Dow-n Memory Lane: Is History About to Repeat Itself?🚨 Breaking News Alert! 🚨

The Dow Jones might be partying like it’s 1929 again! 🎉 Except this time, the crash might make your portfolio flatter than a pancake at a bodybuilder's breakfast. 🥞💪

Let’s talk about the elephant in the chart 🐘—every time the Dow hits the ceiling of this oh-so-perfect wedge pattern, it nose-dives harder than your New Year’s resolutions by February. 📅💔

1906: Boom. Bust. Dow said, "Thanks, but I’m good at -90%."

1929: The OG crash. If you survived this one, congrats—you’re probably immortal now. 🧓💀

2008: The market went "Oops, I did it again" like Britney, wiping out fortunes faster than you can say "subprime mortgage." 🏚️💵

2020: "Hold my beer," said a microscopic virus, and the market tripped like it was wearing untied shoelaces. 🍺😷

Now? The chart suggests we’re flirting with another epic freefall. 🚀⬇️

🧐 How bad could it get?

Well, if history decides to copy-paste itself, we’re looking at a potential 90% drop. Yes, NINETY. PERCENT. That’s like seeing a Tesla go for the price of a second-hand bicycle. 🚲🔋

👉 What can YOU do?

Panic? Sure, if you want, but that doesn’t help. 🫠

Diversify? Probably smart. 📊

Buy gold? Maybe, if you’re a fan of shiny things. 🪙✨

Short the market? 🐻 You rebel, you.

But hey, no pressure. It’s only all your hard-earned savings on the line. 🫣💸

So, are we about to witness the Great Crash 2.0, or will the Dow keep defying gravity like a magician’s top hat? 🎩 Stay tuned, folks, because when this market sneezes, the whole world’s economy catches a cold. 🤧🌍

💬 Drop your hot takes below—because let’s face it, speculating about doom is more fun than living it! 😎🔥

1929crash

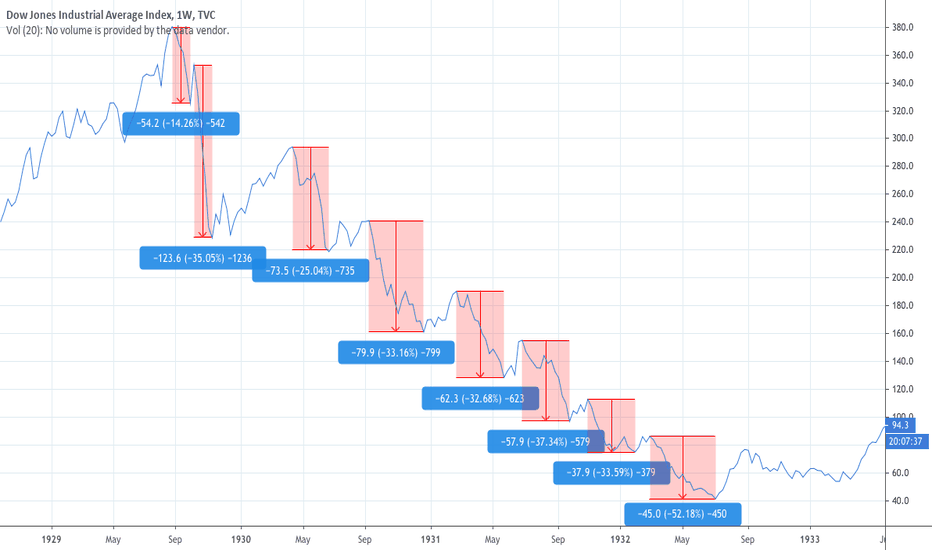

Rate Cut 1930 - Pattern Recognition: 30s vs Today In 1930, when the Fed cut interest rates, the market crashed further. In today's tutorial, we will be comparing the 30s and today’s market to identify some of their similarities.

Where exactly are interest rates’ direction pointing us?

As we may have read, many analysts are forecasting that there will be a few rate cuts in 2024. Is this the best option?

My work in this channel, as always, is to study behavioral science in finance, discover correlations between different markets, and uncover potential opportunities.

Micro Treasury Yields & Its Minimum Fluctuation

Micro 2-Year Yield Futures

Ticker: 2YY

0.001 Index points (1/10th basis point per annum) = $1.00

Micro 5-Year Yield Futures

Ticker: 5YY

0.001 Index points (1/10th basis point per annum) = $1.00

Micro 10-Year Yield Futures

Ticker: 10Y

0.001 Index points (1/10th basis point per annum) = $1.00

Micro 30-Year Yield Futures

Ticker: 30Y

0.01 Index points (1/10th basis point per annum) = $1.00

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

So much similarity - 1929 stock market and today I have broken it into 2 parts.

Part 1 – we can associate it with the sequence then.

Part 2 – we can take reference as the situation unfolds.

Part 1 -

1929 sequence that seems familiar today:

a) Crisis triggered by several factors

b) Stocks rose rapidly

c) Chain reaction of events

d) Bank had invested heavily

e) Bank failed

Part 2 -

As it continued in 1929:

f) Decrease in the money supply

g) Decrease production & employment

i) Decline spending & investment

j) The cycle continued

Following the video comparing the 1929 stock crash followed-by the great depression and the recent years, there are many similarities between its technical and fundamental developments.

Trading & Hedging in Nasdaq -

E-mini Nasdaq Futures & Options:

Minimum fluctuation

0.25 index points = $5.00

Micro E-mini Nasdaq Futures & Options:

Minimum fluctuation

0.25 index points = $0.50

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

100-Year Cycle within Parallel UptrendWhat it might look like if we have a 100-year market cycle that remains within a logarithmic parallel uptrend.

We typically stay within a parallel channel that has a 100 year cycle top to bottom

The majority of the time is spent in the bottom half of the channel

As we approach 100 years, we move into the upper half of that channel

Finally, we experience a euphoric rise to the top and then quickly correct back down to the bottom

This scenario would mimic the 1929 stock market crash almost exactly 100 years later in 2029, and the crash would take us back down to the bottom of the proposed channel.

1929 Stock Market & Today The story of 1929 -

The Great Depression was a severe worldwide economic depression that lasted from 1929 to the late 1930s. There were several factors that contributed to the trigger of the Great Depression, but the key trigger is often attributed to the stock market crash of 1929.

In the 1920s, there was a period of economic growth and prosperity in the United States, also known as the "Roaring Twenties." During this time, people invested heavily in the stock market, and the prices of stocks rose rapidly. However, in September and October of 1929, the stock market began to decline, and on October 24, 1929, known as "Black Thursday," panic selling began, causing the stock market to crash.

The stock market crash led to a chain reaction of events that contributed to the Great Depression. Banks had invested heavily in the stock market and had also made loans to individuals and businesses that were unable to repay them. As a result, many banks failed, leading to a loss of confidence in the banking system.

The collapse of the banking system led to a decrease in the money supply, which caused a decline in spending and investment. The decline in spending and investment led to a decrease in production and employment, which caused a further decline in spending and investment, and the cycle continued.

In summary, the key trigger for the Great Depression was the stock market crash of 1929, which led to a chain reaction of events that caused the collapse of the banking system and a severe decrease in spending and investment.

I am seeing similarities between its technical and fundamental.

My view on technical as a study into "Behavioral price movement" , it refers to the fluctuations in the price of a financial asset that are caused by the collective behavior of investors, traders and events. And they tend to repeat itself.

Trading & Hedging in Nasdaq -

E-mini Nasdaq Futures & Options:

Minimum fluctuation

0.25 index points = $5.00

Micro E-mini Nasdaq Futures & Options:

Minimum fluctuation

0.25 index points = $0.50

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

1929 Market Rise / Crash OverlayJust a quick post here. What if we saw a repeat of a similar pattern to what was witnessed during the 1929 stock market rise and crash that led to an extended economic depression?

If that were the case, we might see something unexpected here:

- an epic rise when everyone is expecting a crash, now

- an epic and extended market crash after having reached the "euphoria" phase of the psychological market cycle

That's not to say we haven't already seen both of those things. This is just a "what if" thought, for fun. Would be hilarious if it actually does this.

If you want to see what I actually think will occur, look at DXY and it's relation to DJI or SPX, here's a post I made indicating we're in for more immediate downside (also see related links below for more info on DXY and SPX):

W.D Gann's 1929 stock market prediction compared to the BTCI have noticed that William Delbert Gann's stock market prediction of 1929 could be very similar to Bitcoin's current price movement and decided to make a comparison. The result was shocking! Gann managed to predict the crash of 1929, also called as "Great Crash" years in advance.

The 5 Crashes That Shook The Markets.A very brief look at 5 of the most significant market crashes to date, using the Dow Jones Index.

Content taken from various online sources.

Great Crash 1929

Many factors likely contributed to the collapse of the stock market. Among the more prominent causes were the period of rampant speculation (those who had bought stocks on margin not only lost the value of their investment, they also owed money to the entities that had granted the loans for the stock purchases), tightening of credit by the Federal Reserve,

the proliferation of holding companies and investment trusts (which tended to create debt), a multitude of large bank loans that could not be liquidated, and an economic recession that had begun earlier in the summer.

During the mid- to late 1920s, the stock market in the United States underwent rapid expansion. It continued for the first six months following President Herbert Hoover’s inauguration in January 1929.

The prices of stocks soared to fantastic heights in the great “Hoover bull market,” and the public, from banking and industrial magnates to chauffeurs and cooks, rushed to brokers to invest their liquid assets or their savings in securities, which they could sell at a profit.

Billions of dollars were drawn from the banks into Wall Street for brokers’ loans to carry margin accounts. The stock market stubbornly kept on climbing. That is, until October 1929, when it all came tumbling down.

Catching on to the market's overheated situation, seasoned investors began "taking profits" in the autumn of 1929. Share prices started to stutter.

They first crash on Oct. 24, 1929, markets opened 11% lower than the previous day. After this "Black Thursday," they rallied briefly. But prices fell again the following Monday. Many investors couldn't make their margin calls.

Wholesale panic set in, leading to more selling. On "Black Tuesday," Oct. 29, investors unloaded millions of shares — and kept on unloading. There were literally no buyers.

The rapid decline in U.S. stocks contributed to the Great Depression of the 1930s.

The Great Depression lasted approximately 10 years and affected both industrialized and non industrialized countries in many parts of the world.

When Franklin D. Roosevelt became President in 1933, he almost immediately started pushing through Congress a series of programs and projects called the New Deal. How much the New Deal actually alleviated the depression is a matter of some debate — throughout the decade, production remained low and unemployment high.

But the New Deal did more than attempt to stabilize the economy, provide relief to jobless Americans and create previously unheard of safety net programs, as well as regulate the private sector. It also reshaped the role of government, with programs that are now part of the fabric of American society.

Black Monday 1987

Many market analysts theorize that the Black Monday crash of 1987 was largely driven simply by a strong bull market that was overdue for a major correction.

1987 marked the fifth year of a major bull market that had not experienced a single major corrective retracement of prices since its inception in 1982. Stock prices had more than tripled in value in the previous four and a half years, rising by 44% in 1987 alone, prior to the Black Monday crash.

The other culprit pinpointed as contributing to the severe crash was computerized trading. Computer, or “program trading,” was still relatively new to the markets in the mid-1980s.

The use of computers enabled brokers to place larger orders and implement trades more quickly. In addition, the software programs developed by banks, brokerages, and other firms were set to automatically execute stop-loss orders, selling out positions, if stocks dropped by a certain percentage.

On Black Monday, the computerized trading systems created a domino effect, continually accelerating the pace of selling as the market dropped, thus causing it to drop even further. The avalanche of selling that was triggered by the initial losses resulted in stock prices dropping even further, which in turn triggered more rounds of computer-driven selling.

A third factor in the crash was “portfolio insurance,” which, like computerized trading, was a relatively new phenomenon at the time. Portfolio insurance involved large institutional investors partially hedging their stock portfolios by taking short positions in S&P 500 futures. The portfolio insurance strategies were designed to automatically increase their short futures positions if there was a significant decline in stock prices.

On Black Monday, the practice triggered the same domino effect as the computerized trading programs. As stock prices declined, large investors sold short more S&P 500 futures contracts. The downward pressure in the futures market put additional selling pressure on the stock market.

In short, the stock market dropped, which caused increased short selling in the futures market, which caused more investors to sell stocks, which caused more investors to short sell stock futures.

A key consequence of the Black Monday crash was the development and implementation of “circuit breakers.” In the aftermath of the 1987 crash, stock exchanges worldwide implemented “circuit breakers” that temporarily halt trading when major stock indices decline by a specified percentage.

For example, as of 2019, if the S&P 500 Index falls by more than 7% from the previous day’s closing price, it trips the first circuit breaker, which halts all stock trading for 15 minutes. The second circuit breaker is triggered if there is a 13% drop in the index from the previous close, and if the third circuit breaker level is triggered – by a 20% decline – then trading is halted for the remainder of the day.

The purpose of the circuit breaker system is to try to avoid a market panic where investors just start recklessly selling out all their holdings. It’s widely believed that such a general panic is to blame for much of the severity of the Black Monday crash.

The temporary halts in trading that occur under the circuit breaker system are designed to give investors a space to catch their breath and, hopefully, take the time to make rational trading decisions, thereby avoiding a blind panic of stock selling.

The Federal Reserve responded to the crash in four distinct ways: (1) issuing a public statement promising to provide liquidity, as needed, “to support the economic and financial system”; (2) providing support to the Treasury securities market by injecting in-high-demand maturities into the market via reverse repurchase agreements; (3) allowing the federal funds rate to fall from 7.5% to 7.0% and below; and (4) intervening directly to allow the rescue of the largest options clearing firm in Chicago.

Dotcom Bubble 2000

The dotcom crash was triggered by the rise and fall of technology stocks. The growth of the Internet created a buzz among investors, who were quick to pour money into start-up companies.

These companies were able to raise enough money to go public without a business plan, product, or track record of profits. These companies quickly ran through their cash, which caused them to go under.

The Internet bubble, grew out of a combination of the presence of speculative or fad-based investing, the abundance of venture capital funding for start-ups, and the failure of dotcoms to turn a profit.

Investors poured money into Internet start-ups during the 1990s hoping they would one day become profitable. Many investors and venture capitalists abandoned a cautious approach for fear of not being able to cash in on the growing use of the Internet.

With capital markets throwing money at the sector, start-ups were in a race to quickly get big. Companies without any proprietary technology abandoned fiscal responsibility. They spent a fortune on marketing to establish brands that would set them apart from the competition. Some start-ups spent as much as 90% of their budget on advertising.

Record amounts of capital started flowing into the Nasdaq in 1997. By 1999, 39% of all venture capital investments were going to Internet companies. That year, most of the 457 initial public offerings (IPOs) were related to Internet companies, followed by 91 in the first quarter of 2000 alone.

The high-water mark was the AOL Time Warner megamerger in January 2000, which became the biggest merger failure in history.

As investment capital began to dry up, so did the lifeblood of cash-strapped dotcom companies. Dotcom companies that reached market capitalizations in the hundreds of millions of dollars became worthless within a matter of months. By the end of 2001, a majority of publicly-traded dotcom companies folded, and trillions of dollars of investment capital evaporated.

The bubble ultimately burst, leaving many investors facing steep losses and several Internet companies going bust. Companies that famously survived the bubble include Amazon, eBay, and Priceline.

The US government would date the start of the dot-com recession as beginning in March 2001. And by the time of the economic shock from the terrorist attacks of September 11, 2001, there was no longer any doubt. In that tragic month of September, for the first time in 26 years, not a single IPO came to market. The dot-com era was over.

Global Financial Crisis 2008-2009

The crisis, often referred to as “The Great Recession,” didn’t happen overnight. There were many factors present leading up to the crisis, and their effects linger to this day.

The foundation of the global financial crisis was built on the back of the housing market bubble that began to form in 2007. Banks and lending institutions offered low interest rates on mortgages and encouraged many homeowners to take out loans that they couldn’t afford.

With all the mortgages flooding in, lenders created new financial instruments called mortgage-backed securities (MBS), which were essentially mortgages bundled together that could then be sold as securities with minimal risk load due to the fact that they were backed by credit default swaps (CDS). Lenders could then easily pass along the mortgages – and all the risk.

Outdated regulations that weren’t rigorously enforced allowed lenders to get sloppy with underwriting, meaning the actual value of the securities couldn’t be established or guaranteed.

Banks began to lend recklessly to families and individuals without true means to follow through on the mortgages they’d been granted. Such high-risk (subprime) loans were then inevitably bundled together and passed down the line.

As the subprime mortgage bundles grew in number to an overwhelming degree, with a large percentage moving into default, lending institutions began to face financial difficulties. It led to the dismal financial conditions around the world during the 2008-2009 period and continued for years to come.

Financial stresses peaked following the failure of the US financial firm Lehman Brothers in September 2008. Together with the failure or near failure of a range of other financial firms around that time, this triggered a panic in financial markets globally.

Many who took out subprime mortgages eventually defaulted. When they could not pay, financial institutions took major hits. The government, however, stepped in to bail out banks.

The housing market was deeply impacted by the crisis. Evictions and foreclosures began within months. The stock market, in response, began to plummet and major businesses worldwide began to fail, losing millions. This, of course, resulted in widespread layoffs and extended periods of unemployment worldwide.

Declining credit availability and failing confidence in financial stability led to fewer and more cautious investments, and international trade slowed to a crawl.

Eventually, the United States responded to the crisis by passing the American Recovery and Reinvestment Act of 2009, which used an expansionary monetary policy, facilitated bank bailouts and mergers, and worked towards stimulating economic growth.

Covid Crash 2020

The 2020 crash occurred because investors were worried about the impact of the COVID-19 coronavirus pandemic.

The uncertainty over the danger of the virus, plus the shuttering of many businesses and industries as states implemented shutdown orders, damaged many sectors of the economy.

Investors predicted that workers would be laid off, resulting in high unemployment and decreased purchasing power.

On March 11, the World Health Organization (WHO) declared the disease a pandemic. The organization was concerned that government leaders weren't doing enough to stop the rapidly spreading virus.

Investors had also been jittery ever since President Donald Trump launched trade wars with China and other countries.

Under both the Trump and Biden administrations, the federal government passed multiple bills to stimulate the economy. These included help directed at specific sectors, cash payments to taxpayers, increases in unemployment insurance, and rental assistance.

These measures further soothed investors, leading to additional gains in the stock market. Investors were also encouraged by the development and distribution of multiple COVID-19 vaccines, which began under the Trump administration.

The driving forces behind the stock market crash of 2020 were unprecedented. However, investor confidence remained high, propelled by a combination of federal stimulus and vaccine development.

1929 & 2008 CRASH FractalsThe DJI seems to be following 2 fractals.

in the mean time, there may be some trade opportunities ($33.8k) in a retrace prior to the big crash.

A Double bounce off the $30.6k will be the last chance to scalp the retrace.

INFLATION is #3 on Google Trends.

trends.google.com

ASSETS are a great protection against inflation. Cryptocurrency is showing signs of decoupling with the nasdaq. GL all holders.

ETH PLAYED OUT TO LEVELS SHOWN BACK IN 2021ETH under 3k, pattern played out perfectly.

ETH under $2150 is this the catalyst to The Great Depression 2?

I don't know.

But if we get 1 more week down in stocks next week the 1929 CRASH will begin straight after.

The world is not prepared for this scenario, but it is needed for the great reset.

If it plays out we will only see the real after affects starting in 6 months with jobs, GDP, mass shortages, people losing everything.

NFA, stay safe.

SPX Printing A MASSIVE Bubble. Be Very Careful !!On the left side of the chart i've compared a chart from 1891 - 1935 to show the similarities between chart back then and todays after the dot-com bubble. The orange chart is not stretch out or anything. It is there to show that when the bubble popped, price did eventually fall below the bottom of the previous sideways range (orange box). In '29 chart also reached above all the fib. extension levels, just like it is doing right now as it is preparing for the final blow of top which is in my opinion only a few % away.

I did the same price comparisment with DJI index in one of my ideas, where the price behaves almost the same as it was from 1915-1929. Really scary stuff if you think about it. Wonder how will that effect the crypto market as it has never experienced a REAL stock market crash.

I am not a financial advisor so non of this should be taken as a financial advise. Be well.

SP:SPX

The Bubble Could Pop Like It Did In 1929I and others who try to spot patterns in charts are starting to see a lot of similarities compering bull run from the 2008-2021 and the one from 1921-1929. You can clearly see that patterns are profoundly which to be honest, it keeps me up at night. Stock market as well as crypto market are VERY high. In last few years/months. everyone wants to become a day-trader or whatever, and having a mindset that everything can only go up from here. It was the same mindset back in 1928-1929 where everyone knew about the stock market, getting overleveraged and promoting it as it could make you rich over night. It is the same now so i want to worn people about all this. Don't listen CNBS and financial media as they are only there to create liquidity for the institutions so they can sell when the time comes. That time is right around the corner.

Also a fib. extension levels extended over previous fall in 2008 takes us to around 11-13% above where we currently are with DOW. Don't be naive and say that this time is different. It's not. Maybe the fall will not be that dramatic as the bubble is not as big as it was in 1929 but we certainly could and probably will fall below the bottom of 2008 ( roughly to 6k), so don't be surprised if it turns out this bear market is longer and deeper, because we need such correction for the market to stay healthy.

I am not financial advisor so non of this is a financial advise, just a BIG warning to you all.

DJ:DJI

The Crash of 29' - The First Diamond - in 3DThe Diamond Pattern can cause havoc in a trading day. The sharp reversals and reversion to the midline; then onto the continuation or consolidation. Here is our very first diamond, which has echoed through-out the system since. A perfect diamond - a most unholy grail.

2021-05-29 DJIA Birdseye view 1929 till 2021Sometimes one needs to take a step back to see the bigger picture on what is going, to learn from the past and start making plans of actions on what to do next ✌

1929 Crash (Wikipedia article)

en.wikipedia.org

1987 Black Monday Crash (Wikipedia article)

en.wikipedia.org(1987)

1999-2000 Dot-Com Bubble (Wikipedia article)

en.wikipedia.org

2007-2008 Subprime Mortgage Crisis (Wikipedia article)

en.wikipedia.org

s&p 500 with -50% crush at 1500 till end of the 2020SPX crushes never stopped above MA 200.

Even FED pump of 3 trillion into market, buying even stocks of companies that are in bankruptcy, would be over.

Earlier or later the crush of -50% will happen as of people will need to sell something to pay bills - already 20% unemployed, 30% not paying rent or mortgage bills in time.

As long FED pumps money to keep the dead market breathing as hard would it be when the market will awaken.

In 1929 it was the speculators who pumped the market 4 times from 7 to 30 and it crushed below 7.

1929 FractalThey say history repeats, we had a pandemic in 1820 and 1920. We had a crash in 1929, so we could be near a same fractal. I compared the 1929 crash and if it were similar this is the path it would take. Down to first major support (2100 area support), than major bounce up in between the .5-.667 fib where people unload and then it continues to fall for 3 years, hopefully this time is different.

Generational Transfer of WealthThe boomers have lived their lives fucking over the millennial, now is their turn to "feel the Bern" lol.

I prefer white path for maximum opportunity.

Maybe FED saves the day and nukes this idea and we can make a larger blow-off top for a -99% decline.

***Not investment advice.