Alibaba

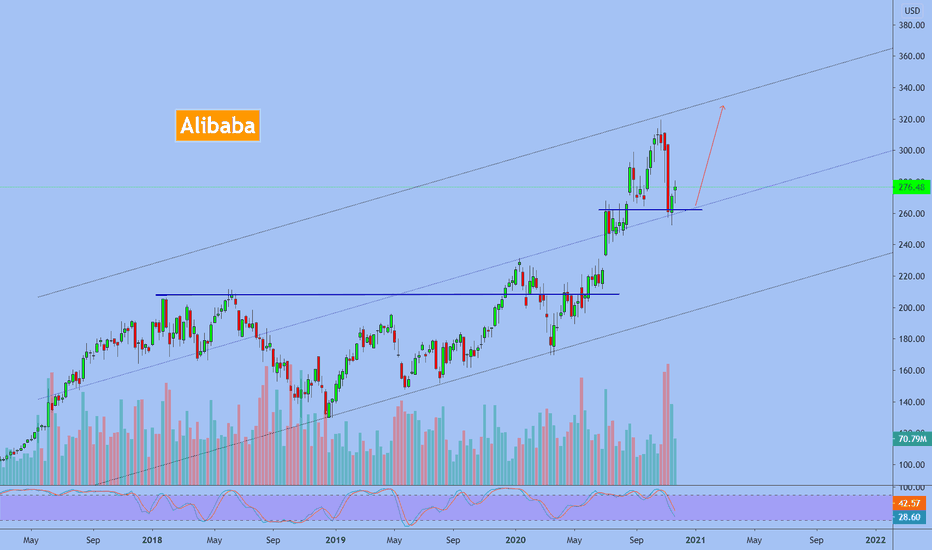

ALIBABAi just wanted to make you remember that it is YET in the top part of the 5 yo channel.

if u buy here, you buy a 5 yo channel top, AND 2 yo LOST channel.

it CAN be an opportunity, alibaba is surely a good stock, yet, in technical analysis is not good looking after all (I would say only the MA 200 and the $250 support(?) in the daily chart)

but It is also kinda risky, it is Chinese (xi Jinping has kinda a lot of power, even on these big stocks).

chart: idk, it can be a TOP, or a LOST trend, OR 200 days MA.

china: ma should shut up if the stock wanna go up, ma should speak if he wants china as western countries (free)

just we will see, trade safe and do not risk all of your money in a single trade :D

BABA - China/US tension heavy on the stockSince the first news that the US is going to ban Chinese companies to list on the US stock market, $BABA was one of the first to took the hit. This can be seen in the volume spikes when investors started to close their positions.

The two uncovered gaps to the South are also making an impression. Volatility has calmed down since then as seen in the lower volume levels, but we are not witnessing any fresh buying or selling.

Price is currently in a range after getting out of the long-term uptrend.

ALIBABA CAN GO UP SHORT TERM We can see on 4h chart that we are close to 200 EMA, and this was solid support last couple of times. Also, RSI is in oversold zone and quiet. It looks like that is time for buying, at least for next 2 weeks for some swing trades. After Christmas I expect for most of the big names to calm down during the holidays.

ALIBABA : BULLISH CYPHER PATTERN IN DAILY TIMEFRAME 🔔Welcome back Traders, Investors and Community!

Analysis of #BABA

If you have found this useful then help us support my page by hitting the LIKE button.

If you are not subscribed yet then please feel free to follow my page for daily updates and ideas. Thank you

It means a lot to us!

***

Strategy: Bullish Cypher harmonic pattern

A clear chart is Always the best business card for a trader.

***

Your support and feedback will always welcome

Thank you for your time.

The information contained herein is not intended to be a source of advice or credit analysis

Regards,

Walter

Alibaba Group Holdings Ltd.Monday, 7 December 2020

22:51 PM (WIB)

Alibaba looking great and healthy. Seems no problem internal with the holdings Ltd. It looks normal. It's just a transition move from the top of the head and overbought, to the neckline's formation.

Check for tomorrow if any updated news

Best regards,

RyodaBrainless

"Live to Ride and Ride to Live"

$BABA - "OPPORTUNITY" NYSE:BABA

BABA on a rollercoaster ride with several negative catalysts getting priced-in causing a significant pullback. Down about 17% from its ATH (as of the time of this writing). Waiting for $265 validation of support, watching two other support levels at $257, all the way down to $240. A breakout of $275 resistance is critical to have a chance to test $280 - $300.

Undervalued company, in my opinion, with a significant competitive advantage in China and its growing economy, Ali Cloud is underappreciated and brings a lot of growth potential in the future. A positive catalyst to also watch is the potential ANT Group IPO along with their successful compliance with S. 945 "Holding Foreign Companies Accountable Act".

LONG all the way. Cheers!

-Kaswrp

ALIBABAthere are lots of things to consider.

Let's start with the price chart.

we had 2 down gap, not yet covered very well, plus the last one of 30th Nov.

considering the 200 ma, it's close, yet away $20.

then the ma 20 days, that took down the price 2 times, at $303 and $280, which is just on top of the price again at $270 (price now $266)

MACD

isn't really good looking now. 12 ma is crossing downturn the 26 ma, which is usually bearish, plus it's close to 0 in the bars.

talking about the RSI.

it's optimistic, since it says the price is going to be more bought, yet under 50% (ca 45%)

VOLUME

It's looking good. volume, since the spike when ALIBABA went down from $310, is lowering, which could mean the downtrend strength is lowering, so it can reverse.

yet the volume is not calm and has not been as low as during the upturn (just like from 270 to 310 in October).

I want to try to use a 1-10 (may scale it in future, just today's new idea), to rate the stock IMO

sooooooo, I'm going to give baba a 7. it's because fundamentally its good, china is a good place for this business right now, and the price is as low as 5 months ago. 1Y +32% ok? quite good.

the chart is not the best at the moment, but if ur not considering buying into it, u should at least check it daily to see if it hit 200 ma.

CAMELOT0707 RATE 03 December 2020 = 7/10

the weekly chart for a larger view.

hourly chart :D you never know

AlibabaWhat Is Holding Back Alibaba Exponential Growth

The Chinese company Alibaba Group owns more than 900 enterprises, generates a turnover of almost $ 400 billion, and creates tens of millions of jobs.

Alibaba was recently set to conduct the largest IPO in history, bringing its subsidiary Ant Group fintech service to two exchanges at once - Shanghai and Hong Kong. During the IPO, the company planned to raise at least $ 34 billion.

Trading in securities was supposed to begin on November 5, but two days before the start of trading, the IPO was suspended by the Chinese government. As a result, Alibaba shares fell in value.

Alibaba's quarterly revenue beats all the forecasts of the analysts. A big increase is expected in connection with the Black Friday and Cyber Monday holidays.

The latest news: Alibaba will help the government build electric vehicles and has been laying the groundwork for this for more than 5 years by working with the Chinese state-owned automaker SAIC Motor.

Technically, Alibaba is currently in an uptrend, the price is moving in the channel and exponential growth is just around the corner.

Best regards EXCAVO