI is oversold

Volume is only in pumps or dumps

But the history did not taught us anything, cuz everything is possible in crypto world...

Cheers!

@Zekis

BTC Falling wedge in a downtrendHi guys,

I am back after a short winter holiday break with new ideas for your. What's going on with BITSTAMP:BTCEUR at the moment? Up, down, up, down, down... and so on.

Come on guys, let's push this chart a little bit.

What I can see now is a falling wedge in this downtrend. And perhaps we will see a nice breakout on Sunday or Monday morning.

Another idea is that it it a simple Bart formation!? Let's see what the wales will do.

What do you think? Is it going up or down next? Please support me with a thumb up and a comment. I would appreciate this :)

I will try to update this post frequently.

See you guys, trade on, Muckrah

Bart Attracting Volume - Pulling In Short Entry ZoneLooks like the Bart dump out stopped out a lot of bulls which means it will probably be harder for price to get up as far as I was thinking.

I'm moving my region of interest to start shorting back to where I first projected it previously. The lower region is mainly a fib projection of the current bart.

This bart hasn't finished so it may expand lower which would change the fib projection.

I am not even going to attempt to predict the path it will take to get up to the shorting zone. It will probably be a tortuous path of barts and widening patterns.

All that matters is that it get outside the range to produce some kind of good RRR.

As long as it's stuck in this range any trade is probably throwing away money because it's very hard to define your risk with any degree of certainty.

btc Bart brings entire crypto market down w/ it; bearflag formsWhile the chances of an inverted bart up from this bearflag are very possible considering rsi levels at the moment...I'm hoping more that we continue the trend so we can finally get this capitulation candle out of the way and bring this bear market to an end. If capitulation is near I anticipate we will break down from the current bear flag right around the time the 1hr deathcross occurs which should lead to subsequent death crosses on the 2hr, 3hr, and eventually the 4hr charts. I think if we pull off a 4hr death cross thats when we will finally see our capitulation candle....unless of course we already dip down far enough during the other 3 death crosses so that when the 4hr death cross occurs it bounces right back up and does a death cross fakeout right back into a golden cross....however hopefully for us all this is the beginning of capitulation...an inverted bart back up here at this point will only prolong the bear market much longer. I think capitulation will occur at 2.9k at the least but possibly much lower.

Okay Bitcoin, is it going to be 4200 or 5200? Part 7What a sick move today, Saturday manipulation at it's best. This market is just so easy for these people when volume is low.

Anyway, there were a lot of things in favor for at least a test of the 4000/4050.

-The daily candle of yesterday was perfect, today's was good as well. But of course, just minutes before the daily close the price got pushed down. Coincidence?

-Alts were very good, they made good rallies yesterday, even though the jump start was a short squeeze.

-ETH', which is leading broke out and made a small bull flag above the big bull flag. It could almost not get any better than that

-Open Intrest was good as well.

-The bull flag of Bitcoin was eventually good as well, making that last drop to 3800ish as a final shake out, which happens more often in a bull flag.

- Volumes were good/decent with those last pushes up as well.

The only danger there was, which was the main reason why i posted that big bearish wedge in the first place (in my previous analysis), was because yesterday's rally of Bitcoin was a 100% short squeeze. This is usually a matter of time until it drops again if we don't see real follow through. That's why i said the next push up has to break the 4000ish, so we don't get that bearish wedge hanging above the market. Well we all saw what happened eventually, it did not even get above the 3950 and a typical Bart move (what i warned for as well), was thrown into the market and within a few minutes we dropped like 7%. You can take my word on it, the same people who made the Bart move yesterday from the 3600 to 3900, did the same with this drop.

So they bought things up yesterday, when being fully loaded with longs:

-They push through the stop zone

-Throwing in more buying power to keep the pressure on the stops

-When the bigger liquidations start, the market does all the work FOR' them. So they only have to wait for the price to come to their closing orders.

So all they have to do is close their longs again at the highs during high volume. And when the volume decreases they have to close the remaining positions with a policy. Selling, but not pushing the price down while doing that. When that part of the trade is done, they do the opposite and start to short the market. This last part is obvious in hindsight. There signs upfront, but with that last push up from 3840 to 3920, it looked like it was a normal move up. Up until that Bart move.

The worst thing of it all, more people start to recognize their patterns. One would think that is good, but actually we are helping them. Because as soon as we see them do it, if we start to sell or short it, we give them extra volume. There is actually no stopping them, unless we would all combine "our" volume and do the opposite of their game plan. So the only way to stop it, is having more volume than "they" do. The only time i saw them loose, was in July, just before the break of the 6800. I have mentioned this many times before, but just saying it again for any new readers.

Okay, back to the charts :) It seems the big wedge i had drawn in the previous analysis, did it's work and we are back at an important support level around 3700. Because of this drop it is likely we will see another drop, seeing movement like we had in the blue circle. Since alts are stronger than Bitcoin', it could be my theory above is quite real. When looking at the OI profile, it could be their already loading up here. A first small step would be the price getting above the 3770ish. If that happens, there is a chance we won't make that second drop, which usually happens after a dump like we had a few hours ago.

For now the 3820/40 is a resistance level. As i am writing this, we can already see sell spoofing orders, trying to push prices into their longs (probably). For the rest, you can see all the support and resistances zones. If we drop below yesterday's low, i need to re evaluate things, because that would not fit in my bigger picture. If bull are able to touch the 4200ish the coming days, the chances will be very big for another rally. Because even if it drops to like 3900/4000 after reaching 4200, it will most likely form a higher low in that area. For the rest, keep an eye on the alts, if they get weak, the market will probably drop, if they remain strong, we will probably go up. They have been a great guide lately, except for today of course :).

I will try to update tomorrow again.

Please don't forget to like if you appreciate this :)

Previous analysis:

Bitcoin Whales And Their Bots Controlling The MarketA few days ago i said i would make an educational analysis about that pattern i saw a few days, something i have seen many MANY times this year. Especially since May until September this year. What do we see here:

After breakouts like we had a few days, where we see a squeeze up happen within 1 or 2 minutes, then we see a dump happen just as fast and usually around 50% of the up move. The most important factor, is the speed of the push down. These are bots in action because nobody can react that fast AND feel so confident to push the price down during a squeeze up, unless you know you have unlimited funds and volume to play with. The only time i know they failed, was in July, when the 6800 broke and we squeezed up to the 7.500. If you remember, i mentioned that several times, because since that moment, it took a while until they showed up again. There were around 200 mil contracts liquidated that day :)

After the push down has been made, we usually see a small bear flag forming, like they are getting a feel of the buying pressure of the market before they start to make their second push down. A few days ago, the buy volume was probably still too strong to we tested the high again, something that didn't happen earlier this year. So there is a slight change in that pattern.

Today's move, which i warned for yesterday was only a 30/40 point move up. But the push down fits the profile i described. And since we are at lower prices now, it might be fair to assume they are at it again.

What and why do they do it.

Why? They play games with over leveraged traders. We always get these obvious resistance or support levels. If it's a bull or bear flag or trend line breakouts. So many traders who are breakout traders go long at these highs while THEY have their short orders already in the book ready to get filled. Then they push the price down just as fast, putting these bulls under immediate pressure. They wait and see a bit how the rest of the market reacts, if they see buying volume dropping, they start to push the price down even more.

Because they trapped these breakout traders, they use THEIR volume as their own, because as soon as these over leveraged traders start to get in a loosing position, they will cut their losses and start to sell as well (or get liquidated which has the same result). So creating volume (fuel) for these whales. And if the market is not strong enough to catch the volume of both of these sellers, we start to see those Bart moves and the market starts to drop again.

You probably remember this chart i showed a week ago, before that move up happened and dropped again. This is a bigger version and a different pattern but it's the same tactic. In case you wondered how the hell did i know it would move like that, well know you have your answer :). Of course it is an assumption upfront and it's not that easy, but it does increase your odds in trading when your aware of these kind of things.

If i get a big support for this educational analysis through likes, i will make a part 2 and will show you examples of these patterns. It takes me many hours to make these kind of educational posts, so i will only continue when i see enough people find it interesting.

I also still have that long term (with log trend lines ) educational post, i am half way but still needs a lot to complete it. I might post that one as well in the near future. Maybe some will finally see and understand the false preferences most TA analysts tell you. Not on purpose, they simply don't know any better. Now i don't need to prove my right with this and i won't even try, it's up to you to make your own conclusion. But i think the fact 90% of retail traders looses money in the financial markets says more than enough. The chart is here below, probably finished but i might still adjust it a bit

I can see only 1 solution for this manipulation, that is combining the volume of all exchanges in 1 order book. Because then they would much more volume to push the price around. Now they only need 1,2 or 3 exchanges and the rest will follow since there are so many bots reacting automatically. Combining all the volume , would make it MUCH more difficult to control. Not impossible, because the same manipulation happens on the normal markets as well.

So in other words, the decentralization of crypto is actually biting it in it's own ass when you think about it. Very unfortunate, but it's the hard truth.

Please don't forget to like if you appreciate this :)

Previous educational analysis: